When the new advocate for B.C. seniors, Dan Levitt, toured the province in his first few months on the job, the message was clear — everything has become expensive.

“The overwhelming issue for seniors in B.C. is affordability,” Levitt wrote in “Ageing Matters: What We Heard from B.C. Seniors,” released in early June. “They are simply unable to absorb increased costs for rent, groceries, transportation, property taxes, home support, personal care and other services needed as we age.”

People are feeling financially squeezed in every community and the situation is particularly hard for the 20 per cent of seniors who rent, he said. “Seniors in homeless shelters and food bank lineups now appear to be commonplace. Inflation has hit seniors on fixed incomes hard with the cost of living being unaffordable for many.”

Seven years after the NDP won power promising to make life more affordable, and four months before the government seeks re-election, Levitt’s is just one of the recent reports making the case that many people in the province are worse off.

And while polls suggest many voters believe the NDP remains the best party to address the housing and affordability crises, they also show that the stress people are feeling is a major force driving the growth of the provincial Conservative party, particularly among young people.

It wasn’t supposed to be like this. In the 2017 election, the NDP’s platform used the words “affordable” or “affordability” 60 times in 118 pages. It included a whole section on “Making Your Life More Affordable.”

The 2020 version, released ahead of the election that saw the NDP win a solid majority, had variations of “affordable” come up 47 times in 57 pages.

The government can point to measures it followed through on to improve affordability. They include eliminating Medical Services Plan fees that cost families up to $1,800 a year, reducing ICBC rates, removing bridge tolls in the Lower Mainland, no longer charging interest on student loans and reducing allowable rent increases for tenants.

It has also cut child-care fees, made birth control free, increased the B.C. family benefit and introduced a suite of housing policies aimed at making homes more affordable.

But despite the various measures — some with more impact than others — the seniors advocate and other observers keep finding that people in the province are increasingly financially strained.

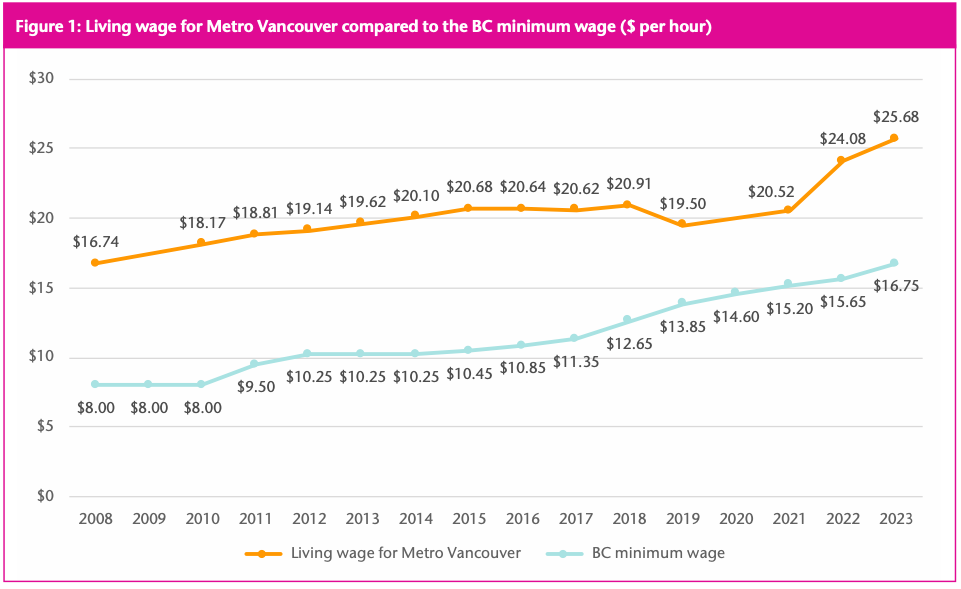

In a recent update, the B.C. office of the Canadian Centre for Policy Alternatives calculated that even with the June 1 minimum wage increase to $17.40 per hour, it is still $8 lower than the living wage in Vancouver or Victoria.

The progressive think tank calculates the living wage as the amount two parents both working full time need to earn to support a family of four, with the exact amount varying by community. It is enough for “a decent if still very modest standard of living without the extras many of us take for granted,” the CCPA says.

Some 740,000 workers in B.C. earn less than the living wage in their community, it said, citing Statistics Canada data.

The organization’s most recent living wage calculations come from a report released last November, when it found the amount needed in Metro Vancouver was $25.68 an hour.

“Although inflation has come down from the historic highs recorded in 2022, the cost of living in Metro Vancouver continues to increase rapidly,” it said.

A chart in the report shows how the city’s living wage has changed over time. When the NDP formed government in 2017, it was $20.62. It made a brief dip before 2021, then spiked through the COVID-19 pandemic years to reach $25.68 by the end of last year.

“New public investments to substantially reduce child-care fees and provide a dental benefit for children, and increases to key income-tested B.C. government benefits have helped counterbalance some of the increases in the cost of living, but the savings are entirely eaten up by rising prices.”

The report pointed to “skyrocketing rents, soaring food costs and high prices for gas and other necessities” as the major factors making life less affordable.

Rising housing costs were a key reason that a third of British Columbians said they were “giving serious consideration” to leaving the province, according to an Angus Reid Institute poll released this month. For people under the age of 35, the number spiked even higher, with half thinking about leaving.

The exodus is real. B.C.’s population has continued to grow thanks to international immigration, but according to the Angus Reid report, the province lost 8,000 more residents to other provinces than it gained from them in 2023, the biggest net interprovincial out-migration in more than a decade.

When Food Banks Canada released its poverty report cards, it gave B.C. a B for “legislative progress,” but low enough marks for everything else to drop the province to a D+ overall.

At 11.6 per cent, the poverty rate in B.C. is “substantially higher” than the 9.9 per cent national average, it said. “Despite being one of Canada’s wealthiest provinces, B.C. struggles with significant income inequality and housing affordability issues, particularly in urban centres like Vancouver.”

It pointed to “access to affordable, high-quality child care” as a key barrier that keeps families out of the labour market. While B.C. was making progress on child care, it said, the province “has lagged considerably compared to the rest of the country.”

From 2019 to 2023 child-care fees dropped by 12 per cent nationally, thanks to the establishment of the federal Early Learning and Child Care Framework, but by only six per cent in B.C., it said.

B.C. also has a high level of core housing need, with about one in 10 households living in places that cost more than they can afford.

Nor have government benefits kept up with rising costs. “B.C. has the highest rate of people who say that social assistance rates are not high enough to keep up with the cost of living,” it said, “41 per cent compared to 30 per cent in Canada as a whole.”

Asked about the Food Banks Canada report when it came out in May, B.C. Premier David Eby acknowledged that the issues with affordability “are serious and ongoing,” but he argued the government was taking steps to improve affordability, particularly with its new housing policies.

He pointed to the effect of high interest rates that the Bank of Canada raised in recent years to combat inflation. “This has always been a more expensive place to live, but when people are renewing their mortgages, when they’re seeing their debt payments go up dramatically, it impacts affordability for them generally and this has a very significant impact on those who are most vulnerable.”

The province has “put in place a whole series of initiatives” targeted to address poverty, Eby said, giving the examples of increased Shelter Aid for Elderly Renters payments, school breakfast programs, subsidized child care, rebates through BC Hydro, rebates through ICBC, and frozen ICBC rates.

Eby said B.C. has gone from having the lowest minimum wage in Canada to the highest, a change it made while leading on job creation and maintaining a strong economy.

Responding to a question about the calls from Food Banks Canada and other advocates to raise social assistance rates to reduce poverty, Eby did not respond directly about his government’s choices, but he criticized the records of Conservative Party of BC Leader John Rustad and BC United Leader Kevin Falcon when both were BC Liberal cabinet ministers.

“It’s a bit laughable that the other parties care about the issue of poverty and people living below the poverty line, given their track record,” he said.

“What people can expect if there is a John Rustad or Kevin Falcon government... if they get back into power, they will cut those programs because that is exactly what they did when they were elected in 2001,” he said. “They cut the affordable daycare program that the NDP had put in place and eliminated that for a generation, and they will do it again.”

According to last year’s B.C. budget documents, the government had succeeded at reducing many of the costs it controls, from income tax to MSP premiums.

Table A4.1 in the 2023 Budget and Fiscal Plan showed the net provincial taxes at various income levels after including MSP premiums, income tax, sales tax, carbon tax, fuel tax and other benefits. (The table, which allowed a comparison across years, was dropped from the most recent budget document.)

A family with $100,000 in net income that would have paid $7,444 in 2017 saw that amount drop to $4,948 last year. For a lower-income family making $30,000, instead of paying $189 as they would have seven years ago, they would have got back $2,565.

But with voters facing rising costs for housing, food and other essentials, many may not accept the government’s explanation that “global inflation” is to blame.

A May survey of 1,000 eligible B.C. voters by Abacus Data found that overall the NDP had a six percentage point lead over the Conservatives, with United and the Greens trailing far behind.

For B.C. Conservative supporters, “the rising cost of living” was far and away the No. 1 issue, and Abacus said the party was “benefiting from the difficult economic situation.” Among voters younger than 29 years old and with those citing the rising cost of living as their top issue, the NDP and the Conservatives were tied.

The next election is scheduled for Oct. 19. Between now and then many potential voters will continue to ask themselves if they are better off than they were when the NDP formed government and which, if any, of the other parties have a credible plan to ease the financial strain they’re feeling. ![]()

Read more: BC Politics, Housing

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion and be patient with moderators. Comments are reviewed regularly but not in real time.

Do:

Do not: