At the height of LNG-mania in 2013/14, high prices in Asia fuelled a gold rush mentality in B.C. based on shipping cheap B.C. gas to Asia for mega-profits.

But those high prices proved only temporary, and by 2015 the economic case for LNG turned on its head. The Asian price for gas was lower than the cost of landing LNG exports there, due to the high energy and financial costs of super-cooling the gas into liquid form for shipment across the ocean.

By this January, however, prices in Asia had pushed past US$10 per million British thermal units (MMBtu), considered the break-even point for landing LNG there from B.C.

While the global LNG market is currently characterized by over-supply, largely due to new capacity from Australia, several analysts project demand for gas to grow beyond available supplies by the mid-2020s.

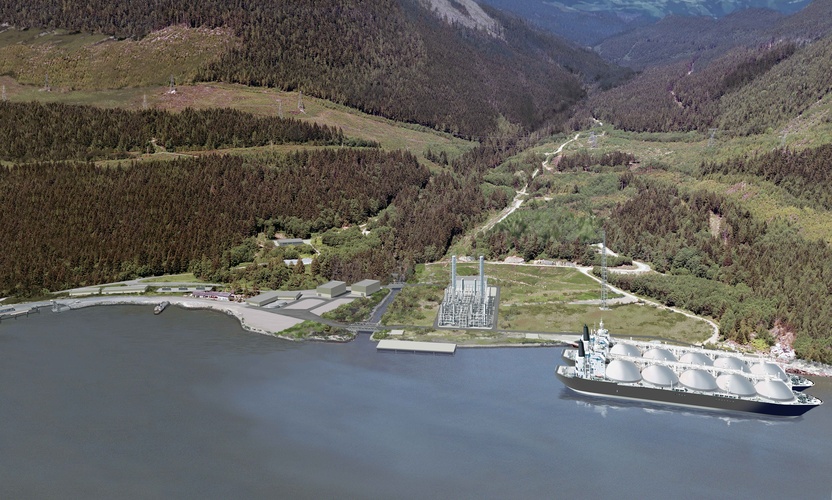

For B.C., this means LNG is back on the agenda. One smaller plant, Woodfibre LNG, is going forward near Squamish. The B.C. government is also courting the LNG Canada consortium for what would be the “largest private sector investment in B.C. history.”

LNG Canada is the biggest fish among LNG proponents, with Malaysia’s Petronas recently joining the consortium after balking at a final investment decision in 2017 for its own Pacific NorthWest LNG project. LNG Canada now has fossil fuel giant Shell at the helm (40 per cent stake) and includes partnerships with major Asian LNG importers: Petronas (25 per cent) PetroChina (15 per cent), Japan’s Mitsubishi (15 per cent) and Korea’s KOGAS (five per cent).

For Asian importers this represents an energy security opportunity to lock down gas supply for several decades into the future. But B.C. is not the only jurisdiction seeking to export LNG. Thus, the new B.C. government has committed to a package of tax concessions and subsidies for LNG Canada on the condition that a final investment decision be made by Nov. 30.

The incentives offered to LNG Canada by the B.C. government include eliminating the LNG income tax, a lower price for BC Hydro electricity, exemption of the provincial sales tax on construction materials and a rebate on new carbon taxes. This is all in addition to other subsidies currently in place — such as extremely generous royalty credits for fracking operations, which virtually eliminate the public rents gas companies must pay for extracting a public resource and subsidize roads and electricity infrastructure. Let’s take a look at each in turn.

Eliminating the LNG income tax

Brought in by the previous Liberal government when LNG prices in Asia were much higher, the LNG income tax was intended to capture a portion of the economic rent associated with selling B.C. gas in Asia. This effort was watered down by a major reduction in the tax rate, as well as by the ability of companies to fully deduct capital costs before paying any LNG income tax. That meant that B.C. would have been underwriting any cost overruns for the project. Moreover, the LNG income tax was accompanied by a reduction in the regular corporate income tax for LNG producers, so it’s not clear that B.C. would have gained at all in terms of revenues.

Instead, the government will rely on the regular 12-per-cent corporate income tax. The catch is that for gas landed in Asia at close to break-even prices there will be essentially no income to tax. Much also depends on final capital costs for construction and how quickly those costs can be written off against revenues. Another wild card is the extent to which the partner companies are able to engage in transfer pricing that would lower profits declared in B.C.

Royalties are supposed to be a principal way that the people of B.C. get a share of the development profits from exploiting the public gas resource. Unfortunately, with the current regime B.C. is effectively giving its gas away. Royalties on record levels of production continue to be extremely low, and companies have stockpiled some $3 billion in credits for fracking and other infrastructure that will be used to reduce future royalties.

There is a trade-off between public revenues from new economic activity and any incentives one makes to LNG proponents. It is not clear how the new B.C. government intends to implement its commitment to “guarantee a fair return for B.C.’s natural resources.” Its backgrounder states it “will utilize a number of other tax and royalty measures under its new fiscal framework” with no further details.

A positive development is that B.C. will repeal the Project Development Agreement. This was brought to the legislature for a special summer sitting in 2015, with the intent of pressing for a final investment decision on Petronas’s Pacific NorthWest LNG project. The act locked down royalty rates — and the overall tax and regulatory regime — for 25 years.

Cheap electricity is a subsidy

For the government, LNG is an appealing new source of demand for electric power in light of the controversial approval of the now-$10.7 billion Site C hydro project, which will add 5,100 gigawatt hours per year of new supply. When it was approved by the previous BC Liberal government, Site C was predicated on massive new LNG investments — so its business case was greatly undermined when LNG failed to take off.

Based on project descriptions, Woodfibre LNG and LNG Canada will each have electricity demand of around 1,200 gigawatt hours per year. Another 2,000 to 2,500 gigawatt hours per year would be required for incremental upstream gas extraction and processing.

Thus, we are looking at 4,400 to 4,900 gigawatt hours of incremental demand from LNG, fed by the Site C dam.

The B.C. government is proposing to lower the rate paid for electric power for new LNG facilities to the “heritage” rate for BC Hydro electricity. The previous Liberal government had published a schedule of electricity pricing for LNG at prices somewhat lower ($86.55 per megawatt hour in 2023) than the cost of Site C power ($88 to $110 per megawatt hour).

Instead, the heritage rate for industrial customers is more like $40 per megawatt hour — less than half the cost of supplying new power through the Site C dam. The value of that cheap power is worth tens of millions of dollars per year to LNG proponents.

For each of Woodfibre LNG and LNG Canada (at full build-out) the value of that subsidy ranges from $56 to $83 million per year (depending on the final cost of Site C, which could escalate further), which will be paid by all other customers through higher rates.

As we’ve documented, Site C is not needed if B.C. were to wind down its fossil fuel industries, as the science says we should. Instead, we are building power we don’t really need to power fossil fuel production that is inconsistent with Canada’s commitments under the Paris Agreement.

Carbon tax rebate

LNG Canada would be able to access a new Clean Growth Incentive Program, which is currently under development. In BC Budget 2018 it is described as providing a rebate on new and incremental carbon taxes paid (i.e. the amount above $30 per tonne) by a company if it meets a performance benchmark based on the lowest emitting facilities in the world).

LNG Canada claims it will build one of the least carbon-intensive facilities in the world, so it would qualify for this program. But such claims are all relative in the LNG universe, given that the core business is extracting fossil fuels to combust for energy, and that the additional energy needed to transport and liquefy the gas is massive. Add in upstream emissions and you have a carbon nightmare that is quite contrary to the spirit of B.C.’s carbon tax.

Removal of the PST on construction materials

This measure would reduce the massive upfront costs of getting the plant built. It would be repayable as an “operational payment” over the following 20 years. Whether there would be any interest paid on this is not clear.

For how much revenue?

The government claims B.C. will receive $22 billion in direct government revenues from LNG exports over 40 years. It is not clear how it came up with this amount, although such a figure seems plausible, at least in comparison to the “$100 billion” number the previous Liberal government touted.

It’s not necessarily easy riches, however. As Australia, a winner of the LNG sweepstakes, discovered, there can be many unintended consequences. Once the LNG taps were turned on, domestic prices shot up, prompting a political crisis for the Australian government. The massive revenues that had been projected were nowhere to be seen. And once the construction boom was over there were few full-time jobs left.

The lesson: be careful what you wish for when it comes to LNG. ![]()

Read more: Energy, BC Politics

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: