When one of Vancouver's most prolific developers proposed 60 West Cordova on the edge of the Downtown Eastside in 2010, he promised it would be a bold new experiment in housing affordability.

The units would be priced as low as possible and sold only to those who lived, worked, or volunteered in the neighbourhood. Buyers would have to agree to live in their units and promise not to sell for at least a year -- a strategy meant to discourage investors.

But some of the early buyers who got a great deal cashed out shortly after the one-year limit, turning profits as high as $74,000 on their "affordable" units. Others have begun renting out their units. According to data gathered at the BC Assessment office in March, 16 per cent of the condos in the building are no longer owner-occupied.

Even to those who stayed, 60 West Cordova now seems like little more than another condo project in a gentrifying area.

"If I were to come in now and buy the apartment that I'm in now from somebody else, I wouldn't find it that affordable," said Sylvia Lim, a resident who bought her unit when the building opened in 2012. "I would sort of see it as being on the average price range for most one-bedroom condos in the area."

Nathan Edelson, a former planner for the Downtown Eastside, said he admires the experimental nature of 60 West Cordova, but sees the end result as "embarrassing" because the developer failed to plan for the second generation of buyers in the building.

"They were trying something," Edelson said. "To try to bring [costs] down toward $250,000, that's a pretty big achievement in itself. How to keep them down was the critical issue, and they didn't quite get there. But the next one, I suspect, will. It'll have to."

Assessed values climb

When developer Ian Gillespie's firm Westbank proposed the project, it took a number of measures to ensure that it would be able to sell the units at rates affordable to people making less than $40,000 per year. Measures included lobbying the city to reduce its parking requirement to only 19 spaces for the 108-unit building, spending minimally on marketing, furnishing units with lower-cost fixtures, and partnering with Vancity credit union to offer flexible financing for buyers.

There are 12 non-market units in the building -- four managed by Habitat for Humanity and eight by PHS Community Services. Prices for the 96 market-rate units started at $219,900, and nearly three-quarters of the units were originally sold for less than $300,000.

Lim said she chose to buy at 60 West Cordova because it was affordable. It would have cost her the same amount to rent in the area as she ended up paying for her mortgage, she said.

"I think it made sense," Lim said. "The price range for this building was quite reasonable."

In 2013, five of the building's market-rate units were resold for prices ranging from $306,000 to $330,000, netting an average profit of almost $56,000 for those sellers.

"Two or three sales of that sort would really make a difference on the affordability [of a building]," Edelson said.

Indeed, these sales have triggered a shift in assessed values at 60 West Cordova. For 2014, nearly-three quarters of the units are valued at more than $300,000.

In an email, Westbank spokeswoman Jill Killeen said this shift was predictable. The developer's goal for the market-rate condos was to attract first-time home buyers and keep out "flippers" and investors, she said.

"It should be expected that assessed values are higher than the original purchase price because the homes were purposely sold for less than market value as that was the goal of the project," she said.

Because of this potential for rapid increases in values, Edelson said he would prefer not to see the city invest in affordable homeownership -- as it did by reducing its parking requirement for the 60 West Cordova project -- unless there's a mechanism to keep prices down. Such a model is in place for the building's non-market units.

First-time buyers priced out

Though prices for the market units at 60 West Cordova have increased, real estate agent Brian Higgins remains a fan of the project. He said he sees a sense of community among residents that gives the building "a unique feel" compared to other condo projects in the area.

Higgins sold a seventh-floor condo in the building earlier this year for $320,000, an increase of more than $88,000 over the unit's original sale price.

The project has been a good opportunity for first-time buyers, he said, noting there are other new buildings in the area where units are selling in the $200,000-range, providing similar opportunities to those found at 60 West Cordova in 2012.

While the building remains on the low end of the Vancouver condo market, some of those first-time buyers it was originally constructed for have already been priced out. A pair of units currently on the market for $310,000 and $339,500 originally sold for $221,000 and $250,000, respectively.

A third unit, originally sold for $281,000, is currently listed for $369,900. If sold for their asking prices, those units would only be affordable -- defined as costing 30 percent or less of a person's total income -- to people making $60,000 or more per year.

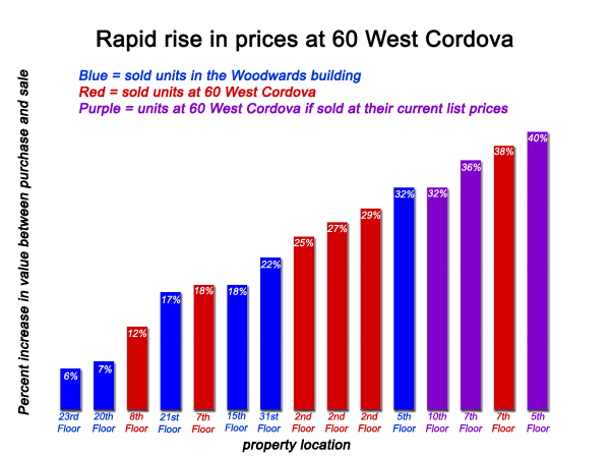

The market-rate condos at 60 West Cordova are still mostly cheaper than their counterparts in the nearby Woodwards building -- also a Westbank project -- but their values have been rising more quickly.

A sampling of six Woodwards condos that sold in 2013 for prices in the $350,000 range showed sellers making profits comparable to those found in the 60 West Cordova sales. The difference is that Woodwards units have been appreciating for four years now, compared to two for 60 West Cordova.

As the city plans to add more than 8,000 "affordable homeownership" units over the course of the recently approved Downtown Eastside local area plan, it will need to look at ways to prevent the price spikes seen at 60 West Cordova, Edelson said.

Affordable homeownership is a model that only works if there are restrictions in place to keep prices low for future generations of buyers, he said.

"The real thing is, when you sell the unit, what are you selling it for?" Edelson said. "It's good that you have to wait at least a year, but beyond that, what is [the price]?... The mechanism around resale is the critical one." ![]()

Read more: Housing

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: