"Land resources in a city like Vancouver are finite. Ask anyone in the real estate business what has happened to housing prices recently. Large amounts of money chasing finite resources can only mean one thing. Prices will rise. In housing, in commercial space, in the cost of doing business, in the simple business of living. Inflation and rising prices are great for those who have things to sell. But what about the future of young people wanting to buy their own homes in Vancouver? What of those wanting to open a business? What happens if large numbers of young families begin to see the dream of owning their own homes taken out of their reach?" -- Hall Leiren, Equity Magazine, June 1988

Politicians are scrambling to deal with skyrocketing house prices and the social tensions they're stirring in Vancouver. It's a civic crisis. And it was long in the making. Whatever leaders propose now, they have no excuse for acting like it took them by surprise.

The die was cast 30 years ago, when a hot housing market fuelled in good measure by foreign buyers left some residents burned, their dreams of owning a home scorched. Then, as now, it was clear that building Vancouver's brand as safe, beautiful and open for global business had a rough downside. Then, as now, regulating real estate ownership was widely debated. Then, as now, the conversation was threatened by those who would scaremonger and appeal to crude racial prejudices.

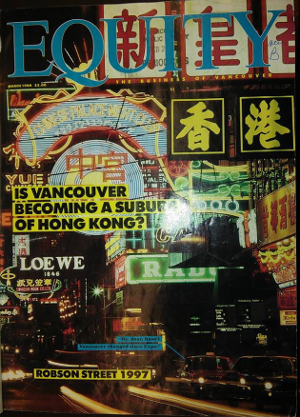

A clear media fail was the Equity magazine cover for March 1988 shown at the top of this article. It's a classic example of "yellow peril" fear mongering, using a photo of a cityscape awash in neon signs with Chinese characters and labeling it "Robson Street 1997." All to pump the coverline: "Is Vancouver Becoming a Suburb of Hong Kong?"

Now defunct, Equity was at the time a leading Vancouver-based business magazine. Its co-founder and editor was the late Harvey Southam. Back then, Southam made a comment to photographer Alex Waterhouse-Hayward that reveals the mixture of fear and prejudice Vancouver's old guard felt towards even Chinese-Canadians long established in the city. Waterhouse-Hayward blogs that he ran into Southam after dining with former Vancouver deputy mayor Bill Yee. He told Southam that "'Yee could make our city's first ethnic mayor.' Southam looked at me and with a gentle smile and said, 'Not while we're around.'"

The Robson Street cover of Equity's March 1988 issue keyed to a story inside headlined "The World's Longest Commute." Writer Gordon Keast detailed the exodus of wealthy investors from Hong Kong before it reverted back to Chinese rule in 1997. "While many of [sic] Hong Kong residents are moving here permanently, a large percentage commute. While the wife and kids live in Kerrisdale, dad minds the store back home in Hong Kong," states the article's introduction.

Three months later, Southam ran a story by Hall Leiren headlined "A New Order Rises," featuring a cartoon caricature of Expo-era property magnate Li Ka-Shing holding a shovel and pail and towering over sand structures mocking the Vancouver skyline.

By then it was already a trend that some wealthy people from China and elsewhere were treating Vancouver as a "hedge city" to quote the term coined a few years ago by Vancouver urban planner Andy Yan. "Astronaut" and "satellite" families -- fathers running businesses in Asia while kids and sometimes mothers lived in Vancouver -- were well documented. Recently a story about a student "owning" a Vancouver mansion made a stir, but really it was old news. The strategy of junior inhabiting the family's global asset while attending school in Canada had been common and identified for decades.

Expo 86's pitch to the world

None of this likely surprises UBC geography professor David Ley, who in a recent journal article notes that Expo 86 was organized to attract Asian investment money to the Lower Mainland.

Afterwards, the Expo lands were sold cheaply to Hong Kong's richest magnate, Li Ka-Shing, who financed and built the gleaming forest of condos along False Creek that Vancouver now markets to the world as a model of enviable livability.

Ley says the federal government accelerated the pull of Asian wealth into Lower Mainland development by creating the business immigration program. In various ways, at every level of government, Ley writes, politicians strived to "reboot a troubled regional economy through an infusion of activity from the growth region of the Asia Pacific."

It was a gambit that refused to acknowledge the huge ratio of foreign wealth to limited land in the Vancouver area, an asymmetry that obviously could swamp the ability to compete in the house market for local earners. Their defeat, wrote Ley, was just so much "collateral damage" in the eyes of provincial and federal politicians who've welcomed the expanded economy that foreign investment drives. Those politicians offered "minimal response" to the fact that "house prices have risen rapidly and the detached housing market is now unaffordable to most Vancouver residents."

Equity writer Hall Leiren sounded the alarm 28 years ago by noting "rising prices are great for those who have things to sell. But what about the future of young people wanting to buy their own homes in Vancouver?"

But when B.C. made its entreaties to global wealth back in the late 1980s, plenty of people welcomed the ensuing windfall. Keast's March 1988 Equity article quotes UBC economics professor Michael Goldberg saying:

"If there is one asset that I like foreigners to own, it's real estate. We get their cash and we also get to keep the asset. If foreigners own our oil or manufacturing sector, they can make capital decisions that radically affect the employment and income base of the country. But with real estate, the product has to be controlled locally. And it can't be moved. From a nationalist point of view, that makes real estate the best of all foreign investments."

Politicians 'violated their responsibility'

Three decades later, Goldberg, to his credit, does not pretend to be surprised that a flood of global wealth, along with other factors, has wildly skewed Vancouver's real estate market. Nor has he changed his analysis. "Not because I'm stubborn," Goldberg told The Tyee by phone from his North Vancouver home. "The problems are the same so that's why my view hasn't changed."

Goldberg argues today as he did 30 years ago that the best way to stabilize housing prices is to increase supply through densification. For years, says Goldberg, political leaders have "violated their responsibility, and the reason they've done it is because it's politically quite unpopular to raise densities. It's much easier to complain about a foreign beast or speculators."

Another powerful tool to prevent inflated house prices due to speculation and foreign ownership, notes Goldberg, is higher residential property taxes. But for 30 years the provincial government, which Goldberg says holds vastly more power over the real estate economy than city governments, has failed to take measures to prevent the unaffordability nightmare Vancouver now faces. In fact, by "having high tax rates on commercial property" the province "very heavily subsidizes" residential property taxes, making Vancouver homes irresistible investments for rich people looking for a place to safely store their wealth. The province "could fix that if they wanted to, but obviously it's not been politically advantageous to take on wealthy property owners, so they don't."

As a result, "the Chinese come and buy housing and pay very little property tax, but that's the way we set it up," says Goldberg, who worries about racial scapegoating as he listens in on today's housing debate. "It's the yellow peril all over again. There are a hell of a lot of Germans that own properties downtown," he says. "But they don't seem to attract a hell of a lot of attention."

Friction and demolition 30 years ago

One person who has made a study of the "cultural politics" of Vancouver real estate debates is Katharyne Mitchell, a professor of geography at the University of Washington. She contributed a chapter to a 1996 collection of essays called Ungrounded Empires: The Cultural Politics of Modern Chinese Transnationalism, which precedes David Ley by detailing how Canadian governments courted investors from Hong Kong in the late 1980s.

"Some of the friction over land that arose in the late 1980s was clearly exacerbated by the Anglo-Canadian perception of differing economic practices by Hong Kong Chinese investors in real estate -- particularly the channeling of business opportunities along extended-family networks," writes Mitchell, who declined to revisit the subject with The Tyee. "Great friction was also caused by the construction of 'monster' houses, speculation in housing, and the removal of trees in west side communities -- actions that many residents felt were undertaken primarily by Hong Kong Chinese developers and buyers."

That friction was the subject of a 1989 thesis completed by Danny Ho for his master's degree in UBC's School of Community and Regional Planning. Ho focused on Vancouver's west side neighbourhood of Kerrisdale and the social impact resulting from "intense development pressure" put on low-rise rental stock there.

"In a neighbourhood which has changed little over the last 20 years, Kerrisdale changed rapidly during 1988 and 1989. Starting in late 1988, the neighbourhood has been inundated with new luxury condominium projects," Ho found. "In the process, 17 rental building have been or will be demolished to make room for the new condominium [sic] and over 300 tenants (many elderly) will be evicted."

Ho examined not only the social impact of the demolitions on renters, but also the rationale behind Kerrisdale's luxury condo boom, stating that "there is a much greater profit margin in developing luxury condominiums than there is for maintaining or constructing rental housing."

"Strong demand from Eastern, local and off-shore investors combined with a severe lack of land zoned for multiple residential development has increased the incentive to demolish the low-rise stock," Ho wrote 28 years ago, adding that research indicated that the situation would not improve "without substantial subsidies from third parties or from government."

"Citizens need to be aware that there is cost to be paid for the status quo," Ho warned.

Ten projects Ho examined also made it grimly clear that, without government aggressively pushing densification, redevelopment would not increase stock. Ho found that 359 units prior to demolition made way for 222 units. Canada Mortgage and Housing data cited by Ho from the era show that the total stock in the area actually went down between 1986 and 1989. "The situation does not look optimistic for renters in Kerrisdale," Ho concluded. And today, populations in many of Vancouver's west side neighbourhoods continues to decline even as housing is knocked down and replaced at an accelerating clip.

No surprises

Three decades ago, Ho surfaced another ugly fact about Vancouver's real estate industry. Flipping property, he discovered, was "relatively common" back then as was the practice of marketing developments offshore to investors who often left properties vacant.

These many years after Expo 86, not a single aspect of the current housing affordability crisis in Vancouver can be said to be unheralded.

In the late-1980s Michael Goldberg waxed positive about foreign real estate buyers, but warned that as Vancouver becomes a more desirable place to invest, politicians had better be ready to greenlight the major increases in density and make it costly to hold property as an asset, otherwise low income residents would be hurt.

Danny Ho was pointing to the seeds of a renter's crisis and the culture shock that grips neighbourhoods transformed by bulldozers.

And Harvey Southam's racially charged, scare mongering magazine cover was showing us exactly how not to facilitate a useful search for solutions.

In the time since Expo 86 flashed its bright for sale sign to the world, Canada has had six prime ministers, British Columbia has had nine premiers, and Vancouver has had six mayors. If the latest batch of politicians look like deer caught in the headlights, they have no excuse. ![]()

Read more: Housing, Urban Planning

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion and be patient with moderators. Comments are reviewed regularly but not in real time.

Do:

Do not: