Gordon Campbell has probably taken the steam out of potential recall campaigns with his bold promise that his government will eliminate the HST if a simple majority votes against the tax in a referendum to be held on Sept. 24, 2011. The pattern since he announced the HST two months after the last election has been for the government to do everything wrong. He could quickly lose any advantage his simple majority vote announcement gave him if he is perceived to be playing games with the wording of the referendum or the rules that will be used to conduct it.

There are three questions that flow from Campbell's announcement: 1) How will the referendum work?; 2) What are the agreed set of facts about the pros and cons of the HST?; and 3) What would happen if the HST is voted down?

How will the referendum work?

Campbell has asked people to trust him because he won't put his promise into an amended Recall and Initiative Act. Many would argue that he is solidly on the public record so that amendment may not be necessary, but he was also solidly on record not to break HEU's contract, not to sell BC Rail and not to run a deficit higher than $495 million. That's why Vander Zalm and others want his promise put in an amended Recall and Initiative Act. While Campbell's government is amending the act, it could also move the voting day up so as to eliminate a full year of uncertainty.

He could eliminate much of the distrust that surrounds his promise by encouraging Elections BC to set the question as soon as possible and by guaranteeing that he won't complicate a single simple yes or no question by adding additional questions to the ballot.

A few big businesses in B.C. will save $2 billion per year as a result of the HST; that tax is shifted to consumers who pay HST on services and restaurant meals that did not previously attract the PST. Those businesses have enormous incentives to spend millions on the pro-HST debate, but ordinary families who get hit with hundreds of dollars in extra costs will not be able to match those advertising dollars. Rules should be set for the referendum debate to create a level playing field so the pro-HST side is not overwhelmingly financed with government advertising and big bucks from big business to the disadvantage of the anti-HST side.

What are the agreed facts about the HST?

Ideally the referendum campaign will focus on the advantages and disadvantages of the HST. I was able to use data from Statistics Canada to verify the government's initial news release that said the tax would shift $2 billion per year from business to ordinary families; however, it has proven impossible to get agreement on how much of that shifted tax will be borne by various typical families.

Simple division suggests $2 billion divided by 4 million people, means $500 per person, but the government and others insist the extra costs to families is much less than that. Before the vote on the referendum, the government should provide an explanation of the tax shift that is transparent and that can be accepted as valid by opponents of the tax.

Without a reconciliation of the government's estimates of business tax savings, government tax revenue and family tax increases, we are left with anecdotal stories about more costly restaurant bills, haircuts, funerals, home maintenance and the like. I hope that this fundamental question is resolved before votes are cast in the referendum.

What will happen if the HST is voted down?

The simple notion is that if the HST is defeated, B.C. would go back to the PST system that existed prior to July 1, 2010. That becomes challenging since all the tax collectors and tax auditors have been either laid off or transferred to Canada Revenue Agency. Rehiring those experts might not be easy. One alternative might be to reach an agreement where Canada Revenue would administer the re-implemented PST.

An attempt should be made to inform voters about the federal government position with respect to facilitating the re-introduction of the PST. If the federal government proves uncooperative, then Stephen Harper will have to bear some of the political consequences that he has managed to escape for the past year.

Of course, the big federal-provincial issue is repayment of the $1.6 billion transition money (bribe). If the HST were not eliminated until July 2015, no repayment would be due, but if it is eliminated prior to that date, the full amount must be repaid to Ottawa. Supporters of the HST will claim that the repayment would jeopardize funding for health and education; opponents of the HST will point out that the transition funds were a one-time payment, and returning them simply means that the provincial deficit and debt would have to be honestly stated.

Supporters of the HST might also worry about a quarter of the population who receive up to $230 per person per year in assistance to offset the impact of the HST. Of course, if the HST is eliminated, there would be no need to provide assistance to offset its impact. Low income families need to understand that only the provincial portion of thir cheques would be eliminated as the system returned to the former GST rebate system, which provides up to $250 for eligible adults and $131 for eligible children.

Extra complications could be introduced by the more unusual provisions of the legislation that Vander Zalm attached to the initiative petition, such as repayment of all monies collected from day one of the HST to all B.C. families on an equal per capita basis. Not only is that unworkable, but it would leave a $7 billion hole in provincial finances. It will not help to inform the debate over the HST if it bogs down on impractical provisions like that.

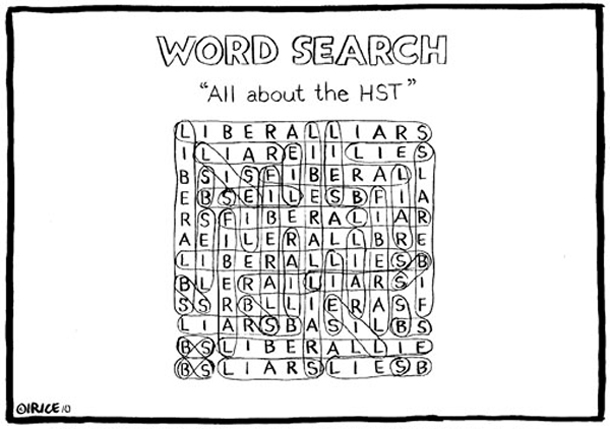

It is in the public interest to keep the debate on the high ground of whether the HST is advantageous or not; that kind of debate should have occurred prior to the May 2009 election. My practical political experience makes me think that this is only wishful thinking. As in war, truth is frequently the first victim in political debates over controversial policies. ![]()

Read more: Politics

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: