Patrick Condon is a well-intentioned urbanist colleague but his critique in The Tyee of Vancouver’s Moderate Income Rental Housing Pilot Program and a project at Alma and Broadway misses the mark.

Condon argues the city’s rental incentives are too rich and offer too little value for money. However, he underplays the affordability of below-market MIRHPP rents; miscalculates the city subsidies granted for the project; and presents an economically unviable alternative “100 per cent affordable” housing program of his own invention.

Condon and I both love this city and agree that we need to invest public funds to build more affordable housing. But I advocate for a more diverse supply and more partnership with the development industry.

Ultimately, sound housing policy requires an accurate understanding of costs and benefits.

First a primer on the MIRHPP program:

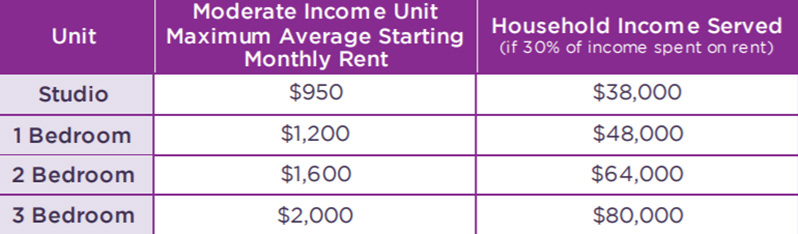

What are moderate income rental units and why are they public benefits?

The city’s moderate income rental pilot program allows rezoning proposals for new buildings where 100 per cent of the residential floor area is secured as rental housing and at least 20 per cent of the residential floor area is permanently secured for moderate income rental housing units at rents significantly below market rates.

The legal agreements last for 60 years or the life of the building, whichever is greater.

The rents for MIRHPP below-market units are vacancy controlled. Even when tenancies change, rents can only increase by the small annual amount allowed by the B.C. Residential Tenancy Branch. These increases lag real operating cost inflation, so the affordability of below-market MIRHPP units only grows over time relative to rising wages.

Plus, the developer assumes all financial and operating risks for the life of these rental projects.

In return, the city grants additional floor area and height, relaxes parking requirements, and waives the city's Development Cost Levy to help make developers make MIRHPP rental projects economically viable.

Reputable third-party economic reviews confirm that these types of incentive programs are needed to make market and below-market rental housing viable and more competitive with condominium uses. Vancouver’s rental incentives are contributing to the growth of market rental housing after a four-decade drought.

Condon claims the benefits of the MIRHPP units aren’t worth the incentives the city grants for them. He suggests that the city would have been better to approve a 14-storey condominium building at Alma and Broadway with the same floor area as the 161-unit rental project that includes 32 below-market MIRHPP units.

That’s because he thinks that a condo building, unlike a rental MIRHPP project, would generate a lot of cash for the city in the form of a Community Amenity Contribution from the developer. This CAC, plus other revenue waived to incentivize the MIRHPP developer, could then be used to fund more below-market units in a 100 per cent affordable rental building on free city land somewhere else, Condon argues. He thinks this could buy four times the number of MIRHPP units at the Alma project.

Let’s look at what he gets wrong.

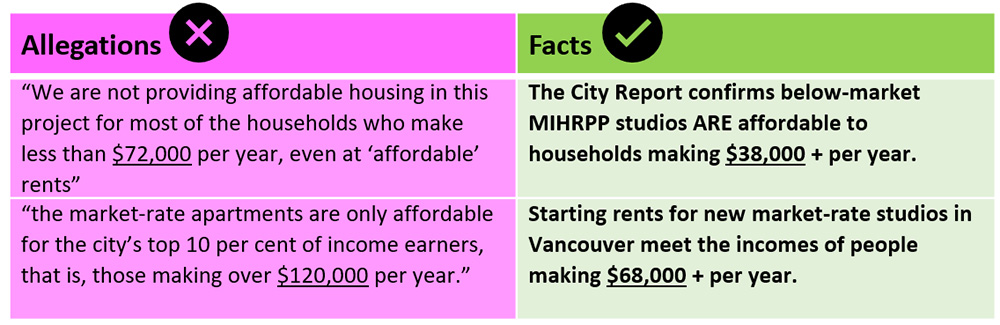

1. Underestimating MIRHPP affordability.

Condon acknowledges the "locked-in" below-market MIRHPP rents are a “good thing” but he paints the Alma non-market units as far less affordable than they really are by referencing only two-bedroom rents, ignoring the lower-rent studios and one-bedroom units which comprise 65 per cent of the 32 below-market units.

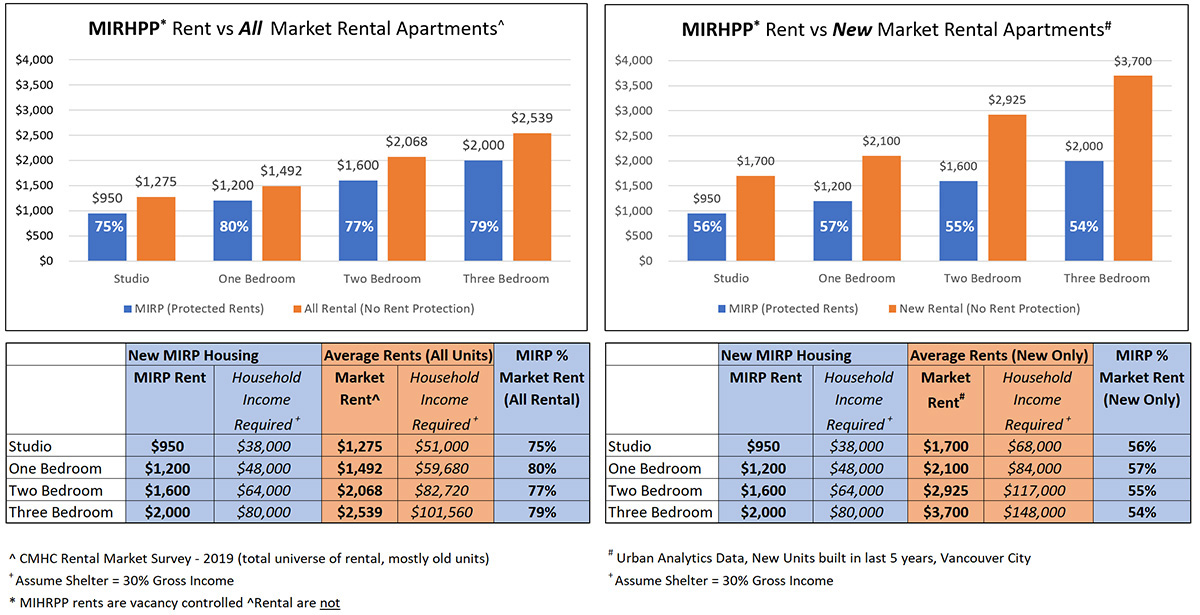

The fact is that new below-market rent-controlled MIRHPP units (blue bars in the graph below) are far more affordable than the universe of older aging units in Vancouver, and they are even more affordable when compared to market rents in new purpose-built rental buildings which reflect today’s higher development costs.

Another affordability test for MIRHPP rents is to place them in context with B.C.’s minimum wage.

In June 2021, the minimum wage will increase to $15.20 per hour. MIRHPP rents will not change. At 37.5 hours per week, a person earning minimum wage ($29,640 a year) would pay 38 per cent of their income for a brand-new studio apartment. Two people at minimum wage could rent a studio for 19 per cent of their income; a one-bedroom unit at 24 per cent of their income; and a two-bedroom unit at 32 per cent of their income.

I see market-delivered vacancy-controlled MIRHPP rents as a significant achievement in Vancouver. MIRHPP rents will only fall over time relative to inflation and wage growth.

Let’s now turn to the public cost of the MIRHPP program which Condon says is too rich.

2. Exaggerating city subsidies for market rental and MIRHPP.

While downplaying MIRHPP benefits, Condon exaggerates the value and nature of the subsidies the city gives to MIRHPP projects. Yes, the modest Development Cost Levy waivers are a direct cash city subsidy for the MIRHPP program. In the case of Alma, the city will waive DCLs of $3.1 million ($19,500 for each of the secured rental units including the 32 MIRHPP units).

The Alma project will still pay for project-specific off-site upgrades for storm drainage, sanitary sewer, road and sidewalks upgrades, commercial DCLs ($212,786); full metro fees ($1,072/unit); and Translink’s fee ($1,545/unit).

Let’s look at some of the other incentives Condon terms too rich.

Relaxed density limits: zero cost to the city. The principal tool available to the city to incent the development of new rental housing and make it economically competitive with condominium development has been to allow additional height and floor space, subject to good design and other planning criteria. Rental tenure projects are significantly less profitable than condos, so condo uses typically outbid rental for land. "Vitamin D(ensity)" is effective in levelling out the playing field: increasing the area of rental housing that can be built on a property, averaging down the fixed land and development costs. This incentive comes at no cost to the city.

Access to low-interest financing from government agencies: zero cost to the city. BC Housing and the Canada Mortgage and Housing Corp. offer low-cost construction loans and long-term mortgages to projects that meet their respective affordability targets. The interest break varies with the degree of affordability generated by the project. This financing has zero financial draws or impacts on city budgets or funds.

Reduced on-site parking requirements: zero cost to the city. Condon counts the city’s 40 per cent reduction in underground parking stalls as a subsidy of $6 million when in fact it is a simple cost reduction to better match parking supply with real demand. Studies show that rental buildings in Metro Vancouver are overparked by 35 per cent (condos even higher) and council is currently exploring the removal of parking minimums across Vancouver. The relaxation has no cost to the city and Mr. Condon’s assumption that the city could collect and redirect the value of this relaxation is not realistic.

The big question: How many CAC millions might a condo development mean for the city? This is a critical element of Condon’s argument. He states that the city “forgives Community Amenity Contribution taxes for MIRHPP projects, money that would otherwise have been paid by a condo developer of this site.”

His calculations assume instead that council up-zones the land at Alma and Broadway to allow a 14-storey tower and a developer proposes a condominium project, all units to be sold at market sales prices instead of the rental housing recently approved.

Community Amenity Contributions are not really a tax. They are a cash or in-kind payment to the city by developers negotiated on a project-by-project basis. Through CACs, the city captures 75 per cent of the rise in land value created by rezoning.

In guessing at a CAC for the Alma project, Condon suggests that $27 million could be collected from the development based on the city’s CAC of $350 per square foot “on all new Broadway corridor developments.”

I’m not aware of any Broadway corridor condo rezonings to date at this CAC rate, which was deliberately set high by the city precisely to deter condo rezoning during the Broadway Plan process.

Still, let’s assume Condon’s $350 per square foot CAC is achievable. He makes a mistake by applying it to too much floor space. The city’s Alma Street rezoning report confirms that the area above what current zoning permits is 48,031 square feet. That area, multiplied by the $350/sq. foot CAC assumption, totals $16.8 million not $27 million — a $10 million error.

3. More 100 per cent affordable units for the same MIRHPP subsidy? No.

After underplaying the benefits of below-market MIRHPP units and overplaying the incentives offered by the city for the same, Condon is overly optimistic about the viability of his proposed alternative 100 per cent below-market housing program.

He asks rhetorically: “If we gave the same MIRHPP perks [and free city land] to non-profits instead of profit-making developers, could we get 100 per cent affordability instead of only 20 per cent?” He suggests that “conventional development taxes could provide over four times more permanently affordable housing than our current MIRHPP program can manage.”

This does not pencil out.

Condon did not prepare much of a budget, so I’ve tested his hypothesis with a basic one-page pro forma. It assumed the corrected condo CAC revenue of $16.8 million is available. It also assumes that, although the city tends to spend DCL revenues on not just housing but parks, daycares and other amenities, this time the entire $3.1 million DCL paid by the condo developer goes to Condon’s project. That gives the city about $20 million. Will that get the job done? (You can read my calculations by clicking here.)

The fact check below guides you through the pro forma and the key mistakes I believe he made with his development economics.

Fact Check:

I calculate that Condon’s alternative “100 per cent affordable” rental project is bankrupt before the first brick has been laid. He underestimates costs and overestimates units, revenue, net operating income and returns to the city. To properly finance his 100 per cent affordable building, the city would have to contribute an additional $16 million in cash to the $16.8 million CAC and $3.1 million DCL Condon would net from the condo project at Alma, and the project would also have to secure a $14 million mortgage to cover the $50 million total development cost.

That’s $459,000 per unit for Condon’s program, even with free land. The public would also be on the hook for major capital repairs for the life of the building. In this scenario, the other 129 secured market rental homes at Alma would of course be lost, replaced by more expensive condos.

This is the reality that most developers work in — new construction is expensive! Operating costs are expensive!

We can collaborate and do better.

MIRHPP units offer secure below-market rental housing for the life of the buildings with very modest city subsidies and leave the city carrying absolutely no risk.

To be clear, I fully agree that we need to spend public money to help house people living with low income, but these 100 per cent affordable projects require heavy capital and operating subsidies even with free land. In my view, it’s wise for the city not to go it alone on deep subsidy housing but rather to partner more with senior levels of government while also working more with Vancouver’s development industry which has the expertise and capacity to create a wider spectrum of market and below-market housing. It’s in the public interest. ![]()

Read more: Housing, Municipal Politics

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: