Canadians buy over $4 billion of bread and baked goods every year — which meant that when Loblaw Companies Ltd. confessed to conspiring with competitors to keep prices high, consumers were angry.

The Canadian bread price-fixing scandal first made headlines in 2017 when the Competition Bureau launched an investigation targeting retailers alleged to have conspired with Loblaw — including Walmart Canada, Sobeys, Metro and Giant Tiger stores — to raise bread prices across Canada in a co-ordinated manner and block sales that offered consumers lower prices. The practice, according to some sources, cost a typical family about $400 over 14 years.

Loblaw, parent of Weston Bakeries, secured immunity from prosecution in the investigation by naming its alleged conspirators and co-operating with the Competition Bureau’s investigation.

Almost four years later the Competition Bureau, which conducts its investigations confidentially, has laid no charges and provided almost no information to the public.

But court documents obtained by The Tyee reveal new details, including a court-authorized raid of meat supply giant Maple Leaf Foods and emails between top-level industry executives that indicate a desire to co-ordinate meat prices much in the same way they had allegedly co-ordinated bread prices.

The documents also uncovered emails implicating several smaller grocers — including several based in B.C. — in co-ordinated bread pricing increases. None of these smaller players are official targets of the Competition Bureau investigation “yet,” according to the court documents obtained by The Tyee.

Competition Bureau raided Maple Leaf Foods

In January 2018, a spokesperson for Maple Leaf Foods told the Globe and Mail the company had “no knowledge of any activities taken by Canada Bread that would have contravened the Competition Act, nor has the company been approached by the Competition Bureau.” Maple Leaf Foods owned Canada Bread until 2014.

In May 2019, the Competition Bureau conducted a surprise raid of Maple Leaf Food’s Mississauga headquarters. The documents obtained by The Tyee reveal the bureau came armed with a court authorization, a locksmith and peace officer to use such force as necessary to facilitate entry, and “electronic evidence officers” trained to transport hard drives off-site and recover files, even those that may have been deleted.

But it would appear that new evidence became held up in a client-attorney privilege claim process.

The bureau had conducted surveillance of the Maple Leaf Foods offices in April 2019 to prepare for the raid, and ultimately seized and held two laptops and six USB thumb drives. According to an October 2019 report filed in court by the Competition Bureau, counsel for Maple Leaf Foods and CEO Michael McCain made blanket claims of solicitor-client privilege on all the seized evidence. The Competition Bureau wrote then that the review process for admissibility of evidence was ongoing and the counsel for the parties had yet to agree to a protocol.

Maple Leaf Foods confirmed to The Tyee that “material obtained by the Bureau from the offices of Maple Leaf Foods related to this investigation continue to be subject to privilege protocols as is routine in these matters.”

Such claims are frequently made in both criminal and civil cases undertaken by the bureau and are addressed on a case-by-case basis, Marcus Callaghan of the Competition Bureau told The Tyee. “They are often resolved without any court proceedings,” Callaghan added.

The raid, which followed similar 2017 search warrants executed at Weston Foods, Metro, Sobeys, Giant Tiger, Walmart offices and Overwaitea in Langley, B.C., represents the end of publicly available activity in the Competition Bureau investigation.

Maple Leafs Foods summarized the interaction in a “management information circular” distributed in May 2020, stating that the company had “recently been advised that the Competition Bureau has formed the view that it should be considered a subject of the investigation.”

Maple Leaf Foods is a top-five food supplier giant in Canada. Notably, as the former owner of Canada Bread, it comprised half of a bread market duopoly with competitor Weston Bakeries — which, after weathering the storm of scandal, is now for sale and awaiting bidders. Canada Bread was sold to Mexico-based Grupo Bimbo in 2014.

Does Maple Leaf Foods need to be grilled about meat pricing?

Email evidence filed while seeking authorization for the raid shows that Maple Leaf Foods CEO Michael McCain discussed applying allegedly anti-competitive pricing strategies to meat products in the same way these strategies had been used for bread pricing.

“Between price increases, there was a constant flow of information between suppliers and retailers with a view to maintaining stability in the market. This was colloquially referred to as ‘category management,’” Competition Bureau lawyer Simon Bessette wrote in a search warrant application. The terminology was explained by a witness whose name is being protected by court order.

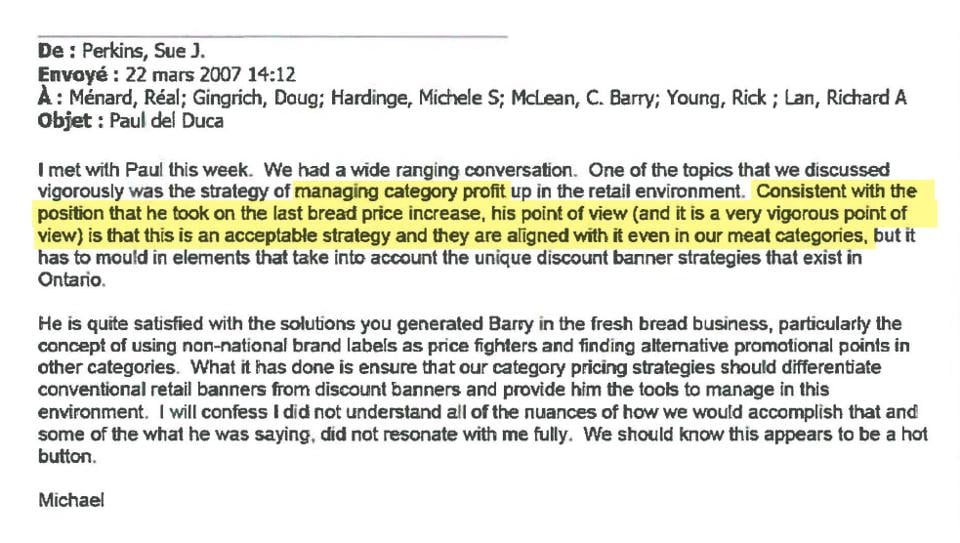

One email from 2007 summarized a meeting between McCain and Paul Del Duca, then president of the Metro grocery chain. The email was sent from the account of an employee listed as McCain’s executive assistant but was signed off with “Michael.”

The strategy, referred to by McCain as “managing category profit,” was “acceptable” and “consistent with the position that he took on the last bread price increase,” McCain wrote to summarize Del Duca’s view, adding that Del Duca was “aligned with it even in our meat categories.”

In an emailed reply to The Tyee, Janet Riley, vice-president of communications at Maple Leaf Foods, characterized the newly surfaced emails as “routine supplier-customer interaction.”

“All consumer-packaged goods manufacturers engage in regular dialogue with their customers about the pricing and the performance of the items they supply,” wrote Riley.

Riley also emphasized that while Maple Leaf was a majority shareholder in Canada Bread until 2014, the latter was a separate company.

“Although there were administrative service arrangements in place between Maple Leaf Foods and Canada Bread, Canada Bread had its own employees, supply chain, management and operations,” wrote Riley.

“We have acted ethically and lawfully at all times. We are not aware of and have never engaged in inappropriate or anticompetitive pricing activity,” added Riley.

Marie-Claude Bacon of Metro also responded to questions from The Tyee, though her statement did not directly address whether Metro had participated in price co-ordination on meat products.

“Based on the information processed to date, we have found no evidence that Metro or its employees have violated the Competition Act,” Bacon wrote.

The Competition Bureau filed this email evidence alongside a whistleblower’s account of how co-ordinated pricing is alleged to have taken place.

The evidence shows suppliers acting as go-betweens for competing retail clients in order to discourage low promotional prices on bread, “managing” competitors from “reacting” when such pricing occurs, and ensuring planned price increases will occur by providing confirmation that competitors’ prices had risen or were about to rise. The process was referred to as “socializing” pricing increases, says a witness in court documents.

Waiting on the West: Safeway, Co-op, HY Louie and Overwaitea

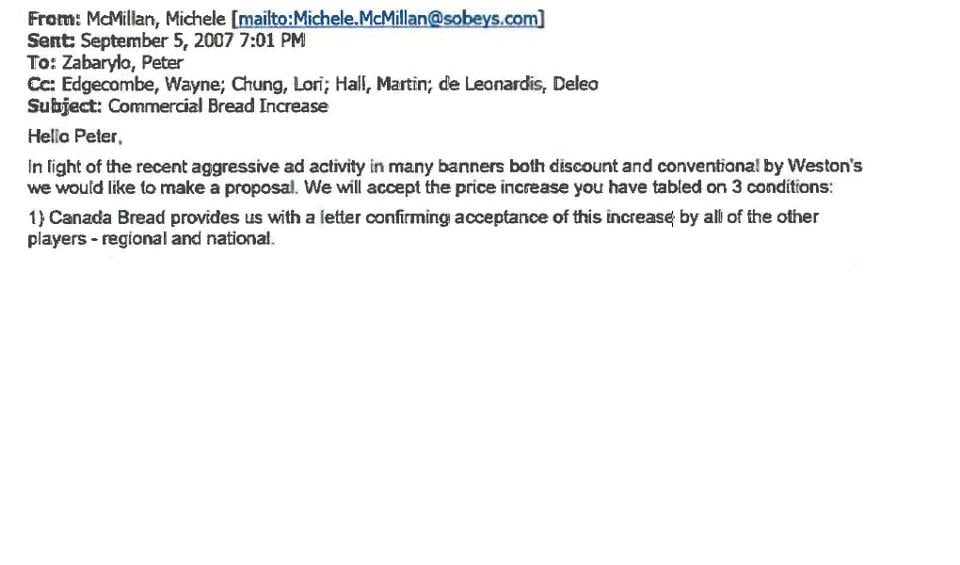

In another email exchange carrying the subject line “Commercial Bread Increase,” a Sobeys employee stated that Sobeys would sign off on a proposed bread price increase only if other retailers would also raise their prices.

“In light of the recent aggressive ad activity” by retailers offering discounts on the products of Canada Bread’s main competitor, Weston Bakeries, Sobeys would only accept a proposed price increase if Canada Bread provided “a letter confirming acceptance of this increase by all of the other players — regional and national,” wrote Michele McMilan, then national procurement director of baked goods at Sobeys, to Peter Zabarylo, a vice-president of national retail accounts at Canada Bread in 2007. (McMilan is now a national account director at Surrey, B.C.-based wholesaler Thomas Fresh, while Zabarylo is now VP of support and planning with Canada Bread’s new owner Grupo Bimbo.)

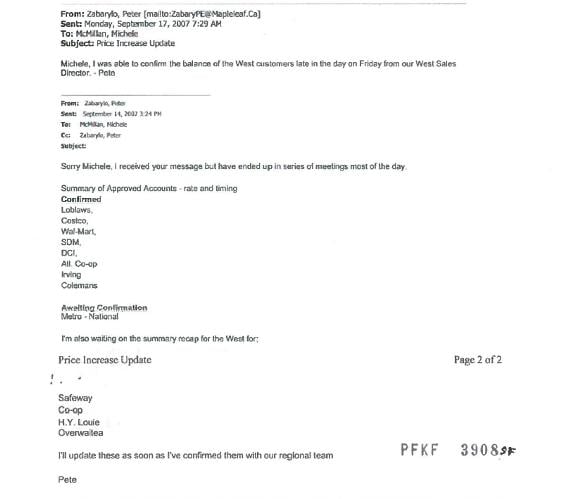

Zabarylo’s response to McMilan showed that the last companies to sign on to the increase — western Canadian grocers — finally did so late on a Friday. This list of western Canadian grocers included Overwaitea (owner of Save-On-Foods), H.Y. Louie (owner of London Drugs and B.C.-based IGA locations) and Safeway.

Already listed as signed on from the East in a prior email were Loblaws, Costco, Walmart, Shopper’s Drug Mart, Irving (which owns grocery stores and many businesses in New Brunswick), Colemans and Distribution Canada Inc., a buying group for “independent Canadian grocers” whose membership includes smaller chains such as Stong’s Market in B.C.

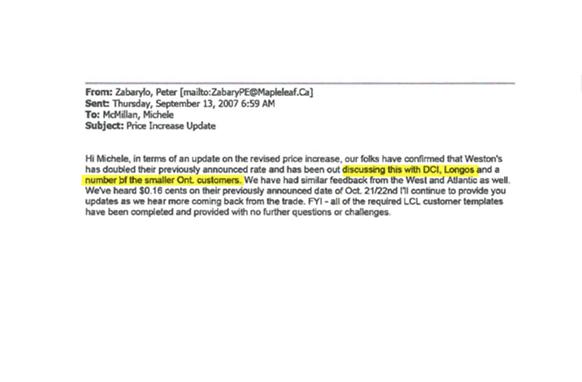

Another email with the subject line “Price Increase Update” from Zabarylo to McMilan provides confirmation that Canada Bread competitor Weston Bakeries has “doubled their previously announced rate” of increase and had been “discussing this” with “DCI,” (an acronym often used for Distribution Canada Inc.) as well as Longos and “a number of smaller Ont[ario] Customers.”

“We have had similar feedback from the West and Atlantic as well,” he added.

The Tyee has not received reply to requests for comment on these issues from Overwaitea, Distribution Canada Inc., H.Y. Louie, Loblaws and Co-op.

Janet Riley of Maple Leaf Foods said these interactions are routine. “Like other commercial terms, pricing is always a negotiation between a supplier and its customer. Suppliers like Maple Leaf Foods do not have the ability to increase prices without the agreement of their retail customers,” she wrote via email.

But this reliance on agreements is precisely what the Competition Bureau is probing.

“It was not possible for a single supplier to take a price increase alone and for a price increase to be successful it required compliance right through the chain from supplier to retailer,” a witness quoted in court documents told the Competition Bureau.

Summarizing a witness statement in court documents, Competition Bureau lawyer Simon Bessette wrote that Weston Bakeries had tried — and failed — to institute price increases on several occasions. (Email exchanges document that proposed price increases fell through when a grocery chain executive who had increased prices lost trust their competitors were following through fast enough, and lowered their prices again in order to compete.)

To date, news on the Competition Bureau investigation has focused on larger chains based in Ontario and Quebec. Court evidence filed by the bureau states that B.C.-based Save-On-Foods owner Overwaitea is “not — at this time — a target of the present inquiry,” a distinction the company has repeated, calling itself a “fact witness” — though that term is not used in the documents.

Bread under a buck: ‘Astonishing’ that Weston ‘let this happen’

Court documents cite dozens of examples of email exchanges showing specific suspected price co-ordination involving Maple Leaf Foods, some of which have been filed for previous court authorizations and covered elsewhere.

One as-yet unpublished exchange stands out as an example of the nature of the alleged co-ordination.

Sometime in 2007, Loblaw, the owner of Shopper’s Drug Mart, appeared to offend the broader network of bread suppliers and retailers by crossing a boundary that “no one wants to see.”

This boundary? A loaf of bread advertised at a price below $1.

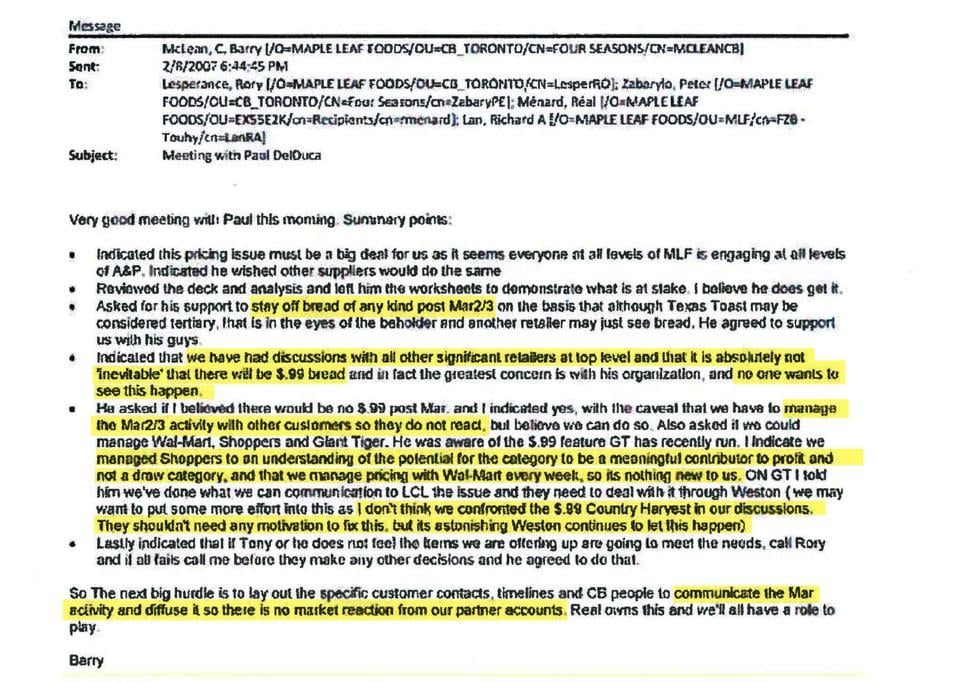

According to the email, Del Duca of Metro and Barry McLean, then president of Canada Bread (now a board advisor for the Lang School of Business and Economics at the University of Guelph), met in February 2007 with the former seeking assurances that no competitors would offer 99-cent bread after already-advertised promotional prices slated to be in effect from March 2 to 3.

McLean said he believed there would not be, with the “caveat” that “we will have to manage the March 2/3 activity with other customers so they do not react.”

McLean wrote that he indicated to Del Duca that Maple Leaf Foods had “discussions with all other significant retailers at the top level” and that it is “absolutely not ‘inevitable’ that there will be $0.99 bread.” The quotes around inevitable suggest that McLean was refuting this argument from Del Duca.

“No one wants to see this happen,” added McLean.

Del Duca had asked if McLean could “manage” Walmart, Shoppers and Giant Tiger. Giant Tiger had also broken the $1-a-loaf price boundary recently, McLean noted.

After McLean summarized his successful efforts to “manage pricing” with those retailers, he asserted that Canada Bread had “done what they can” to manage Loblaw Companies Ltd. — Del Duca would have to take further concerns up with Canada Bread’s competitor, Weston Bakeries.

“They shouldn’t need any motivation to fix this,” McLean added. “Its [sic] astonishing Weston continues to let this happen.”

McLean finished the email by writing that the “next big hurdle” would be to finalize specific contracts with retailers and “communicate the Mar activity” — the upcoming low prices — in order to avoid “market reaction” from other retailers, who might otherwise also lower prices to compete.

“I have reason to believe, and do believe, that the alleged conspiracy was a deliberate attempt by management of Canada Bread and Weston Bakeries, along with the retailers, to suppress competition at both the wholesale and retail level and thereby increase the wholesale and retail prices of fresh commercial bread in Canada,” wrote Bessette in summary of evidence.

Bessette added that he believed the conduct was ongoing “until the time of the execution of the first round of searches,” which took place in October 2017.

Truth remains in the shadows, says bureau

Reached by the Tyee, Marcus Callaghan of the Competition Bureau confirmed it had conducted searches of Maple Leaf Foods in May 2019.

“It is difficult to predict how long a particular investigation may take,” wrote Callaghan by email when asked about the lack of updates.

Callaghan referred to a 2018 speech made by former Competition Bureau commissioner John Pecman in answer to questions about delays.

“The truth about price-fixing often remains hidden in the shadows,” said Pecman.

“Cartels typically involve secret deals between schemers who are careful to cover their tracks. Neatly written agreements between competitors rarely exist. Emails get deleted, and meetings to collude on price happen in obscure places.”

In 2019, Pecman told The Tyee that it was a “a matter of public record” that the bureau was already investigating Loblaw on the broader issue of abusing its market power when the company admitted the bread price-fixing conspiracy.

At the time, Pecman said that the company’s choice to come forward could suggest a “linkage” between the Competition Bureau’s review of their practices and the company’s application for immunity.

Three years later, the details in these documents raise more questions than answers.

In the meantime, Canadians are left to wonder how many more such agreements yet remain in the shadows — and how many of those brought to light will bear consequences. ![]()

Read more: Local Economy, Food

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: