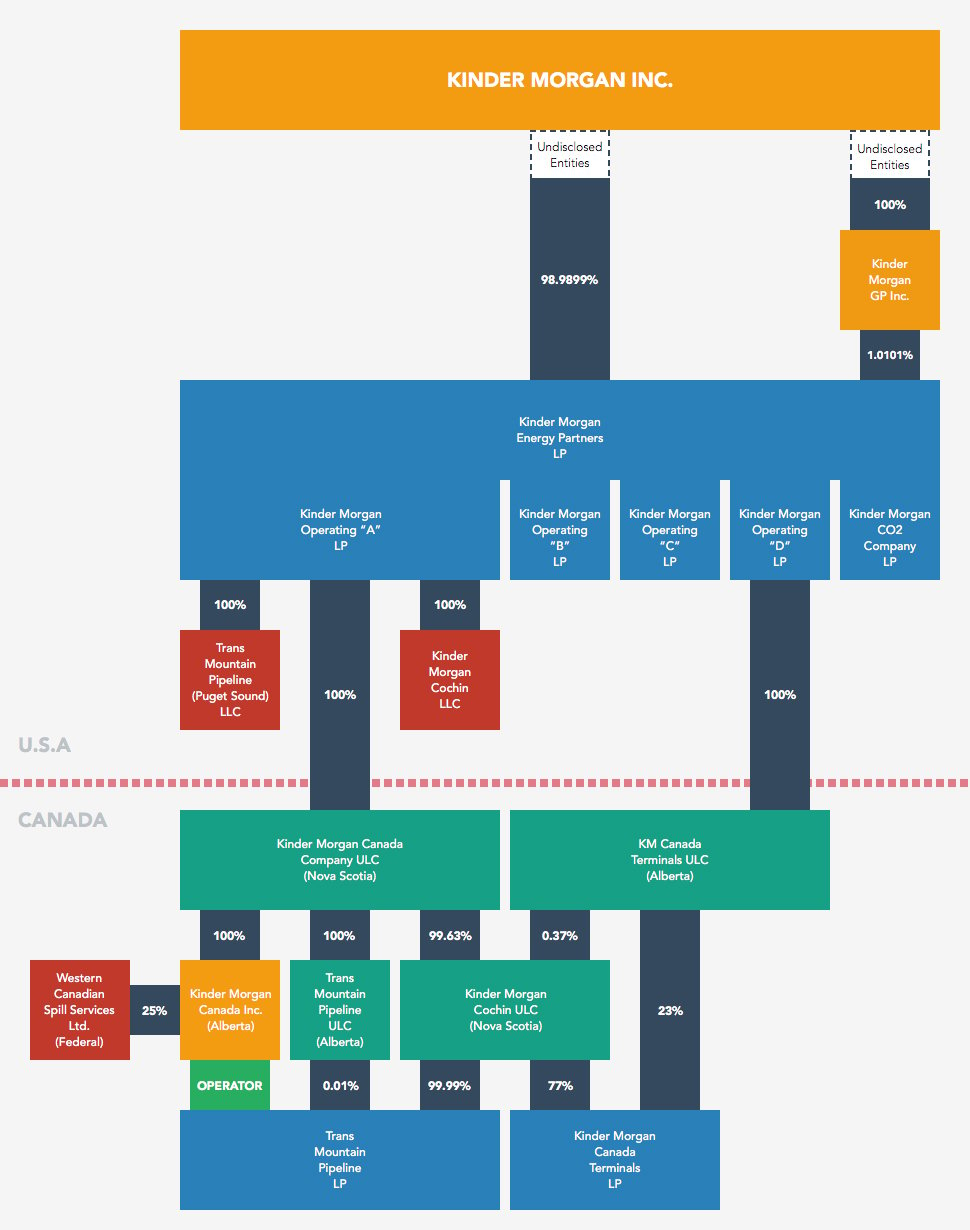

[Editor’s note: Scroll down to see chart mapping how Kinder Morgan Canada Inc. fits into a complex corporate empire run from Texas.]

U.S.-based Kinder Morgan says its Trans Mountain expansion project represents financial and economic benefit to the Canadian economy, and our federal and provincial public treasuries.

Who would spend a year investigating such claims, rooted as they are in complex tax law, regulations and corporate structure? I did.

What I found made me conclude the opposite -- Kinder Morgan drains financial wealth from our economy and does not pay its fair share of taxes.

I have written about the project's complicated design to yield meagre tax revenues for Canadians in a previous Tyee article.

Now let me examine just how Canadian Kinder Morgan Canada Inc. is. The answer: hardly at all.

Pop the hood and take a look at Kinder Morgan's inner workings and the idea that this is a Canadian company operating for the good of Canadians is dispelled quicker than Kinder Morgan can say injunction.

If you are bored by arcane discussions of corporate structure and governance, that may be just what Kinder Morgan is hoping.

Please bear with me. It's critical we know who really runs, and benefits from, Kinder Morgan Canada Inc.

From the boys who brought us Enron

Kinder Morgan Canada is little more than a Canadian face for one of the 50 richest American billionaires, Richard Kinder, and his Houston, Texas, based executive team -- many of them the same boys who brought us Enron.

Enron was a U.S. energy giant responsible for one of the biggest accounting frauds in history. According to Robert Roach, U.S. Senate counsel and chief investigator into Enron's collapse, Enron's executives began falsely inflating revenues and cheating on taxes way back in 1992 (page 16 Volume 1 of 2). When it became apparent what they were up to, the house of cards imploded. Enron filed for Chapter 11 bankruptcy on Dec. 2, 2001.

It is common knowledge that Richard Kinder -- chair and CEO of Kinder Morgan -- worked at Enron for 16 years. By the late 1980s he was vice-chairman of Enron's Board, becoming its president and chief operating officer (COO) in 1990. Kinder was instrumental (see page 109 and 119) in helping establish some pretty creative tax avoidance structured transactions the company became infamous for.

Kinder and his partner William Morgan -- another key player at Enron -- bought Enron Liquids Pipeline Company from Enron in early 1997. What is not generally understood is Kinder himself set Enron Liquids Pipeline Co. on its path five years before he bought the company. Kinder was a member of Enron Liquids Pipeline Co.'s Board of Directors when the company filed its initial public offering (IPO) with the U.S. Securities and Exchange Commission (SEC) in 1992.

It is also not common knowledge that at least four other key Kinder Morgan executives employed in senior positions today are Enron alumni. Three of them were with Enron when it went under and the SEC eventually brought one before the U.S. District Court on fraud charges.

Current Kinder Morgan elite who held senior positions at Enron include Steven J. Kean, Kinder Morgan's president and COO. Kean was Enron's executive vice-president and chief of staff in charge of human resources, government affairs, public relations, corporate communication and administration when the company filed for bankruptcy. From 1997 to 1999 he was Enron's senior vice-president of government affairs. Kean spent 12 years at Enron -- he started with the energy giant in 1989. What's strange is that Kean's corporate bio on Kinder Morgan's site makes no mention of the dozen years Kean spent at Enron.

Kean must be clever. While executive vice-president at Enron he sold (page 53) more than $5.1 million in Enron stock including more than 60,000 shares on Jan. 31, 2001. The highest price Enron shares reached was $90.75 in August 2001. A year after Kean sold more than 60,000 shares at $80 each, Enron's stock closed at 42 cents a share.

Jordan H. Mintz is Kinder Morgan's chief tax officer and a member of the board of various Canadian Kinder Morgan subsidiaries. Mintz was the vice-president of Enron's tax division from 1996-2000 and became general counsel for Enron Global Financial in October 2000. He joined Kinder Morgan in 2006. The U.S. government's Securities and Exchange Commission sued Mintz in 2007 for violating anti-fraud laws, aiding and abetting Enron's violations of anti-fraud and periodic reporting provisions, and lying to auditors while he was general counsel.

In January 2009 the SEC settled its lawsuit against Mintz -- he paid a civil penalty and was suspended from practicing as a lawyer before the SEC for two years.

Two other senior Kinder Morgan executives are Enron alumni -- Dax Sanders, now Kinder Morgan's vice-president of corporate development and David P. Michels, Kinder Morgan's vice-president of finance and investor relations. Both were hired into Enron's Analysts and Associates Program -- Enron's boot camp that fed aggressive university grads into Enron's work force at mid-level positions where they would rotate through different corporate divisions within Enron. Analysts and Associates learned how to structure complex deals, obtain financing, work the trading floor and generally became steeped in Enron's corporate culture.

A pocket full of radicals

Dividend growth is key to Kinder Morgan's stock price, but dividend growth needs revenue growth. This is why Trans Mountain's new pipeline is so important to Kinder Morgan. The company plans to triple pipeline capacity while siphoning away more than five times the financial return. Kinder Morgan predicts (page 3) $850 million a year in cash flowing out of the Canadian economy to U.S.-based shareholders when Trans Mountain's expansion becomes operational.

Trans Mountain's expansion is the biggest single project on Kinder Morgan's capital expenditure back log. It represents more than 30 per cent of planned expenditures. Without Trans Mountain, Kinder Morgan's financial prospects severely diminish. Kinder Morgan won't back down from Trans Mountain's expansion without a tough fight and they will never give the impression they aren't winning. Their stock price can't afford it.

This may be why former Enron employee and Kinder Morgan vice-president of corporate development Dax Sanders characterized the Trans Mountain Expansion project as a done deal. He was speaking at the Bank of America Merrill Lynch Global Energy Conference in Miami on Nov. 14, 2014.

Sanders assured (minute 25) his audience that Kinder Morgan is "very optimistic" about the pipeline and that the company is "expecting the NEB authorization... the federal government is enormously supportive of it... the real opposition is some of the few pockets of the more radical views in the lower mainland; in Burnaby and Vancouver."

It hard to understand how Sanders can characterize a majority of British Columbians opposed to Kinder Morgan's twinning -- including the mayors and municipal representatives of Vancouver, Burnaby and the entire North Shore -- as a "few pockets of the more radical views."

All roads lead to Houston

All Kinder Morgan's big decisions are made in Houston. Whether it's in-house legal, human resources, project financing, information technology, communications, audit, tax planning, insurance -- the orders come from Texan deal makers.

Kinder Morgan Canada Inc. is an operating arm of the U.S. multinational. Its president, Ian Anderson -- who many of us recognize from TV ads -- has two people directly reporting to him aside from an executive assistant: a vice-president of operations and engineering, and a vice-president of regulatory affairs and finance. All other corporate functions report to Houston.

On operating matters, Anderson himself reports to Steven Kean. When he files stock trading statements with the U.S. SEC, Anderson identifies himself as a Kinder Morgan Inc. vice-president.

This is where the complex corporate structure begins to come into the picture and helps reveal Kinder Morgan Canada Inc. as more of a mask than a face. Kinder Morgan Canada Inc., registered in Alberta, does not own the Trans Mountain Pipeline system, nor does it own any pipeline, storage, terminal or other assets.

Corporate structure

As shown by the Corporate Structure Chart I've prepared to accompany this article, Trans Mountain's system is owned by corporate entities that feed from Trans Mountain Pipeline LP registered in Alberta, through a myriad of entities.

Some of these are ULCs. ULC stands for Unlimited Liability Company. These unique entities only exist in Nova Scotia, Alberta and B.C. They can offer tax minimization opportunities to U.S. parent companies because of their special treatment under the U.S.-Canada Income Tax Treaty.

Trans Mountain Pipeline LP feeds into entities including Trans Mountain Pipeline ULC registered in Alberta, onto Kinder Morgan Canada Company ULC registered in Nova Scotia.

Then we cross the border and into Texas with Kinder Morgan Operating LP "A," to Kinder Morgan Energy Partners Ltd., to Kinder Morgan GP Inc. to undisclosed entities and onto Kinder Morgan Inc. All U.S. entities are registered in Delaware because of lax laws, but their head office is in Houston, Texas.

The only corporate shares Trans Mountain's operator Kinder Morgan Canada Inc. owns is its 25 per cent interest in Western Canadian Spill Services Ltd. (WCSS), a terrestrial spill preparedness and response organization that books profits because oil spills can, and do, happen. WCSS' other shareholders are Enbridge Pipelines Inc., the Canadian Association of Petroleum Producers (CAPP) and the Explorers and Producers Association of Canada.

Kinder Morgan Canada Inc. operates more than Trans Mountain. It also operates the Puget Sound and Trans Mountain Jet Fuel pipelines, Westridge marine terminal, Vancouver Wharves and the North Forty terminal. Kinder Morgan Canada Inc. plays a minor role with the Cochin condensate import pipeline because Kinder Morgan product pipelines group out of Houston, Texas -- Kinder Morgan Operating LP "D" -- is responsible for operating the actual Cochin system.

The flow of funds gushing away from the Canadian economy takes a slightly different route than the rights over ownership of assets. But the difference is significant -- it helps directors and officers as well as the corporate entity itself avoid liability, and assists in minimizing taxes. Companies bother with complex and sophisticated corporate structures because they pay. Whether or not the structure is outside the spirit of the law or represents tax evasion is a matter for the Canada Revenue Agency to investigate and determine.

Limited Partnership unit holders do not have any say in the day-to-day running of a business if they want to protect their limits of liability to what they have invested in the Limited Partnership. This is one reason why, for example, Trans Mountain Pipeline LP would send 99.99 per cent of its partnership unit based financial returns to Kinder Morgan Cochin ULC, but only 0.01 per cent to its general partner, Trans Mountain Pipeline ULC.

The funds then flow to Kinder Morgan Canada Co. -- a ULC registered in Nova Scotia and a little bit to Kinder Morgan Terminals Canada -- a ULC registered in Alberta. A simpler, more direct and less lucrative route would be to have Trans Mountain as a wholly owned company of Kinder Morgan Inc. in the U.S.

Understanding the corporate structure helps us see how millions of dollars a year generated from Kinder Morgan's Canadian activities can be repatriated to the U.S. with very little Canadian tax obligation. According to Kinder Morgan, over the past five years for Trans Mountain alone, an average of $172 million a year flows to the U.S. with an annual average tax burden of $1.5 million a year -- Trans Mountain received a cash tax refund in two of them.

It is not only distributable cash flow that Kinder Morgan Inc. in the U.S. siphons from the Canadian economy. The Houston based parent charges Kinder Morgan Canada Inc. for corporate services such as in-house legal, human resources, tax advice, auditing, information technology, procurement and insurance.

As well, Kinder Morgan Inc. -- the 100 per cent indirect parent of Trans Mountain -- is the sole-source financing for all Kinder Morgan activities in Canada. This means interest and fees related to project financing flow to Houston. This effectively removes an opportunity for our financial sector, and Canadian investors, to participate domestically and directly in these federally regulated transportation systems, including the $5.4 billion expansion project.

As the Corporate Structure Chart shows, Trans Mountain's pipeline system begins as a limited partnership with 0.01 per cent of its units owned by its general partner Trans Mountain Pipeline ULC and 99.99 per cent of its units owned by Kinder Morgan Cochin ULC -- the company that owns the Cochin pipeline system.

Recall that ULC stands for Unlimited Liability Company, and that these unique entities, existing only in Nova Scotia, Alberta and B.C., can diminish taxes to U.S. parent companies because of their special treatment under the U.S.-Canada Income Tax Treaty.

Kinder Morgan Cochin ULC imports condensate into Alberta to mix with bitumen so it can be exported back out as diluted bitumen. Cochin used to export propane from Canada until mid-2014. Condensate production and shipment from the U.S. is a Kinder Morgan profit centre.

Trans Mountain's expansion means every barrel of diluted bitumen exported from Kinder Morgan's Westridge marine terminal in Burnaby will include 30 per cent condensate imported from the U.S. Trans Mountain's expansion is not the "made-in-Canada" crude oil export opportunity as is being pitched by Kinder Morgan. What's more, co-mingling financial returns from Trans Mountain with Cochin's net results can represent further financial opportunities to Kinder Morgan.

The Corporate Structure Chart higher in this article shows that after Kinder Morgan Cochin ULC has absorbed its returns from Trans Mountain with its operation of the condensate import line and returns from its partnership units in Kinder Morgan Canada Terminal LP, 99.63 per cent of distributable funds flow from Kinder Morgan Cochin ULC to Kinder Morgan Canada Company ULC and 0.37 per cent to KM Canada Terminals ULC.*

Kinder Morgan Canada Company is a ULC registered in Nova Scotia with all but two of its directors and officers based in Houston. Mintz is the vice-president and chief tax officer of Kinder Morgan Canada Co. ULC.

Kinder Morgan Canada Co. is a company on paper. It is 100 per cent owned indirectly by Kinder Morgan Inc. through two disclosed and at least one or more undisclosed entities. Kinder Morgan Inc. purchased its 100 per cent ownership in all the Canadian entities as part of its $76 billion acquisition on Nov. 26, 2014. The purchase allows Kinder Morgan Inc. to legally inflate the value of the purchased assets to achieve significant tax write-offs -- $20 billion over 14 years turning Kinder Morgan Inc. into a tax shelter according to Rich Kinder.

As part of my right as a qualified expert intervenor at the Trans Mountain expansion project, reviewed and regulated by the National Energy Board, I asked Kinder Morgan to provide a complete corporate structure and reconcile its public claims regarding its financial and tax contribution to the Canadian economy contradicted by its reports to investor analysts in the U.S. Kinder Morgan refused arguing that the request was outside the scope of the public interest review. The National Energy Board sided with Kinder Morgan.

Kinder Morgan's unwillingness to be transparent and accountable is frustrating. The complicity in this by Canada's regulatory agency -- the National Energy Board -- is in my view tragic.

The corporate structure illustrated in the chart accompanying this article is based on a selected rendering submitted to the National Energy Board by Kinder Morgan and independent research I have conducted which relies on numerous outside publicly available sources including federal and provincial corporate registries. Best efforts have been made to be accurate. It should be noted that Kinder Morgan has more than 250 individual corporate entities with as many as 20 registered in Canada -- six of them ULCs. The corporate structure provided here focuses on the Trans Mountain system and its related entities.

The Trans Mountain expansion project is a project fronted by a very Canadian sounding Kinder Morgan Canada Inc. when it's actually driven by Richard Kinder and his executive team in Houston, Texas, many of them ex-Enron employees. Their interests are not our interests.

Canadians are being asked to decide whether a three-fold expansion of Trans Mountain's pipeline capacity is in our economic interests. At the very least we deserve to know who is running the show, how decisions are made, who gets the money and where it's going.

Let me repeat. There is nothing I have found in the past year of my research into Kinder Morgan that supports the claim that the Trans Mountain expansion project represents a net financial or economic benefit to the Canadian economy, or federal and provincial public treasuries. It's just the opposite -- Kinder Morgan drains financial wealth from our economy and does not pay its fair share of taxes.

*Figure corrected Jan. 13 at 8 a.m. ![]()

Read more: Energy, Labour + Industry

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: