The B.C. government’s budget today promised to return money to individuals and families ahead of the October election, but critics say the measures won’t make a significant long-term difference in the affordability crisis.

“We know it’s tough for families right now,” said Finance Minister Katrine Conroy in her speech presenting the budget at the Victoria Conference Centre Thursday morning. “Going it alone doesn’t work.”

The budget includes direct payments to electricity customers and families as well as increased carbon-tax credits.

The one-time BC Electricity Affordability Credit will save households an average $100 on their bills over the course of the year, depending on their power usage, budget documents said. The credits will begin to appear on electricity bills starting in April.

Overall the credit represents a $370-million cost for government that customers will see as savings. Commercial and industrial electricity customers will also get up to a 4.6 per cent cut on their payments.

The government is also making a one-year 25 per cent increase to BC Family Benefits received by low- and middle-income families with children under 18. A family of four receiving $2,850 this year will see a bump to $3,563 starting in July. The measure will cost the government $248 million and benefit some 340,000 families.

Asked about the payments being for one year only, Conroy said, “I think families will be very, very grateful to get the boost this year.”

As revenue increases from the carbon tax, the province will use the money to raise Climate Action Tax Credit payments. “If a family of four received $890 last year, they will receive $1,005,” budget documents say, “and an individual that received $447 last year will receive $504 starting in July 2024.”

The payments are income-tested and the target is that 80 per cent of households will qualify for the program by 2030.

This year is also the first in which people will see the $400 renter’s tax credit. Long promised and announced in last year’s budget, it will be available as people file their 2023 income taxes.

Responding to a question about making one-time payments to people in the months ahead of an election, Conroy said, “There would be a lot more in the budget if we were just focusing on the election.”

BC Federation of Labour head Sussanne Skidmore called the payments “an investment in British Columbians.”

“I actually think this is, you know, one of the ways that government over the years has made sure that people have money in their pockets where they need it,” she said. “What we’re hearing when we’re out talking to workers in their work sites and in their homes, is they need money in their pockets, and that money we know goes back into the economy.”

The one-time payments are welcome, said Ayendri Riddell, a campaigner with the BC Health Coalition, but there needs to be focus on housing and other social services that are key to people’s health. “Injections are great, but what we do need are the structural changes that not just revitalize but build the health-care system we need.”

David Williams of the Business Council of BC called it “a budget with a big price tag.”

Williams said the rising debt as a proportion of the province’s GDP is worrying for the province’s future.

“We need a greater focus on getting that per capita income metric growing again,” he said. “There really isn’t an overall focus on that.”

The quick handouts are to be expected with the election on the horizon, said Fiona Famulak, CEO of the BC Chamber of Commerce. “There are no surprises in the choices the government has made in their budget given it is an election year,” she said. “I think the sentiment is well intended, but businesses don’t plan on a one-year basis. It’s helpful, but it’s not significant.”

Famulak welcomed the doubling of the exemption threshold for the Employer Health Tax from $500,000 to $1 million, which the BC Chamber of Commerce and other business groups had sought. The new threshold will make about 90 per cent of businesses exempt and cost the government about $100 million a year in forgone revenue.

Rowan Burge, the provincial director for the BC Poverty Reduction Coalition, said that while cash injections are welcome, she would have preferred to see increases to income and disability assistance rates, which were frozen for the second year in a row.

The budget includes a table showing the net provincial tax for households after taking into consideration the eliminated Medical Services Plan premiums, provincial income tax, child and family benefits and taxes on carbon, sales and fuel.

Depending on income level, it says, families are paying between $2,600 and $4,100 less in provincial taxes than they were in 2017.

In her speech Conroy pointed out that some families will be significantly better off than they were, giving the example of someone saving $2,100 a month on child care thanks to changes in government policy.

The executive director for the Centre for Family Equity, Viveca Ellis, said more funding is needed to make $10-a-day child care a reality for more families. While spaces exist, the province isn’t even halfway to making the program universal, she said. “They’re unicorn spaces.”

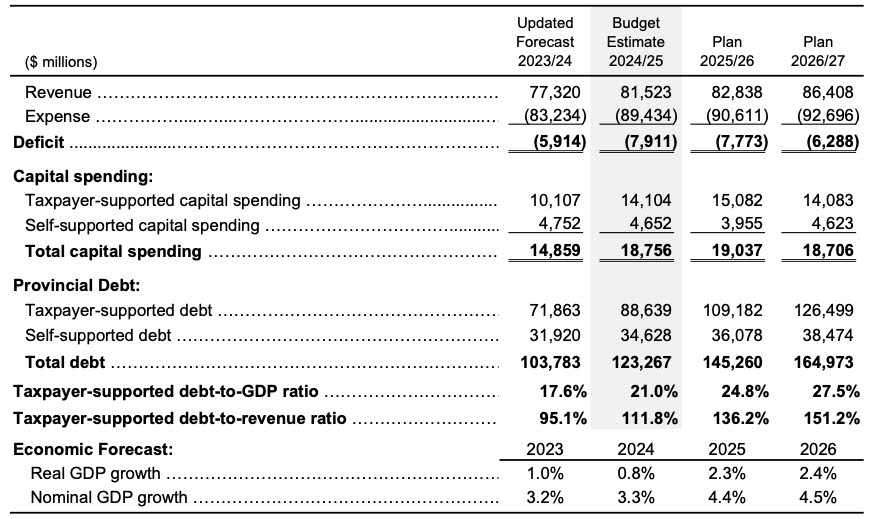

Overall the government will collect $81.5 billion in 2024-25 and spend $89.4 billion, resulting in a record deficit of $7.9 billion.

Conroy defended running a deficit to protect the services British Columbians count on. “People can’t afford us not to do it,” she said. “What would be reckless would be to make cuts to people in this province.”

For the first time in more than a decade the budget includes no forecast allowance, normally a large amount of money set aside in case the province’s economic performance is worse than expected.

In the current fiscal year, for example, there was a $700-million forecast allowance that was drawn down in the third quarter to offset losses, including a $1.3-billion drop in revenue from natural gas.

Conroy said that forecast allowances are good to have to fall back on, but the government has made a different choice. “What we’re doing this year is contingencies, because actually contingencies give more flexibility than forecast allowance does.”

The province’s total debt will rise from $103 billion to $123 billion in 2024-25 and is forecast to go up by another $40 billion over the next two years.

Despite higher borrowing costs, Conroy said, “our debt remains affordable for a province of our size.”

The debt-to-GDP ratio, commonly used as an affordability measure, is forecast to rise to 27.5 per cent by 2027, up from a low of 15.2 per cent a year ago.

The outline of assumptions and risks included at the start of the budget document and signed by Heather Wood, deputy minister and secretary to Treasury Board, says, “British Columbia’s economy has softened against a backdrop of higher interest rates and slowing domestic and global economic activity.”

BC United Leader Kevin Falcon said he likes the spending on in vitro fertilization, which he’d advocated for, but overall the government is spending a lot of money with little to show for it. “As a former finance minister, I honestly was shocked,” he said. “It is the most reckless inflationary budget that I’ve ever seen.”

Despite the government spending, there are challenges in health care, crime and social disorder, drug overdose death rates and housing, he said. “The question I ask is with all of this spending, all of this debt, why are we getting the worst outcomes we’ve ever seen?”

The budget also showed a lack of fiscal prudence, Falcon said, noting the government has broken from the tradition of using a number for projected economic growth that’s below the average from its economic forecast council.

“Although this is a record deficit, it’s a record deficit with very little margin of error now,” he said. “It’s like you’re on a sinking ship and they’re tossing out all the safety measures.”

The average prediction of GDP growth for 2024 from the council was 0.5 per cent, but the government built the budget on an assumption of 0.8 per cent growth. While that might sound like a small difference, Falcon said, it would have a major impact on the province’s bottom line.

He predicted that when credit agencies review the budget they will downgrade the province’s rating, leading to higher borrowing costs.

Sonia Furstenau, the leader of the BC Green Party, said the budget lacks a long-term vision and leaves people with lower incomes behind. “It is terrible fiscal planning to give these one-off rebates instead of investing in a healthier, more sustainable future for the province.”

Climate change is practically invisible in the budget, but the numbers do show that the government is counting on growing exports of fracked methane gas, she said.

“It’s astonishing to see an NDP government bring forward an $89-billion budget that effectively is a status quo budget,” Furstenau said. “At a time when we really do need bold moves and investments, this government is pretty much choosing to stick to the course that it has been on for years and demonstrate that they’re not interested in investing in a healthy, secure, sustainable future for this province.”

Conservative Party of BC Leader John Rustad said that under Premier David Eby’s leadership the government is saddling future generations with paying for massive deficits without solving the problems of today.

“They’re just doubling down on doing more of the same,” Rustad said. “When you look at all of the things that are in crisis right now, it is not being spent effectively and that money should be spent effectively on behalf of British Columbians.”

Other highlights of the budget include money for people using in vitro fertilization, a new tax to discourage people from flipping real estate, and an increase to the property transfer tax exemption threshold.

With files from Brishti Basu and Zoë Yunker. ![]()

Read more: BC Politics

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion and be patient with moderators. Comments are reviewed regularly but not in real time.

Do:

Do not: