Do Gordon Campbell's B.C. Liberals deserve credit for the province's improved economic and fiscal fortunes? That question sparked considerable debate a year and a half ago, during the 2005 provincial general election. Yes! B.C. Liberal supporters loudly proclaimed. No! screamed their political opponents.

More than a few members of the news media enthusiastically joined the former group. One was Vancouver Sun editorialist Harvey Enchin, who wrote a lengthy column that appeared on May 14, 2005 -- mere days before voters went to the polls. B.C. Liberal policies, Enchin claimed, "have, in fact, kickstarted a dramatic economic turnaround."

However, two recent reports from independent entities headquartered outside the province indicate that government policies have had little to do with B.C.'s improved circumstances. The first was written by Scotia Economics, a division of Scotiabank, while the second came from Moody's Investor Services. Both reports illustrate that British Columbia's current prosperity is primarily due to a historic boom in global commodity prices.

Reading the graph lines

"Scotiabank's Commodity Price Index Hits Record High in August," was the headline on a Sept. 29 news release heralding a report by Patricia Mohr, Scotiabank's vice-president of industry and commodity market research. (See Mohr's most recent report here.)

Mohr calculated that between October 2001 (five months after the B.C. Liberals first won election to government) and August 2006, the Scotiabank commodity index grew by a stunning 112.8 per cent. This rise, Mohr wrote in her report, was "the second most powerful upswing since the Second World War."

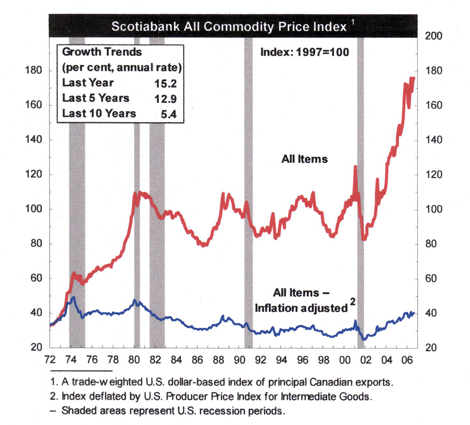

The explosion in commodity prices is clearly visible in the Scotiabank chart reproduced at the top of this article. The red line in the chart, moving from left to right, shows a theoretical basket of Canada's principal commodity exports from 1972 to the present, priced in constant (1997) U.S. dollars.

Note that the red line moved sharply upward through the 1970s, thanks to a dramatic increase in energy prices (the OPEC "oil shocks" occurred in 1974 and 1979) and a spike in metal prices (notably gold). It then went sideways for two decades, as commodity prices fluctuated in a relatively narrow range through the 1980s and 1990s.

A sharp, but short-lived advance is evident in late 2000, which many British Columbians will remember for windfall profits from hydro-electricity exports to California. That upward move was quickly reversed in the first-half of 2001, however, concomitant with a U.S. recession.

The grey, vertical bars in the chart mark economic downturns in the United States. (Sharp-eyed readers will note that U.S. recessions in 1975, 1991 and 2001 coincided with the defeat of three B.C. provincial governments, an occurrence which should give pause to those who believe that B.C. politicians exercise supreme control over the provincial economy -- and their own careers.)

In late 2001, the index began a massive, rocket-like advance, which has continued through the current year. Clearly, the improvement in British Columbia's economic and fiscal fortunes occurred at the same time as a phenomenal rise in commodity prices.

Minerals, petro and gas tripled in value

To see if there is a connection between the two events, let's compare economic and fiscal data for B.C. from a point prior to the recent boom, 1998, to last year, 2005. We'll use the B.C. Ministry of Finance's 2006 Financial and Economic Review (F&ER) and begin by looking at the prices for a few of B.C.'s natural-resource exports. (All prices are in U.S dollars, and from the F&ER, p. 32.)

- In 1998, the average price for copper was 75 cents a pound; in 2005 the average was $1.67. (Earlier this year, copper traded at more than $4 per pound.)

- Lead sold at an average price of 24 cents a pound in 1998; last year the average was 44 cents.

- The average price of gold eight years ago was $294 per troy ounce; in 2005 it averaged $445. (And briefly soared above $700 earlier this year.)

- Molybdenum's average price in 1998 was $3.31 per pound; last year it averaged $31.05 --- a 10-fold increase.

- Natural gas fetched an average of just $1.61 per Mmbtu in 1998, but averaged $7.15 last year. (Extremely volatile, natural gas prices last winter were over $15, but recently plummeted to the $4-$5 range before returning to about $7.)

These rising prices have had a positive impact on the value of British Columbia's commodities production and exports. In 1998, "solid mineral shipments" were less than $2.9 billion; last year, they rose to almost $4.9 billion. (F&ER, p. 24.)

And whereas B.C.'s oil and natural gas production in 1998 was valued at less than $1.6 billion; in 2005 that figure more than quintupled to $8.9 billion. (F&ER, p. 24.)

In total, the value of B.C.'s mineral, petroleum and natural gas shipments from 1998 to 2005 tripled from just $4.5 billion to an eye-popping $13.8 billion. (F&ER, p. 34.)

It is manifestly evident that British Columbia has benefited from the recent run-up in global commodity prices.

Tax windfalls

So, too, has the provincial government. In 1997-98, Victoria's natural-resource revenues totalled $2.2 billion; last year, 2005-06, the comparable figure had doubled to over $4.5 billion. (F&ER, p. 90.)

The federal government also enjoys improved revenues because of rising commodity prices, and as a consequence has been able to substantially enhance transfers to the provinces. In 1997-98, Ottawa sent just $1.8 billion to Victoria; in 2005-06, that figure had climbed to more than $5 billion. (F&ER, p. 90.)

Not surprisingly, these windfall revenues have helped B.C.'s finances turn from deficits into surpluses. In 1997-98, the province had a fiscal shortfall of $167 million. Last year, 2005-06, we had a surplus of $3.1 billion. (F&ER, p. 89.)

Triple-A rating

The second report, issued on Oct. 5, announced that Moody's Investor Services had upgraded British Columbia's credit-rating to Aaa ("triple A"), a level shared in Canada only with the federal government and oil-rich Alberta.

This is good news for all British Columbians: it means that the interest charges for monies borrowed by Victoria will be lower than would be the case if B.C. had a poor credit rating. (Yes, despite recording two enormous back-to-back surpluses, the provincial government continues to borrow funds to service our $37 billion debt and to finance our sizeable capital expenditures.)

But there is an interesting point to Moody's upgrade of B.C.'s credit-worthiness: it marks the return to a rating level not seen in our province in more than two decades. As was pointed out by Moody's, British Columbia has not had a "triple A" rating since 1983. Remember that date: 1983. That was the last time B.C. had a "triple A" rating. And it is here that the correlation between skyrocketing commodity prices and B.C.'s improved economy and government finances (and the recent credit upgrade) is most easily seen.

When commodities slide, deficits grow

Look again at the Scotiabank chart at the top of this article. Whereas earlier we considered the red line across the chart, now look at the narrow blue line. This shows the same basket of Canadian commodity exports with prices adjusted for inflation.

Interestingly, while the red line took a sharp upward turn in the 1970s, the blue line remained relatively constant. This was because the '70s were a time of soaring inflation, and the rise in commodity prices largely reflected the devaluation (the erosion of purchasing power) of the U.S. dollar. Put another way, buyers had to spend more devalued dollars merely to obtain the same amount of commodities.

Then, between 1980 and 1983, the blue line recorded the first of a series of precipitous declines, as real commodity prices plummeted and B.C. endured its second-worst economic recession of the 20th century (after the Great Depression).

It was in 1983 that the Social Credit government survived a general election only after introducing controversial "restraint" policies to pare government expenditures. It also was at this point that B.C. lost its "triple A" credit rating.

The first long decline in real commodity prices lasted from 1980 until 1987. Then, after a brief upswing, the erosion continued from 1988 through 1992. Prices stabilized in the middle of the decade, but resumed their downward path from 1997 to 1999. Another short recovery ended in 2001 with a sharp collapse.

Not surprisingly, as commodity prices sank through the 1980s and the 1990s, the province endured what seemed like a never-ending series of budgetary deficits. From 1980-81 to 2003-04, B.C. had 20 fiscal shortfalls, and just four lonely surpluses.

Of course, many British Columbians blamed Victoria for the province's deteriorating finances. In 1991, after a decade of weakening commodity prices and persistent deficits, Social Credit was turfed from office and the party soon disappeared from the political scene. In 2001, after a second decade of deteriorating commodity prices and budgetary shortfalls, the New Democratic Party government also was defeated, reduced to a paltry two seats.

Since then, as the Scotiabank chart clearly shows, real commodity prices have shown surprising strength, and recently returned to levels last seen more than two decades ago.

Rising prices fuel investment

One of the more interesting things about the recent run-up in commodity prices -- and in sharp contrast to the 1970s -- is that it is occurring in a low-inflation environment. (The U.S. dollar, however, has lost about one-third of its value, vis-a-vis other currencies, since 2001.)

This is in part because the global consumption of natural resources -- and especially by China -- has grown at a prodigious rate in recent years, and thereby created an imbalance between supply and demand. Real commodity prices have risen ever higher so as to correct this imbalance.

Encouraged by rising prices, companies and investors have put new capital to work in exploration projects, mine development and production, and new oil and natural gas wells. Fortunately for British Columbians, much of this exploration, mine development and gas production is underway in our own province.

In next-door Alberta, politicians and the news media have acknowledged that their government did little to cause the explosion in global commodity (and especially energy) prices, and the resulting torrent of revenues flowing into the provincial treasury. Indeed, soon-to-retire premier Ralph Klein has confessed to being unprepared for the windfall benefits showering upon his province.

"The boom came on very, very quickly," Klein told reporters at a news conference in August to mark his final legislative session. "No one could anticipate the phenomenal growth that was taking place."

Taylor the self-congratulator

It is a different story in B.C., of course. In response to Moody's rating upgrade, finance minister and head cheerleader Carole Taylor issued a self-congratulatory news release, which praised "the leadership shown by the Premier, cabinet and my treasury board colleagues, to turn around B.C.'s economy and get our fiscal house in order."

Just as predictably, perhaps, editorialists at the Vancouver Sun quickly joined Taylor in waving their pom-poms. "[T]he upgrade to triple A," the newspaper chirped, "was rightly viewed as a tribute to the hard work the Liberal government has done to get the province's books in order."

Yet as the Scotiabank analysis clearly illustrates, the B.C. Liberals took office almost exactly at the point when global commodity prices reversed their two-decade long decline. Their election to government accompanied, to repeat Patricia Mohr's observation, the beginning of "the second most powerful upswing" in commodity prices in more than 50 years.

Together, the Scotiabank report and Moody's upgrade show that the B.C. Liberals, instead of being the architects, actually are the beneficiaries of British Columbia's improved economic and fiscal fortunes.

Related Tyee stories:

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: