New-build major hydroelectric projects in Canada are proving costly, controversial and vulnerable to review and reconsiderations even after construction has commenced.

Three recent examples of this are the Muskrat Falls project in Newfoundland, the Keeyask Dam in Manitoba and Site C in British Columbia. Each of these projects:

- is a major hydroelectric dam with a reservoir providing storage capacity — but also flooding river valleys;

- is expected to cost in the range of $8 billion to $10 billion per 1,000 megawatts of capacity, making them among the most capital-intensive power facilities in the world;

- has taken the better part of a decade to complete the required permitting and approvals process, including any necessary feasibility and field studies; and

- became a provincial election issue and, on a change of government, was required to undergo some form of review and reconsideration, despite billions having already been spent on construction.

Muskrat Falls

Muskrat Falls is an 824-megawatt hydro plant in Labrador linked by a 1,000-kilometre transmission line to Newfoundland. Initially forecast to cost $7.4 billion, costs had escalated to an estimated $12.7 billion as of June 2017. Those overruns threatened the solvency of Nalcor Energy, the sponsoring Crown corporation, as well as of Newfoundland itself.

After the November 2015 provincial election, the newly elected Liberal government replaced Nalcor’s management with a new group whose mandate was to consider whether to complete or to cancel the project. While Nalcor’s new management labelled Muskrat Falls a “boondoggle,” the government concluded that completion was the only realistic option. Cancellation would have left the province with no asset to show for all the money it had spent, while requiring it to write off billions in sunk capital costs, cancellation fees, remediation costs and other liabilities.

Keeyask

Keeyask, a 695-megawatt dam in northeastern Manitoba, was originally estimated to cost $6.2 billion. By September 2016 costs had escalated to well over $7 billion. In March, the expected cost was increased again to $8.7 billion.

Keeyask and various related Manitoba Hydro projects were an issue in the 2016 Manitoba election. After the election, the new Progressive Conservative government replaced senior management of Manitoba Hydro, who then engaged Boston Consulting Group to review the strategic options for Keeyask and other assets. Boston Consulting concluded that termination of the partially completed project was not a realistic option. On their analysis, the cost of completing Keeyask, beyond the sunk costs already incurred, would be in the neighbourhood of $4.7 billion. To cancel the project, on the other hand, would have required Manitoba Hydro to incur cancellation and remediation costs in the neighbourhood of $1 billion and the further costs of acquiring power from the next least expensive generation source — a gas-fired power plant. The aggregate of those costs was estimated to be in the $11 billion range. Although the new chair of Manitoba Hydro concluded that Keeyask was “imprudent” at the time it was commissioned, cancellation was accordingly not a realistic option.

Site C

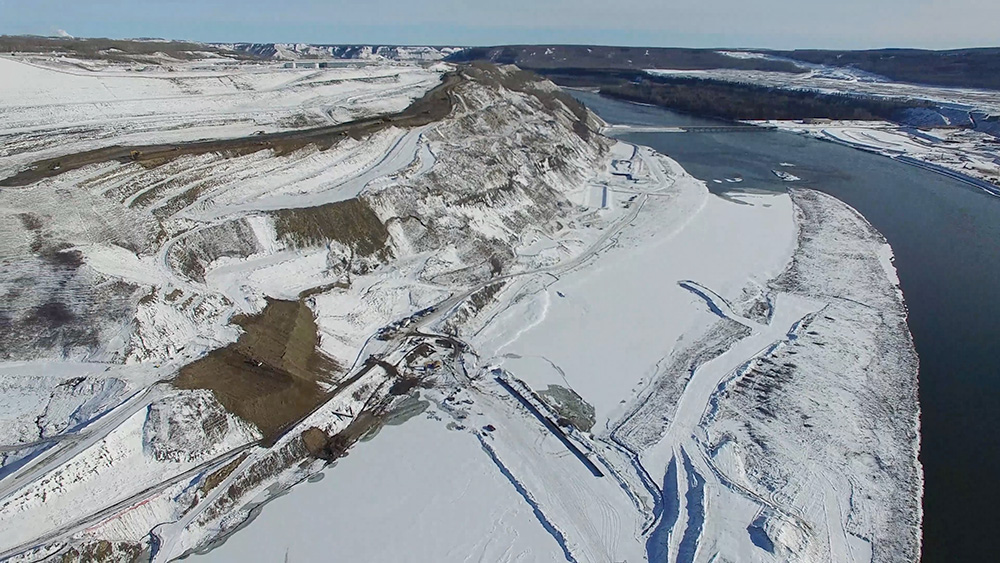

Now to Site C, an 1,100-megawatt hydroelectric plant being constructed on the Peace River in northeastern British Columbia. In 2007, on completion of initial feasibility studies, Site C was projected to cost $6.6 billion. Cost estimates were subsequently increased to $7.9 billion in 2011 and increased further to $8.34 billion in 2014. With forecast demand for electricity in B.C. apparently slowing, much of the power from Site C could be surplus to the province’s requirements for up to a decade after completion, scheduled for 2024.

Site C became an issue in B.C.’s election last May. After the NDP formed government with Green support, they determined to review whether Site C should be completed or cancelled and referred the issue to the British Columbia Utilities Commission.

The BCUC has provided its report on its inquiry into Site C to the B.C. government. The final report does not make cheerful reading for BC Hydro. The BCUC concluded:

- there is doubt that Site C can remain on schedule for completion November 2024;

- Site C is not within its most recent proposed $8.34-billion budget — indeed total construction costs could escalate to be more than $10 billion and could even escalate further into the $12 billion range — as much as 50 per cent above its most recent budget;

- cancelling Site C would bring cancellation and remediation costs of roughly $1.8 billion plus the costs of finding alternative energy resources that would be required to meet expected demand in the future; and

- various alternative energy resources (such as wind, geothermal and industrial curtailments) could provide similar benefits to Site C, at an equal or lower cost, even after accounting for any necessary cancellation and remediation costs.

The BCUC did not provide a clear recommendation as to what the government should do in these circumstances. Rather, the BCUC conceded that all of the alternatives have risks and appropriately left it to the government to make a final decision.

Completing Site C involves risks of delays, cost overruns and funding ultimately uneconomic resources. But cancelling Site C comes with its own risks, including that the BCUC may have underestimated a variety of factors, including the potential demand growth for electricity, cancellation and remediation costs and the execution risks associated with the acquisition of a portfolio of alternative energy resources to replace Site C.

The government has indicated that it will probably make its decision to complete or cancel Site C by the end of this year. One might initially be inclined to think that B.C. would grudgingly determine to carry on with construction, just like Newfoundland and Manitoba did when they had to make similar decisions regarding Muskrat Falls and Keeyask.

However, there are several significant differences between Site C and Muskrat Falls or Keeyask.

First, it appears that the balance between the marginal costs to complete Site C and the costs to terminate it, remediate the site and acquire an alternate portfolio of energy sources may be different and less favourable to completion.

Second, while the projects are all roughly the same size, the size of the sponsoring provinces are not. B.C.’s economy is almost five times the size of Manitoba’s and 10 times the size of Newfoundland’s. In the case of Muskrat Falls, the potential bankruptcy or reorganization not only of Nalcor, but also of the province of Newfoundland itself, was at stake. In the case of Keeyask, the economic health of Manitoba Hydro was in the balance. While the costs of abandoning Site C seem large in isolation, they are relatively small in the context of B.C.’s current and projected economy. If any potential write-offs associated with cancelling Site C were spread out over 10 years (as proposed by BC Hydro) or 30 years (as proposed by the BCUC), they would represent just a fraction of one per cent of B.C.’s GDP over that period.

That means the B.C. government, in making its decision to complete or cancel Site C, is free to take into account not just matters of pure regulatory economics, but also broader public policy considerations as to the future of B.C.’s electricity industry. That makes the outcome of B.C.’s review more difficult to predict — but also potentially more interesting.

The electricity utility industry — certainly in the developed world — is at an interesting inflection point. Traditional large-scale, centralized generation plants and related transmission lines are increasingly controversial, costly and difficult to build — at least in any predictable manner. At the same time, the costs of various smaller and decentralized types of renewable generation, distributed energy resources such as rooftop solar and new storage solutions are becoming ever cheaper and more technically feasible.

The decision by the B.C. government on Site C could provide some interesting guidance about designing the electricity grid of the future, whether based on traditional megaprojects such as Muskrat Falls, Keeyask and Site C or some combination of smaller and more discrete renewable projects, emerging storage technologies and more aggressive demand-side management. ![]()

Read more: Energy, BC Politics

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: