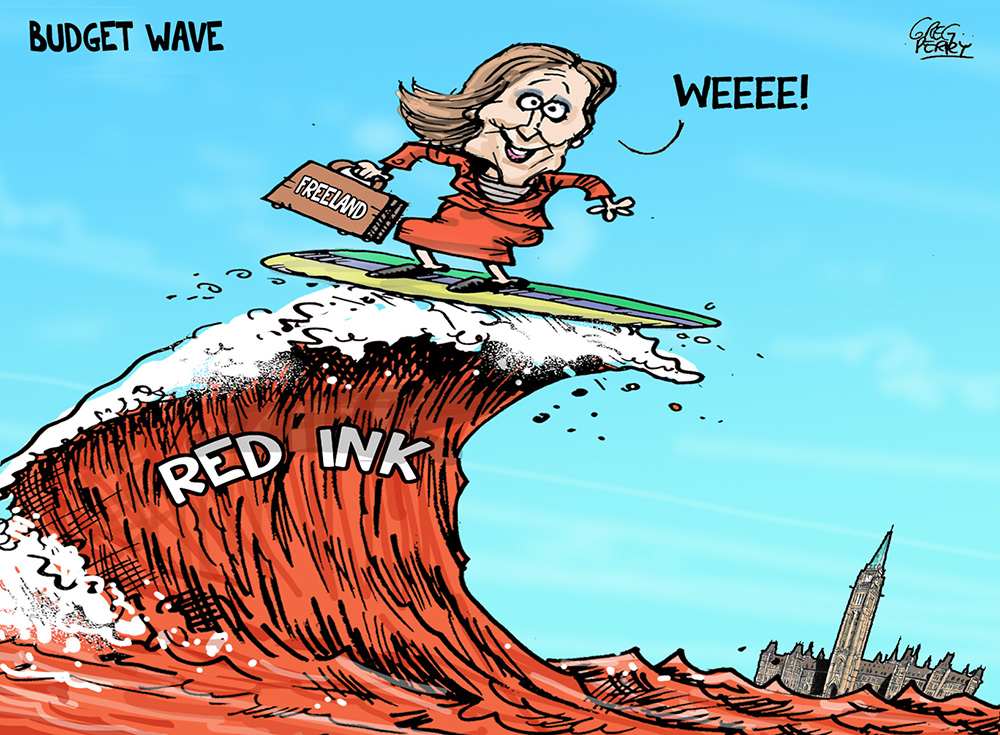

Three chickens in every pot — that’s the essence of the Trudeau government’s first budget in two years. Featuring $101.4 billion in new spending, it draws a stark distinction between Liberals waging a cheque-book war against the pandemic, and tight-fisted Conservatives, who can’t stand Big Government getting bigger.

In other words, this is an election budget. Which is probably why Conservative Leader Erin O’Toole was totally disappointed by the budget because it didn’t have “a plan.” To the contrary, Chrystia Freeland can be accused of many things in her first budget, but a lack of plans is not one of them.

Her budget rained down cash on a stubborn pandemic, a national child-care program, and what it is calling a green recovery to “build back better” after COVID-19 has been vanquished. As the finance minister herself put it, the budget is about “finishing the fight against COVID” and “healing wounds left by the COVID recession.”

On the COVID-19 front, Minister Freeland announced that all of the government’s main support programs, including the Canada Emergency Wage Subsidy and the Canada Emergency Rent Subsidy will be extended to September to accommodate the third wave of the pandemic. A total of $12 billion was earmarked for those two programs alone.

The CEWS program began on March 15, 2020 and was initially available for a period of 12 weeks, to June 6, 2020. That subsidy provided up to 75 per cent of an eligible employee’s wage to a maximum of $847 per week. The government has since extended the wage subsidy to June 30, 2021. The finance minister has extended that program for a second time, stretching out to September 2021.

The star of this 739-page budget? The federal government will also spend $30 billion over the next five years on a national child-care program. That is something that the Liberals have been promising since 1993, when it was a key plank in their campaign platform document, the Red Book.

Under the new program announced by Minister Freeland, child care will cost parents a lot less. The goal is to cut child-care costs in half by 2022, and then make the service available at $10 a day to all Canadian families by 2025. Quebec is the only province that currently has a government subsidized child-care program, offering care for $8.35 a day. Private child care runs from between $35 to $60 a day.

This marks the second time a Liberal government has introduced a national child-care program. The first one was created by former prime minister Paul Martin. That short-lived program was barely up and running when incoming prime minister Stephen Harper cancelled it. Harper replaced the national plan with a $100-per-child payment made directly to parents.

Ottawa’s current spending on child care runs out late in this decade. In last fall’s economic update, the Liberals pledged to invest $870 million a year in 2028. Today’s budget went lightyears beyond that number.

Mindful of the reaction of the business community, Freeland tossed more than a few bonbons its way. Small and medium-sized businesses will be a big part of the focus of the government’s new $100-billion stimulus program, a sum that represents four percent of Canada’s GDP. Small businesses will have access to grants, while medium-sized enterprises will be eligible for interest-free loans.

The finance minister also announced a new hiring credit for employers, which can be used to hire new staff or raise the wages of existing employees. The federal government will cover as much as $1,100 of a worker’s pay every four weeks.

Addressing the crisis in affordable housing, the budget included a new tax on absentee foreign property owners speculating in the Canadian housing market. Faced with an over-heated real estate market, Ottawa will also invest in incentives for first time homebuyers, and generous tax credits to homeowners to make their homes more energy efficient. A total of $4.5 billion will go into that program in the form of $40,000, interest-free loans to participants.

Freeland announced a few tax tweaks, including a tax on luxury cars, boats and private aircraft. The tax will be between 10 and 20 per cent on cars and planes worth more than $100,000 and yachts valued at $250,000 or more.

Other new measures include a sales tax for online platforms and e-commerce warehouses, and a digital services tax on big web companies.

Budget 2021 was definitely an exercise in no voter left behind.

Canada’s minimum wage was raised to $15 an hour.

The provinces got a $7 billion top-up in health-care transfers.

Pensioners get a $500 cheque this summer, and a ten per cent increase annually starting in July 2022.

There is $57 million for farmers who had to pay to quarantine offshore workers coming into the country.

Employment insurance sickness benefits have been extended from 15 to 26 weeks.

The doubling of Canada Student Grants has been extended for two years, and there are also interest payment breaks for students with outstanding loans.

Freeland also set aside $18 billion for safer communities for Indigenous peoples.

But it all adds up — and up and up. The prime minister often says that his government has the public’s back. But that same public is going to be up to its neck in debt for a long time to come.

The Parliamentary Budget Office has wondered out loud if the $100-billion stimulus package is really needed, since the economy appears to be making a good recovery without it. The PBO has suggested that though the stimulus package would no doubt help speed the recovery, it also burdens the government with huge deficits in the midterm.

Back in March 2019, then-finance minister Bill Morneau estimated that the federal deficit for fiscal 2020-2021 would be $19.7 billion. By the time the fall update was delivered, Morneau’s projection dissolved into fiction.

The deficit exploded to $354.2 billion. Freeland’s deficit projection for fiscal 2021-2022 is also gigantic — a whopping $155 billion. In both cases, COVID-19-related spending is the culprit, which will double Canada’s debt over time. It will soon amount to 50 per cent of Canada’s gross domestic product.

The prospect of these massive budget deficits likely triggered Bill C-14, which raises the government’s debt ceiling to $1.8 trillion. That bill passed the House of Commons on April 15, without a single vote from the Conservative Party of Canada. The bill will now be debated in the Senate.

What happens next is a moment of political drama, but faux drama. There will be four days of debate on the budget, following which the Conservatives will move the traditional opposition amendment. The third party in Parliament, the Bloc Québécois, will then move a sub-amendment. Both of those amendments will be voted on in Parliament.

Then it’s show time. The House of Commons will vote either for or against the government’s budget. Since this is a confidence matter, and the Liberals are in a minority government, Trudeau could fall if the opposition voted together. That would mean a snap election.

But don’t steam up your glasses. It won’t happen.

The Liberals only need one partner in this political budgetary dance to survive and they have one. NDP Leader Jagmeet Singh is already firmly on record with the statement that even if the NDP didn’t get what it wanted from Finance Minister Freeland, the party will support the budget to avoid triggering an election during the third wave of the pandemic. And he said so even though the feds have ignored Singh’s demand for pharmacare.

Once again, pandemic politics breaks the government’s way. It’s hard to go up against the politicians putting all those chickens into all those pots. After all, who do you want having your back, Lady Bountiful, or Mr. Scrooge? ![]()

Read more: Coronavirus, Federal Politics

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: