Its members include the most powerful players in the province’s forest industry, companies that do the vast majority of logging on British Columbia’s coast. Its website boasts of “innovative, high-tech” companies whose workers turn out “a growing array of forest and wood products.”

But in truth, members of the Coast Forest Products Association are far from the job creators they could be.

While forest industry manufacturing on B.C.’s coast stagnates, CFPA member companies, including the huge corporations TimberWest, Western Forest Products and Interfor, collectively ship millions of cubic metres of raw, unprocessed logs out of the province each year — a practice the association claims will increase profits, which may one day lead to investments in new sawmills. Included in the export mix are logs from old-growth trees harvested on Vancouver Island and Haida Gwaii, the Nass Valley in northern B.C. and up and down the province’s coast, including in the Great Bear Rainforest, B.C.’s much-touted showcase for coastal forest conservation and “ecosystem-based” logging.

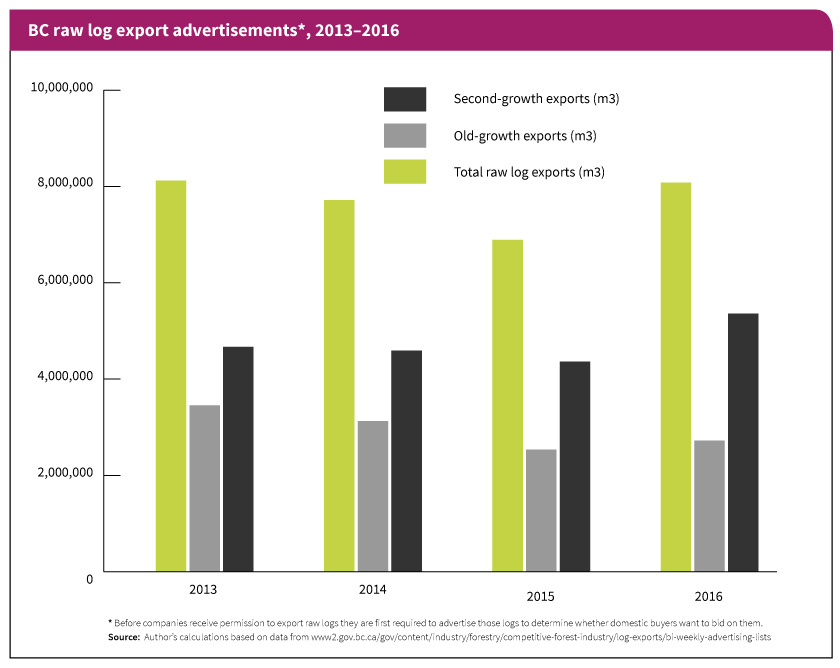

Since 2013, the year Premier Christy Clark led her government to re-election, almost 26 million cubic metres of raw logs were shipped from the province, with a combined sales value of more than $3.02 billion. No government in B.C. history has sanctioned such a high level of valuable raw log exports on its watch, or been so silent about the consequences.

Last year nearly 6.3 million cubic metres of raw logs left the province. Had those unprocessed logs been milled in B.C. instead, an estimated 3,650 more men and women could have been working in the province’s neglected forest sector. Moving up the value chain and making even higher value forest products would have added even more jobs to the tally.

For more than four years, the provincial government has invested much political capital in a largely failed attempt to create a new liquefied natural gas industry — an initiative in tatters with only one company committed to a modest project that may one day employ 100 people. Meanwhile, thousands more forest industry jobs may soon be on the chopping block should the upward trend in raw log exports continue unchecked.

Ironically, the location of the promised LNG plant on Howe Sound is near Squamish on lands once occupied by the Woodfibre pulp mill, which closed in 2006. Such an LNG plant would be no replacement for a forest industry that, if properly regulated, could generate thousands more high-paying jobs in rural communities at a fraction of the investment costs associated with LNG plants and infrastructure. Barring changes in government policies, there is every reason to believe that a similar fate awaits other pulp mills and sawmills on B.C.’s coast, in part because so much of what is logged today never enters a domestic mill.

Raw logs are, strictly speaking, forest products, but they are the most rudimentary and lowest value of all products derived from trees. Depending on age and quality, real value-added would mean transforming those logs into the studs and joists that frame our houses, the floors we walk on or the guitars and pianos we play.

In 2016, log exports climbed more than 6.2 per cent to reach just under 6.3 million cubic metres. The increase meant that nearly one in three trees logged on the coast left the province in raw log form.

Cubic metres are a rather abstract measurement and don’t convey what is actually at stake. Consider this: if the raw logs that left B.C. last year had been used just to make the lumber and other wood products commonly used in house construction, enough wood would have been milled to build approximately 134,000 homes, or roughly half of Vancouver’s standing detached housing stock.

As the export of this valuable raw commodity continues, rural communities pay the highest and social and economic costs, deepening the divide as B.C.’s major centres show modest job growth and opportunities decline everywhere else.

Port Alberni is one such have-not community. The central Vancouver Island town was once a thriving, diversified forest products manufacturing centre. Now sawmill production is down at least 20 per cent from the community’s economic heyday in the 1980s and 1990s, the once-thriving plywood mill is closed and pulp and paper production has dropped precipitously — a 57-per-cent fall from its peak. The decline in high paying jobs in the once-bustling forest industry has brought a sobering social reality: Port Alberni has among the province’s highest child poverty rates.

Keith Wyton is an elected Alberni-Clayoquot Regional District councillor. He also runs a successful value-added outdoor cedar furniture and landscape tie manufacturing facility, although the business is vastly scaled down as he nears retirement.

Wyton says there is growing unease as residents worry about the future of the region’s forests and its remaining forest industry. A resolution passed last year at the Union of BC Municipalities convention calling for a ban on logging old-growth forests on Vancouver Island underscored the unease, with some residents supporting the call and others opposed.

But no matter what side of the divide Port Alberni residents landed on, Wyton said, no one is happy with the status quo.

Vancouver Island’s vastly diminished old-growth forests continue to be logged at the same time logging of the Island’s smaller second-growth trees accelerates. Yet all that logging is not translating into increased jobs as more raw logs are being loaded into ships anchored in Port Alberni Inlet within sight of the town’s mills.

“The supply for these mills is going away,” Wyton says. “Meanwhile, there’s no indication that a company like Western Forest Products is going to invest in a new, smaller diameter mill.”

Wyton fears that if companies like Western Forest Products don’t invest in new mills that can process logs from smaller diameter second-growth trees, raw log exports will increase even more in the future.

The Coast Forest Products Association doesn’t boast about the large number of raw logs exported by its members. But provincial government data shows that in 2016 CFPA member companies proposed to ship out almost as many raw logs as all other exporters in the province combined.

Of the almost 8.1 million cubic metres of raw logs that companies indicated that they hoped to export from the province in 2016, 3.8 million cubic metres (or 47 per cent) originated with CFPA member companies. One of those companies — TimberWest — was by far the biggest player, accounting for 2.03 million cubic metres. Other CFPA member companies of note were Western Forest Products, Probyn Log Ltd. and Interfor, with combined sales notices accounting for another 1.24 million cubic metres. (Companies wishing to export logs from the province are first required to advertise them for sale to interested domestic buyers, which do purchase some of the available logs. This partly explains the difference between the 8.1 million cubic metres of raw logs that companies advertised for sale — a first step in the export approval process — and the 6.3 million cubic metres ultimately exported in 2016. The spread between the two numbers is somewhat deceiving, however. Logs advertised for sale toward the end of one year may, in fact, be shipped out of the province early the next.)

It is likely, however, that these figures do not reflect the true extent of each company’s involvement in exports. Western Forest Products, for example, has a dedicated “export team” and in hundreds of entries in the province’s databank the words “WFP Export Team” appear along with another client company on export applications.

Most of the raw logs exported from B.C. end up in China, other countries in the Asia Pacific or the United States. Mills in the U.S. Pacific Northwest, just across Juan de Fuca Strait from southern Vancouver Island, are among those that receive raw logs from B.C.

Island Timberlands, which is not a CFPA member company, was second only to TimberWest in its efforts to export raw logs from the province. The company served notice that it hoped to export nearly 1.53 million cubic metres in 2016. Along with Western Forest Products, these three companies are the undisputed export powerhouses in B.C., accounting for more than half of all log export applications.

As the exodus of raw logs continues, BC Stats’ employment numbers paint a disturbing picture of declines in forest industry jobs. In the past 10 years, at least 22,400 people lost their jobs. The largest job losses by far were in manufacturing — sawmills and pulp and paper mills — not logging, underscoring what is at stake with continued raw log exports.

In coastal B.C., not a single new sawmill of significant size has been built in well over a decade. The Teal Jones Group was the last company to build a new sawmill on the coast, a $30-million project in Surrey in 2003. This mill processes smaller second-growth logs, but shipments of second-growth logs still dominate the export market. In 2016, B.C. companies sought to ship almost five million cubic metres of second-growth logs while old-growth raw log shipments added roughly another 3.1 million cubic metres to the export tally.

Western Forest Products, which is coastal B.C.’s largest lumber maker, has made significant investments in recent years to some of its existing mills on Vancouver Island, improving their efficiency and profitability.

But such investments do not represent new mills, a critical point. Under existing rules, logs deemed “surplus” to domestic milling needs essentially have the government’s green light for export.

This raises a thorny question: If more sawmills close, an eventuality that Wyton foresees as old-growth forests diminish, will log exports climb further still? Wyton’s fear, echoed by many forest industry workers, is that the answer is yes. Nothing will prevent a surge in exports without more investments — and soon — in state-of-the-art sawmills designed for second-growth logs.

We can only estimate the jobs lost as a result of the lack of new mills. Assuming that enough mills were built to handle the almost 6.3 million cubic metres of logs that left the province in 2016, and those mills matched the provincial average in terms of jobs generated per unit of wood, another 3,650 men and women could be working in the industry. More re-cutting wood into higher-value components would generate even more jobs.

Laying the groundwork for getting more mills built is another matter, however. That’s because in 2003 the provincial government abandoned a longstanding policy that required companies logging trees on publicly owned or Crown lands to also mill the trees in that region.

The scrapping of those rules — known as appurtenancy clauses — flung the door wide open for companies to close mills without fear of reprisal. Mills were closing before the clauses were abandoned, but that sped up dramatically after the policy change. Since 1997, an estimated 100 mills have closed in B.C.

With dramatically fewer mills processing wood, log exports soared. And in recent years, the largest increase in exports has been from Crown lands under provincial government control, underscoring the link between policy choices by the government of former premier Gordon Campbell and the consistently high level of exports from Crown lands in recent years.

Historically, most raw log exports came from private lands, but no longer. In the last five years, approximately 60 per cent of log exports originated from lands under direct provincial government control. The remaining 40 per cent came primarily from privately owned lands, largely on southern Vancouver Island. Rules dating back to B.C.’s entry into Confederation have subjected those raw log exports to federal regulations.

Two companies dominate the log export business on those federally regulated lands — TimberWest and Island Timberlands. The disturbing reality is that these companies are now moving aggressively to dominate exports on provincial lands as well.

A “value-added” initiative by one of these companies underscores what may be at risk as the provincial government continues to ignore B.C.’s languishing forest sector.

To read the second part of this investigation, go here. ![]()

Read more: Local Economy, Labour + Industry, BC Election 2017, BC Politics

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: