[First in a three-part series]

Few British Columbian cities depend more on the forest industry than Quesnel.

With two pulp mills, six sizeable sawmills, a veneer, plywood and panel mill, the city in BC's Central Interior is considered to be 45 percent dependent on the forest products sector, with 3,000 people directly employed in the industry.

And now, because of that dependence, Quesnel is facing what could be described as a perfect storm.

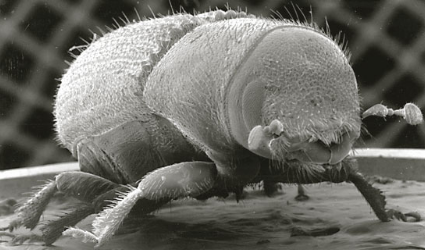

An unprecedented insect infestation, fuelled by global warming, is turning vast areas of local forest to carpets of dead trees. Years into what was already an unsustainable harvest rate, logging activities have rocketed even higher in response to the bugs. New and bigger sawmills are being built that churn through more wood with fewer people, again partly in response to all the additional "beetle-attacked" timber flowing in from the hinterland.

The upshot is that logging rates in short order will fall drastically. Some estimates are by as much as 80 percent. There are only so many healthy trees to go around, and most of what the companies are unable to log in the next decade will remain on the landscape, dead and useless for conversion into lumber or pulp - products that currently underpin the economies of many interior communities.

Jim Savage, executive director of Quesnel's economic development commission, is blunt in his assessment of what this likely means: "A precipitous drop in employment and a jarring shock to the tax base."

Quesnel is hardly alone in needing to brace itself for this coming economic blowdown. Many timber towns across BC, even in the middle of the current logging boom, already feel pressed to slash taxes and rain favours on timber firms so that their operations might be the ones to survive after the boom goes bust.

Some are calling it a race to the bottom of BC's rural economy.

Tax cuts in Quesnel

For a sense of the pressures local politicians will face, Quesnel offers a prime example. There, a simmering dispute surrounds one of largest forest companies in BC and undisputed kingpin in Quesnel: West Fraser Timber Co. Ltd.

In February, Quesnel's city council asked its senior staff to leave the chambers while a closed-door session was held with members of the economic development commission. At issue was whether the City would support either the building of a new sawmill by West Fraser or the upgrading of an existing mill. The commission, whose members include senior West Fraser employees, said the new mill, which would cost $105 million to build, was better than an upgrade that would cost $60 million. While the upgraded mill would turn out about the same number of boards as the new mill, it would do so less efficiently. West Fraser was prepared to spend the additional money on a new mill but if, and only if, Quesnel's council gave it a tax break.

Not long ago such a concession would have been unthinkable. But new rules, enacted in 2004 by the provincial Liberals over the objection of 70 percent of Union of BC Municipality members, changed the community charter allowing local governments to reduce corporate property taxes to stimulate economic development.

Many UBCM members worried that the changes would result in what Quesnel resident, Cariboo North MLA and NDP forestry critic, Bob Simpson, calls "a race to the bottom". The fear was that once a community acquiesced to requests for a tax break, the same community would have little choice but to do the same if approached by other companies. Moreover, other communities would be forced to play the same game to maintain parity.

In August, the Quesnel city council formally read into the record its decision to give West Fraser the requested break. But word of the deal was already out. In April, shortly before the provincial election, West Fraser issued a news release announcing its plans to build a new mill. Premier Gordon Campbell was quoted saying:

"This significant investment by West Fraser is good news for Quesnel, good news for the surrounding region and the province."

Added Campbell with a boosterish flourish: "Quesnel has taken advantage of the new legislative framework we established to encourage investment in their community. Everyone is a winner when this kind of investment takes place."

But is that the case?

According to a "revised information package" prepared for the August council meeting at which West Fraser's tax exemption was formally read into the record, it was noted that the company would pay $6 million less in taxes over the next decade. That's money that Simpson says will be sorely needed by the City because he predicts many local mills will not be left standing when the dust settles after all the additional logging in response to the beetles ends.

For one thing, West Fraser will close down the sawmill it proposed upgrading as soon as the new mill opens next year. Another smaller sawmill also owned by the same company may be in jeopardy along with a local plywood mill, which faces stiff competition for a limited number of suitable logs. Speculation runs high that with looming sawmill closures a local pulp mill might close too.

'Best position to survive'

To be fair, no one knows for sure what mills will survive and which ones won't.

But it doesn't take much to figure that the jolt Savage predicts will occur and that many mills will not survive. So why is Savage supporting the tax break?

First, he says, the taxes to be paid by West Fraser over the next several years will essentially remain the same as if it operated an upgraded mill. So there is actually no net loss in business taxes to Quesnel and, in fact, a slight gain of $34,000 per year.

Savage also points out the company argued successfully that the tax structure, as it applied to the new mill, was disproportionate to what would have applied had West Fraser spent $60 million on an upgrade.

"Our taxes will go up by almost four times for something very similar. How is that fair?" is how Savage describes the successful pitch to Council.

Finally, Savage says that, in the long run, Quesnel's council had to wrestle with a tricky question. If mills will close, which ones stand a chance of surviving? A new mill with the most up-to-date technology is "theoretically the best positioned to survive", Savage says.

But Simpson believes the tax break puts the city on a slippery slope. He believes it will not be long before other major companies operating mills in the same community, including Canadian Forest Products (Canfor) and Tolko, tell the city they too expect comparable tax treatment.

Simpson notes that last year West Fraser recorded net earnings of $212 million. If the company continues posting such robust numbers (far from certain), an average annual tax break of $600,000 over 10 years translates to "marginal" shareholder gains. "At the same time the city of Quesnel, like most municipalities, has had costs downloaded on them, with no offsetting revenue-generating capacity," Simpson says.

To highlight that point, Simpson points to a loan authorization request read into the record at the same council meeting at which West Fraser's tax break was. In it, the city proposed increasing local homeowner property taxes over 12 years to cover the costs of a bridge deck replacement, responsibility for which used to reside with BC's Ministry of Transportation and Highways, but was offloaded on the city. Ironically, a good number of trucks use the Johnston Street Bridge, including those delivering logs to West Fraser. The deck replacement will cost local taxpayers $1.5 million.

There's also a looming problem that will require $13 million in city investments to do engineering and remediation work in a part of town where 750 homes are located near slopes that are currently slumping. With corporate taxes foregone, funds must come from elsewhere.

Make way for mega mills

If, at the end of the day, West Fraser does run one of the last mills standing in this forestry dependent community, both Simpson and Savage agree on one thing. Very challenging times lie ahead for the entire Central interior region.

In nearby Prince George, John Brink, an independent value-added mill operator, says the current trend in BC's interior is toward bigger lumber mills. Canfor already has the world's largest softwood lumber mill in Houston with an output of 600 million board feet annually, and is building a new mill in Vanderhoof to rival it in size. West Fraser's new mill will produce 500 million board feet annually. Brink says it is within the realm of possibility that the vast central interior could become dominated by six "mega mills" each turning out a mind-boggling one billion board feet of lumber per year.

If, as Savage predicts, West Fraser's mill emerges as the best positioned to survive, it could eventually morph into one of those six mega mills. But even then, nobody is underestimating the challenge that lies ahead.

Around Quesnel, logging rates are poised to plummet from more than 5 million cubic metres today to 900,000 cubic metres or so. West Fraser's new mill, in order to operate at its initial operating capacity, will need 1.9 million cubic metres of logs per year.

Clearly, it is going to have to reach deep into forests well outside of the region to stay afloat. And it will do so at the same time as other mills in other communities do the same.

Quesnel's Council is clearly betting that West Fraser will be one of them. It won't have long to wait to learn what the consequences of its bet are.

Tomorrow: How much should government be investing in beetle zone towns?

Freelance writer and researcher Ben Parfitt lives in Victoria. He is a frequent writer and commentator on natural resource, business, environmental and social justice issues for a variety of publications and author of Forest Follies: Adventures and Misadventures in the Great Canadian Forest. ![]()

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: