Paul Kershaw can’t help but be a little flattered by Pierre Poilievre’s latest effort to reach young voters. The Conservative leader’s YouTube video — clocking in at 15 minutes and 330,000 views so far — uses many of the same housing messages developed by Generation Squeeze.

That group, started by University of British Columbia professor Kershaw in 2015, highlights the financial struggles of Canadians in their 20s, 30s and 40s, asking questions like “Why is it so much harder for us to buy a house compared to when our parents were young?”

As a maker of video explainers himself, Kershaw says he’s impressed by the way Poilievre’s video — titled “Housing Hell” — captures the grief and anger of young people who feel shut out of the dream of home ownership.

“He is acknowledging that Canada is experiencing something that doesn’t need to be normal, that has caused a great deal of harm for some,” said Kershaw. “He’s framing it as a nightmare and showing that the nightmare is here.”

But for voters actually looking for solutions to Canada’s housing problems, there are a lot of gaps in Poilievre’s video, said Kershaw.

And despite the slick, emotional messaging, the two solutions put forward by Poilievre are familiar Conservative talking points: cut government spending in general, then cut the “red tape” that’s holding up housing construction and let the private market fill Canada’s housing needs. These are the same ideas that have appeared in previous Conservative platforms.

Let’s take a closer look at what the video gets right, and where it falls flat.

Capturing the anger of young renters

Poilievre’s video starts by describing the state of Canada’s housing market as “new and strange” and “not normal.” The video then highlights the huge differences in housing costs and earning power between the 1970s and the ’80s, when boomers were forming their families, and today, when mortgage payments take up “66 per cent of average monthly income,” according to an unsourced fact that pops up on the video.

The video also acknowledges that home ownership is out of reach for many young people, so they rent — “but rent has doubled in the last eight years,” Poilievre points out.

The video’s time frames all coincide with the Liberals’ time in power. And that’s where the video presents a very truncated version of why Canadian home prices have become so high: Poilievre wants to pin all the blame on Prime Minister Justin Trudeau.

“The video starts with doubling home prices and rents and increasing homelessness since 2015,” Ottawa-based housing researcher Carolyn Whitzman pointed out in a series of social media posts.

“True. What’s false is that this followed ‘generations of stable home prices.’ Actually, median home prices in relation to household income started to rise in the 1980s and got out of control in 2000s.”

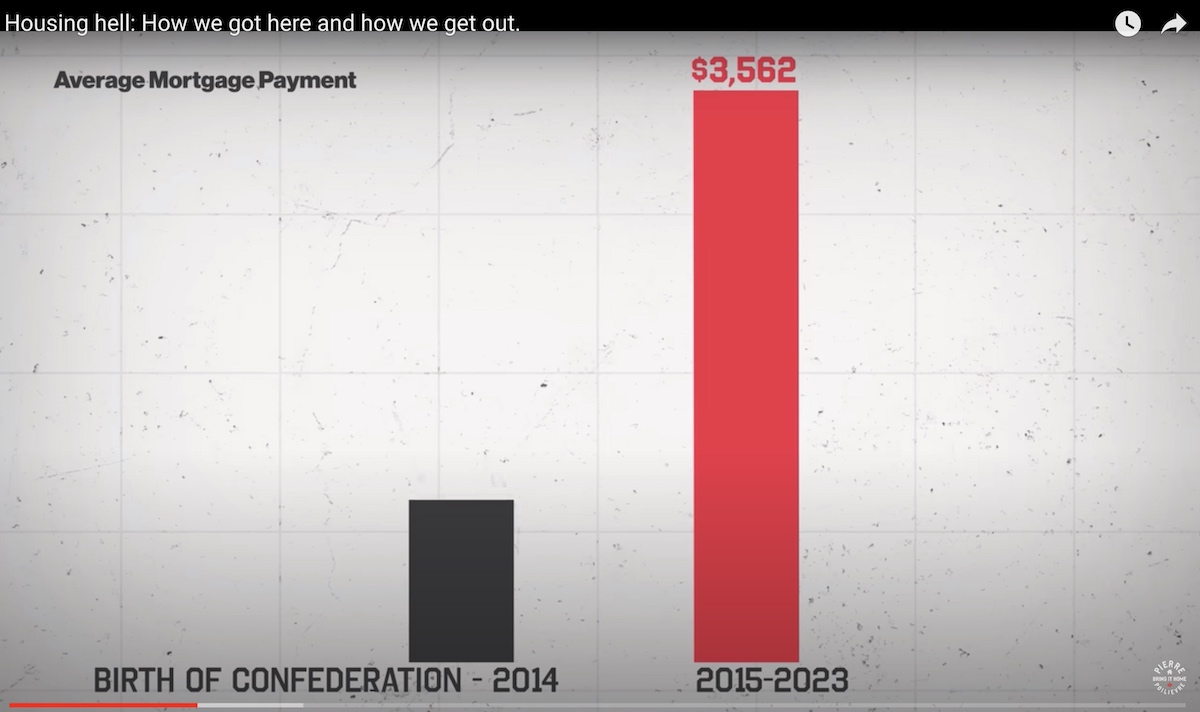

While many of the charts Poilievre uses throughout his video are accurate and clearly sourced, others are questionable. For instance, a chart that attempts to show how much mortgage payments have increased since the Liberals took power in 2015 compares 2015-23 with 1867-2014. Of course the average mortgage payments for 2015-23 are substantially higher than a period that spans 147 years.

Canada has gone through two steep increases in housing costs since Trudeau’s Liberal party came to power. In 2016, a mostly Vancouver-centric increase led to a sharp rise in home prices, rents and homelessness. In 2020, housing prices rose again, this time across Canada, in response to changing work habits and attitudes sparked by the COVID-19 pandemic.

But you have to go back to the 1980s to get to the root of the housing crisis, when two successive Canadian governments — one Conservative, the other Liberal — ended federal housing programs that had built thousands of units of affordable housing. Governments switched to supporting Canadians to enter the housing market as homeowners, pushing the idea that a home is not just a place to live but a savvy investment.

That thirst for home ownership — and banks’ relaxation of lending to help ordinary people attain that dream — led to a housing bubble across North America and parts of Europe, which ended with the 2008 financial crisis.

When the Liberals were elected in 2015, they announced the federal government would be re-entering housing with the creation of the National Housing Strategy. But from the start, critics panned the strategy for not being bold enough and failing to devote enough funding to actually make a dent in the huge need for affordable housing.

'Simplistic explanation'

The housing market is complicated, swayed by population and demographic trends, market conditions, building costs and municipal, provincial and federal policies. So how does Poilievre manage to blame the whole thing on Trudeau?

Pinpointing 2020, the year the COVID-19 pandemic started, although this isn’t mentioned in the video, Poilievre zeros in on the Trudeau government’s increased spending in this period — the benefits like the Canada Emergency Response Benefit, or CERB, that were hastily designed to cushion Canadians through a historic interruption in economic activity.

Poilievre then draws a line from government spending to increased inflation to higher interest rates, which have led to higher mortgage payments for many Canadians. He promises that a Conservative government will cut government spending — here the video focuses on another Poilievre villain, the CBC — as a way to tame inflation.

“I think that's a very simplistic explanation. Most governments ran really big deficits during COVID,” said John Pasalis, president of Toronto real estate brokerage Realosophy. “It’s a bit naive to suggest that these are the causes.”

The non-Poilievre explanation for what happened to Canada’s economy during the pandemic goes like this.

In 2020, the federal government spent big to protect individuals and businesses from the economic effects of COVID-19. The Bank of Canada also bought government bonds in a process called quantitative easing, which is supposed to help a flagging economy by reducing the cost of borrowing. (The previous Conservative government also increased spending to counter the 2008 financial crisis and stimulate the economy, and the Bank of Canada also used quantitative easing during that period.)

Throughout 2021 and 2022, normal manufacturing and shipping were disrupted across the globe by COVID-19. With demand outweighing supply for many goods, inflation rose significantly in a short time.

To counter that rising inflation, the Bank of Canada raised interest rates — leading to higher mortgage rates, something most homeowners hadn’t experienced because interest rates have been very low for the past two decades. Those low interest rates were a key factor in rising home prices over the past 20 years.

But according to Poilievre — who doesn’t mention the COVID-19 pandemic once in his video — this problem will be solved by a Conservative government that promises to cut government waste and introduce a “dollar for dollar” law that requires one dollar in savings to be found for every dollar of new spending.

Poilievre is promising that reducing government spending will bring down mortgage interest rates.

Kershaw said he agrees that quantitative easing played a part in higher home prices during the early pandemic period, when people were looking for homes in smaller towns as work culture changed.

“But the relationship between today’s deficits and interest rates is fundamentally different,” he said, adding that today’s federal deficits are caused not by pandemic-era stimulus spending but by health and benefits spending as Canada’s population ages.

Cutting that red tape

Along with cutting government spending, Poilievre is promising to use the federal government’s spending power to get municipalities to allow more home building in Canadian cities and towns.

This is a popular idea these days. For decades, existing homeowners have had a lot of political power to block denser housing in their neighbourhoods, and some municipalities have used zoning rules to prevent new housing from being built.

Here in B.C., the BC NDP introduced a suite of measures this fall designed to speed up housing construction in municipalities, and has set targets for the number of units 10 specific municipalities need to get built in order to meet the housing need for the province.

Poilievre names several of the municipal rules that “YIMBY” housing advocates regularly bring up as unnecessary barriers to denser housing, like requiring developers to build a certain number of parking spots.

Poilievre is promising to withhold federal infrastructure grants to cities that don’t meet housing targets, and says that all new federally funded transit needs to be zoned for high-density housing.

In relation to the transit promise, Poilievre says cities will not get the infrastructure funding until they build the housing.

Pasalis says there are two problems with this promise.

One is that municipalities don’t control every aspect of the housing development process, such as whether builders actually have the means to construct the housing municipalities have approved.

“Number 2, you need infrastructure dollars to build more housing,” Pasalis said. “To say that you're only going to give the municipalities this money after the fact is backwards.”

What the video doesn’t say

Whitzman said she appreciates seeing Poilievre mention the role of investors in Canada’s housing crisis, but she also noticed that he doesn’t come back to the role of investors or how housing has become an investment for ordinary Canadians. Nor does he provide any solutions.

She has some suggestions for how to tackle the role of investors in the housing market: “You can charge capital gains for rapid house flipping, and you can make banks, REITs and pension funds back new affordable housing.”

While Poilievre briefly shows and mentions tent cities, he never comes back to the issue of rising homelessness and he never mentions anything about what the federal government can do to increase Canada’s supply of affordable housing.

“I think this has been one of the big failures of federal governments going back to the ’90s, when they stopped investing federal money into government-funded, means-tested social housing,” Pasalis said.

“Part of Poilievre’s vision is that everything's going to be fixed by the private sector — just remove the barriers and let people ‘build, build, build,’” he said.

“That's obviously not the case when it comes to affordable housing because most people cannot afford market rents, especially in cities like Toronto and Vancouver.”

Pasalis said he also noticed that Poilievre never mentions a big demographic factor that is driving housing demand: increases in both immigration and international students. Pasalis said governments need to develop a co-ordinated plan to make sure enough housing is being built to accommodate new Canadians.

After watching the video, Whitzman has some advice to offer to Canada’s other federal parties.

“NDP and Liberals, you have your work cut out. Get better YouTube social media communicators. Agree that policy decisions of 30 to 50 years ago screwed Canada up. Agree that the status quo is unacceptable.” ![]()

Read more: Federal Politics, Housing

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion and be patient with moderators. Comments are reviewed regularly but not in real time.

Do:

Do not: