Christopher Pollon marvels at how technology empowered him to write Pitfall, his new book tracing the juggernaut that is global mining. Thanks to the internet, “during the two years I researched this, I was a truly international citizen, living in multiple time zones while driving my family bonkers, depending where the next interview was located,” he says.

“I tracked down artisanal miners on the ground in the Democratic Republic of Congo, mining activists (and victims of extreme violence) in Guatemala, West Papuan separatist leaders living in European exile, environmental advocates in Indonesia and Malaysia, Indigenous leaders all over the world, and more academics and mining company PR staff than I could count. I talked to all of these people, often again and again, across five continents, all from my loft in East Vancouver.”

But that very deepened dependence on technology — including our massive bet that renewable energy can deliver us from climate catastrophe — is what’s driving a mining boom wreaking its own devastation around the world.

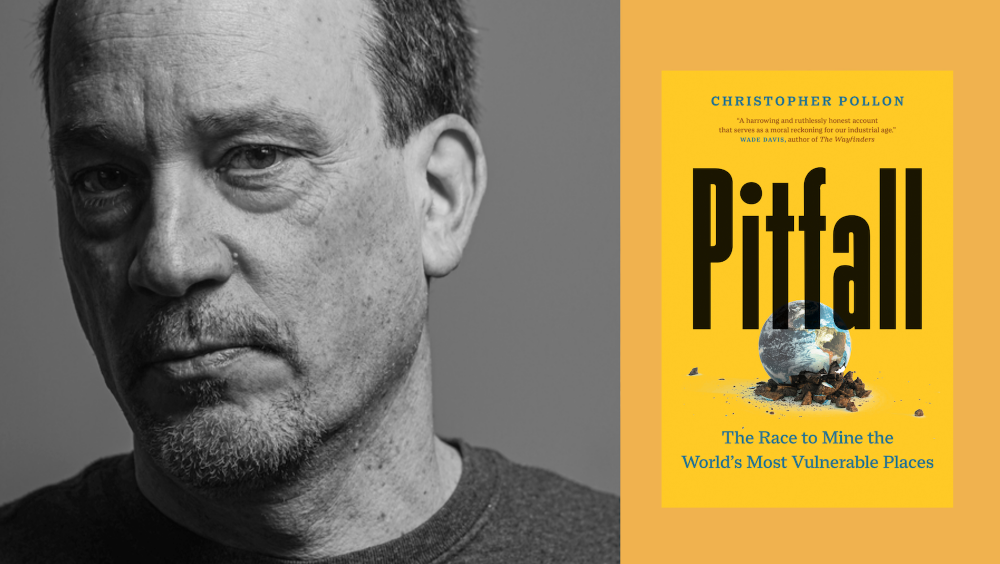

It would be hard to imagine a journalist better suited to explore this paradox. Pollon is an independent journalist with bylines in major outlets including National Geographic, Vice, the Walrus and the Globe and Mail, and he’s made mining his beat for decades.

Readers of The Tyee will recognize his frequent byline in these pages. Pollon’s first piece for us, in 2006, was about risk posed by mining — the kind involving gravel scooped from the Fraser River. In 2014 his prescient Tyee series followed a chunk of copper mined in B.C. as it made its way through the global supply chain and into various consumer goods.

Now, with Pitfall, he’s delivered a fast-reading primer on the true cost some humans — and ecosystems — pay for the minerals and metals that fuel our modern middle-class way of life. Sure, it’s cool to be connected. And optimism gleams in the sleek shape of another EV humming by. But at this point none of us can call ourselves responsible, climate-conscious citizens if we don’t better understand the hidden costs associated with our modern lifestyles.

The perfect place to start is Pollon’s fascinating volume published by Greystone Books in partnership with David Suzuki Institute. (Pollon’s rich reporting, by the way, did take him well out of his swivel chair in Vancouver, including a trek to a mountaintop in the Andes.)

On Thursday of this week, Oct. 12, Pollon launches his book with a talk at Vancouver Central Library, a free event beginning at 7 p.m. In anticipation, I caught up with him for a conversation, shared here.

The Tyee: Congrats, Chris, on your deeply researched book. It clearly involved a huge commitment on your part. Why did you want to write it?

Christopher Pollon: The timing was right, because mining is invisible to most of us, but it won’t be for much longer. That’s because the clean energy transition will be much more metals-intensive than the fossil fuel world we hope to leave behind — all the batteries, wind farms, solar plants and infrastructure will necessitate a lot of new mining, no matter how much we recycle.

Stepping back from this transition is not an option. Much of these metals will be found across Asia, Africa, Oceania and Latin America. This will have to happen as climate change impacts intensify, Indigenous rights are ascendent, and the reality that most of the richest deposits have already been picked over. So what do we do? How do we get the metals we need without fouling our collective nest, or recreating the social and environmental abuses of the past?

I view these questions through an environmental and social lens, an approach at odds with most mining journalism focused on providing intelligence for investors. At the same time a central premise of the book is that we need mining. The result is a book that could not have been written by a mainstream business journalist, or by an environmental activist either.

Help us understand the scope and makeup of today’s global mining industry.

Right up to the mid-20th century, the point where my book begins, humanity relied on about a dozen mined minerals — now we use most of the periodic table. A modern smartphone employs at least 60 different elements, most of them metals that must be dug out of the ground. We now mine more than ever before.

A bulk of the metals we consume are mined by a relatively small number of large, publicly traded companies that are based in rich countries but are “transnational” in their operations. A large parent company might be based in Toronto or London or Melbourne, but it operates across many national borders, employing a web of smaller subsidiaries. (Companies like Glencore, Rio Tinto and Vancouver’s Teck are examples).

Then there are a number of very large Chinese mining companies, which operate as private enterprises yet also enjoy the direct support of the Chinese government. There are also big state-owned mining companies, like Chile’s Codelco, or Gécamines in the Democratic Republic of Congo, which at least theoretically return the proceeds of mining to government coffers.

About 90 per cent of the world’s miners are small-scale artisanal operators, working with everything from their hands and shovels to heavy equipment, estimated to number at least 45 million, but producing only about 10 per cent of global mining output. These activities employ large numbers of women and children, often working in precarious conditions.

You said earlier that shifting to a low-carbon economy necessarily means even more mining. Way more. Give us a sense of what’s coming.

Vast amounts of metal — things like rare earths, steel and especially copper — will be needed if our plan is to rebuild a society powered by clean energy. In 2021, the World Bank predicted over three billion tonnes of minerals and metals would be required to achieve a below-two-degree future. I’ve seen a figure of US$16 trillion given as the amount of investment that would be needed to do this mobilization. The challenge is to try to figure out what we will really need. What exactly will our future clean energy society be?

Will we just convert the 1.4 billion fossil fuel vehicles to EV and continue as if nothing else has changed? If the goal is to just substitute our cheap oil-powered industrial civilization with a green model of the same, enabled by a massive expansion of industrial metals mining, it will not be possible to implement in time to solve climate change.

We’re going to have to build back smarter and reduce consumption for real if we are to avoid scouring the planet — including our oceans — like a swarm of locusts.

The subtitle of your book points to “the world’s most vulnerable places” targeted by miners. Can you name one in particular that stands out as a stark example of larger forces at play, and tell us why?

Chile, and the hard limits climate change is beginning to impose on copper mining, was an eye-opener. They produce about a quarter of the world’s supply of copper — the metal we will need the most as we attempt to electrify our civilization.

When I was there in early 2022, Chile was in the throes of a 15-year megadrought — they still are — and water scarcity was having an impact on how much copper could be extracted from the ground. Copper mining requires massive quantities of fresh water; the situation was so dire, BHP (the world’s biggest mining company) has been forced to invest about $4 billion to build the biggest desalination plant in the Americas, to process ocean water and pump it multiple kilometres up into the Andes, to keep their Escondida mine (the biggest copper mine on Earth) operational.

Meanwhile powerful agricultural and mining interests control a lot of the water licences for dwindling supplies, and there won’t be enough for everyone. There’s growing conflict too with mining up in the Andes affecting glaciers, which are already under enormous stress, and which provide irrigation and emergency water supplies. While I was there, I really got the sense that potable fresh water was becoming more precious than copper.

Here’s a strange footnote: I visited the lithium mining region in the northern Atacama Desert, where lithium-rich liquid brine is sucked up from underneath ancient dead lakes called salt flats. If you drive an EV, you are intimately connected to this place, whether you know it or not.

The current conflict in Chile around lithium extraction — one of the most important “battery metals” — revolves around how you define water. The mining companies and the Chilean state do not classify the lithium-rich brines as water at all, while activists insist it is. Depending on where you are, you can divide the population into those who say lithium mining extracts water, and those who insist it does not!

I wonder how many people know that your hometown, Vancouver, is quite a mining centre.

There are at least 800 junior mining companies — small corporations that prospect for minerals and sell promising prospects on to big companies — in and around Vancouver, which is an important financing hub. Generous tax incentives draw companies here, as well as a critical mass of legal, financial and environmental expertise that has gravitated and grown here over the years.

The Vancouver Stock Exchange, now defunct, was infamous for its loose regulation beginning in the late 1970s, with the ending of the gold standard and new mining technologies like heap leaching which suddenly made the mining of very low-grade gold deposits immensely profitable. Toronto remains the main Canadian mining hub — and home to the TSX and TSX venture stock exchanges. That city first emerged in the early 20th century as a centre for mining investment and promotion that was, at the time, considered too risky for Wall Street.

About half of the world’s publicly traded mining companies are based in Canada. But most of them are small junior exploration companies, so Canadians are miners to the world, it’s true, but in a very specific, limited sense. [More on this shadowy world of smaller Canadian mining players, including some called “zombies,” in the excerpt from 'Pitfall' to be published on The Tyee tomorrow.]

You write about “a growing global movement, led by local people, to take their battles directly to the home countries of mining companies.” What is the power and potential of that movement, do you think?

Legal action is one of the few avenues of recourse available to people claiming harm from mining. Even then, it’s both immensely time-consuming and expensive. That said, there has been success in recent years holding parent companies (often based in wealthy countries) responsible for alleged crimes of their subsidiaries in poorer countries.

Thousands of Indigenous Papua New Guineans got the ball rolling when they sued BHP in Australia in the mid-’90s — for damages from dumping mine tailings into their home rivers. BHP eventually settled out of court for $500 million.

Even though the pollution occurred in PNG, the case was heard in Australia. The idea here is that having the legal case heard in the home country of the parent corporation often improves the chances of a fair trial, with less potential for corruption, intimidation, violence, etc. And it also hits the company, literally, where they (and a lot of their investors) live.

An out-of-court settlement is also what happened when a group of farmers protesting the Escobal silver mine in central Guatemala sued the Canadian parent company after being brutally attacked by mine security. I recount this in my book, based on interviews with the key plaintiffs and access to video footage of the entire episode; many of these men still have serious health effects from the shootings, and as of this writing, they continue to resist silver mining in the area. The mine has yet to reopen.

Something I’m watching closely is one of the biggest class-action lawsuits in British legal history underway now: 700,000 claimants in Brazil are suing BHP in the U.K. over the 2015 collapse of the Fundão dam, with the company (and possibly its partner Vale) potentially on the hook for US$44 billion in damages. It’s a huge proceeding, being tried in the U.K. — the kind of case that has the power to change the world.

At one point a mining exec tells you: “Wherever you are, if you just look around yourself, and you take away everything that has been created through mining, you’ll feel very exposed.” What’s your response to that?

One of the reasons I wrote this book was because I got tired of being told by mining executives over the years to “look around the room” whenever a tough question was posed. The subtext of this statement is that you’re a hypocrite if you criticize mining but simultaneously rely on it for almost everything in your life. In the Pitfall introduction, I similarly recount how an oil and gas CEO silenced a room of activists at a conference I was attending, simply by asking if any of them used oil.

It’s a successful rhetorical strategy, because it reflects an indisputable truth. We can’t live in comfort without mining. Where I differ with this speaker, is what we should do about this dependence. If we need mining, especially to save the world from climate change, how well we do it must be everyone’s business. How do we minimize the harms?

A CEO in your book defends mining by saying, “In terms of its global environmental footprint, mining is a pinprick compared to agriculture, or to urban sprawl.” Assuming it is done right, he says, “a good mine can be reclaimed so well the average person wouldn’t know it was a mine. It’s a short-term impact.”

Where do you land on that?

Assuming something is “done right” requires a huge leap of faith. Agriculture disturbs more of the Earth’s surface, but nothing rivals mining when it comes to moving earth and rock. Mining literally moves mountains.

Tailings are the Achilles heel of mining. A working mine might last between 15 and 50 years on average, but all the toxic, potentially acid-generating waste produced during this relatively short lifetime usually needs to be kept permanently separated from the environment. A mine in this context is more a permanent waste storage facility than a source of valuable materials.

“Forever” is a time scale that publicly traded mining companies, in particular, focused on maintaining steady short-term production amid volatile metal price swings, cannot adequately navigate. The premise that any of the world’s current mining companies will exist in 200 years, or 1,000, to ensure the stability of a dam, or make sure a water treatment system is operational, is a fiction.

There are between 10,000 and 30,000 tailings dams in the world today — nobody knows the exact number — in varying stages of decline. When I say we need to limit the number of new mines we dig, this is the biggest reason why.

And about “doing the right thing.” The CEO who used that phrase in my book is someone I know who walks the talk when it comes to the environment. But most mining companies have a fiduciary duty to maximize returns for investors. Period. They do not exist to make the world a better place, and I think it’s unreasonable to expect them to put environment or social considerations on an equal footing as profits. They exist to make money.

Some folks, including The Tyee’s own Andrew Nikiforuk, argue that instead of furiously mining more to maintain our hyper-technologized way of life, civilization can only survive by dramatically downsizing our expectations and economy.

French engineer Philippe Bihouix and the Australian scientist/academic Simon Michaux, who both appear in Pitfall, have raised similar ideas. Voluntarily cutting consumption in rich countries would entail living as simply as most of our grandparents did (except with better dentistry). I’m cynical that we can do that any time soon.

Bihouix believes this shift to living with less — from his excellent book The Age of Low Tech — is inevitable, but that it will probably not come by choice. Michaux has estimated that building out just the first generation of a clean energy transition would require almost five billion tonnes of copper alone — which is physically impossible in the timeline we need to work in. He told me that this target presents a dire risk to humanity and the ecosphere because miners, emboldened in their new role as climate saviours, will try their best to go out and get it. (For example, scaling up industrial mining on the global seabed to get metals to make EV batteries.)

Michaux also points out, quite rightly I think, that we cannot expect to get climate change under control while simultaneously expecting our economies to continue to grow, year on year.

Such shifts to lower consumption feel impossible at this moment, but I am forced to take solace in the fact that it is possible. I write about the Second World War American home front, and how society turned on a dime and transformed virtually overnight, taking metals recycling and reuse of virtually everything to new extremes. This was the “circular economy” for real, motivated by a credible threat. We face very different threats than in the 1940s, but climate change and Anthropocene mass extinctions certainly qualify as incentives for getting on a war footing!

I also take solace in how many younger people seem keen to collect experiences more than material things; my 17-year-old doesn’t care about getting a driver’s licence, and there’s every reason to believe that our single-occupancy vehicle paradigm of mobility will wane and be replaced by something infinitely greener once boomers and gen-Xers drive off into the sunset.

So yes, we consume too much, time is short and the stakes are dire. But I also need to be hopeful on some level, or else the endgame is to go live down by the river in a van filled with army surplus dehydrated food to wait out the apocalypse. We need to face hard truths, but being a complete killjoy will not save the planet either.

You provide with your book a list of 10 reader takeaways. I found it a good guide to how we should act instead of sticking our heads in the mining sand. What are your top ones?

Here are two:

Extend the life of your “stuff.” Demand government and industry take steps to restrict “planned obsolescence” — the intentional reduction of a product’s lifespan by design — following the example of recent legislation in France, and emulate the EU’s evolving “right to repair” laws that make it possible for everyone to repair broken consumer items by ensuring access to tools, parts and information.

And reconsider bling. Gold generates more waste per ounce than any other metal; consider the real costs of gold before you buy jewelry.

Christopher Pollon discusses his new book 'Pitfall: The Race to Mine the World’s Most Vulnerable Places' with journalist Francesca Fionda on Oct. 12, 7 p.m., at the Vancouver Central Library. Read more details for the free event. ![]()

Read more: Books, Environment

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion and be patient with moderators. Comments are reviewed regularly but not in real time.

Do:

Do not: