The Tyee office was nearly empty when I arrived back at work early on Monday morning. Vanessa Richmond, our managing editor, looked up briefly from her cluttered desk, smiled and silently returned my casual wave as I walked through the newsroom to my office in the basement.

I'd been away for the past few weeks, getting some rest at Dr. Robert's Sanitarium and Convalescent Centre on Lasqueti Island. Nothing serious, really; just a chance to relax after too many stressful months watching the legislature, poring over budget estimates, analyzing government bills and writing about B.C. politics.

I'm a pundit; it's what I do.

My blissful reverie was destroyed the instant I got to my desk and saw the note. Written in the unmistakable scrawl of David Beers, The Tyee's editor, it read: "I want you in my office as soon as you get in!"

I raced back upstairs, my heart pounding and a cold sweat starting to trickle down my shirt collar. Vanessa kept her head down as I ran through the newsroom to Beers's office. She knew what was coming; she'd seen it before.

An unsmiling hulk of a man, Beers scared all of us Tyee staffers. It was rumoured that he once had a try-out with the B.C. Lions, but he didn't last long. Some said it was because they couldn't find a uniform big enough to fit him; others said that Beers was too mean and had injured too many of his teammates during practice.

A few years ago, inexplicably, the corporate hedge-fund that owns The Tyee hired him as our editor. His sole objective is to manage the bottom line, which he does by brow-beating the wimpy writers, inexperienced interns and desperate freelancers who contribute copy to The Tyee. His favourite put-down is, "You wouldn't last two seconds in a knife fight."

Man with a gun

I got to his office and knocked tentatively on the open door. Beers was cleaning the police-issue Glock 22 that he brings to editorial meetings. Unsmiling, he motioned for me to sit, pointing with the pistol to the chair in front of his desk.

"While you were away, ah, resting," he sneered. "Carole Taylor released the 2006-07 public accounts."

He explained that the year-end results were nothing less than stellar. In the consolidated revenue fund, the province's main operating account, receipts totalled $31.2 billion and expenses were $29.9 billion, good for a whopping CRF surplus of $3.3 billion.

Under the much-broader GAAP measurement -- which counts the CRF, plus Crown corporations and the so-called SUCH sector (schools, universities, colleges and the health sector) -- revenues were $38.5 billion, while expenditures totalled $34.4 billion (including $264 million in "negotiating framework incentive payments"). That left an eye-popping surplus of almost $4.1 billion.

I nodded, but before I could reply Beers cut me off with a wave of the Glock. "But the big story is Taylor's eroding credibility. When she attributed the surplus to the BC Liberals' tax cuts, and said that the tax cuts had paid for themselves, the news media actually sought the opinions of others in an attempt to verify what she said was true, or at least offer a different perspective."

I let out a low whistle. That was news!

Taylor's whoppers

Beers reminded me of the sequence of events that led to Taylor's denouement. It started in the fall of 2005, when she dangled $1 billion in signing bonuses before public sector workers. She claimed that, if new agreements were not concluded by March 31, 2006, the cash would automatically disappear -- because of GAAP (generally accepted accounting principles) -- into the black hole of debt repayment.

Journalists and pundits, radio talk show hosts and newspaper editorialists, all fell victim to this laughably silly assertion, seemingly unaware that there is no such GAAP requirement. Nor is there any provincial statute that demands the government allocate a year-end surplus to outstanding debt.

Then, late last year, Taylor declared at a news conference that unless Victoria took corrective action to fix soaring health care expenditures, in a decade health would consume more than 70 per cent of the province's annual budget. Most media drones quickly succumbed to this wacky suggestion (and some remain convinced of impending doom), but an intrepid few -- notably columnists Paul Willcocks and Craig McInnes, and pundit David Schreck -- promptly demolished Taylor's calculations with empirical precision.

The proverbial last straw for B.C.'s news media may have been Taylor's 2007-08 budget, released last February. The centrepiece was a 10 per cent reduction in personal income tax rates, a costly measure expected to reduce provincial revenues by more than $1 billion over this fiscal year and the next.

Plainly this was a tax-cutting fiscal plan, but Taylor stubbornly insisted that she was "Building a Housing Legacy," claiming that lower tax rates would give British Columbians more money to pay their monthly mortgage and rental payments.

Even in the face of persistent questioning, the finance minister refused to acknowledge that taxpayers, instead of allocating their new-found wealth to housing, might opt to purchase any number of other goods and services. The media's smiling admiration for Taylor turned to head-shaking disbelief.

Tax-cut magic?

Using the Glock, Beers pushed two sheets of paper towards me across his desk. I glanced at them quickly: one was a printout from the CBC News website, and the other a photocopy of a story by Vancouver Sun reporter, Chad Skelton. "Read 'em," Beers ordered, "especially the parts where Taylor talks about tax revenues."

The CBC piece quoted Taylor thusly: "When you look at so much growth from tax revenue, it does show that tax cuts work because tax cuts have stimulated the economy." That assertion was followed by a rebuttal of sorts by some NDP MLA by the name of Farnworth. I'd never seen that before; imagine, the media acknowledging that a lowly New Democrat could challenge Taylor. Wow!

In the Sun story, Skelton quoted Taylor as saying, "What this...shows very dramatically is that, while tax cuts at first cause your taxation revenue to drop, as it stimulates the economy...your tax revenues start to go up quite dramatically." And then, incredibly, Skelton actually interviewed two university professors to see if they concurred with Taylor; one did, but the other disagreed with her assertion. Unbelievable!

Sir, yes sir

"Sheesh, Boss, that's a great observation you made," I wheedled. "Taylor's claim that BC Liberal tax cuts led to a booming economy and an overflowing provincial treasury was greeted by the news media, not by the usual head-nodding sycophancy, but mild skepticism. You nailed it."

Beers peered at me, his eyes narrowing like the gun slits in an armoured personnel carrier. He didn't respond well to flattery. In fact, he didn't seem to react well to anything.

"Do you know what I want you to do now, dimwit?" he asked. I cringed and shook my head.

"I want you to go through the public accounts," he said, pointing to a foot-high stack of documents and papers sitting on a chair beside his desk, "and find out if Taylor was right in claiming that the Campbell government's tax cuts had stimulated tax revenues and produced this massive surplus."

"Right-away, sir!" I grabbed the pile of papers and quickly fled, walking as fast as I could to my office.

True revenue sources

In both the CBC and the Sun accounts, Taylor specifically referenced "tax revenue."

Some readers may be surprised to learn that provincial tax revenues last year totalled just $18 billion, or less than half, of total GAAP receipts.

The remaining $20.5 billion of total GAAP revenues in 2006-07 was derived from a variety of other sources. Last year, Ottawa contributed $6.4 billion; natural resource sales generated $4.0 billion; and the province's Crown corporations had net earnings of $2.7 billion.

Another $7.4 billion came from sources under the "Other" category. This includes Medical Services Plan premiums, university and college tuition and other fees, investment earnings, the sale of goods and services, motor vehicles licences and permits, and countless other fees and licences.

True cost of tax cuts

Contrary to Taylor's assertion, the growth of provincial tax revenues since the BC Liberals introduced their tax cuts has been much slower than that of Victoria's other sources of income.

In fiscal 2000-01, the year before Gordon Campbell and his B.C. Liberals won election to government, Victoria's GAAP revenues totalled $29.7 billion. Of that amount, provincial taxation provided 48.1 per cent ($14.3 billion), while non-provincial taxation revenues came to 51.9 per cent ($15.4 billion).

Last year, according to the public accounts released by Taylor, B.C. taxes produced just 46.7 per cent of total GAAP revenues, while non-provincial taxation generated 53.2 per cent.

In the last six years, then, provincial taxation revenues have dropped from 48.1 per cent to just 46.7 per cent of B.C.'s total GAAP receipts. Simply, the BC Liberal tax cuts caused taxation receipts to produce less, not more, of Victoria's annual revenues.

At the same time, Victoria's non-tax GAAP revenues have climbed from 51.9 per cent to 53.2 per cent of the total. The tax cuts instituted by Campbell's Liberals, which Taylor claims have pushed up tax revenues, instead have increased the province's reliance on non-tax revenues.

Soaring non-tax revenues

The same point can be made in a different way. From 2000-01, the year before Campbell became premier, to the last fiscal period, 2006-07, Victoria's GAAP revenues rose by 29.6 per cent (from $29.7 billion to $38.5 billion).

Over that time, the province's tax revenues grew by just 26 per cent (from $14.3 billion to $18 billion), while non-tax receipts rose by 33 per cent (from $15.4 billion to $20.5 billion).

Obviously, Victoria's non-tax revenues have been climbing higher and faster since Gordon Campbell and his BC Liberals took power in 2001, than have the province's tax receipts.

And so while Taylor and BC Liberal supporters try to attribute last year's record-breaking $4.1 billion surplus to their government's tax cuts, it is clear that soaring non-tax revenues played a greater part in producing our latest fiscal windfall than did tax revenues.

Bountiful luxury taxes

Closer examination of tax revenues further undercuts Taylor's tax-cut claims. As stated earlier, total revenues from taxation climbed by just 26 per cent in the six years since the Campbell Liberals took power.

But revenues from personal and corporate income taxes -- the two areas where the BC Liberal tax cuts have been focused -- grew at an even weaker rate, rising by a mere 20.3 per cent over the past six years.

Yet at the same time, the combined revenues from the sales tax, property and property purchase taxes, the fuel and tobacco taxes, and other miscellaneous taxes, have soared by 31.4 per cent.

Thanks feds and students!

It is plain to see that despite Carole Taylor's claims of her government's tax cuts building Victoria's surplus and boosting B.C.'s economy, the growth of taxation revenues has been greatly overshadowed by non-provincial taxation receipts.

Leading the way in terms of provincial revenues are federal government transfers, which, since 2000-01, have soared 93.8 per cent (from $3.3 billion to $6.4 billion).

Post-secondary tuition and fees have leaped by an astounding 111 per cent over the period (from $440 million to $928 million), while MSP premiums racked up a remarkable 70.5 per cent increase (from $894 million to more than $1.5 billion).

(It was the Campbell Liberals, of course, who, months after first cutting personal and corporate income taxes, turned around and boosted MSP premiums, and removed a freeze on university and college tuition rates.)

Crown corporation revenues have climbed by a whopping 65.5 per cent since 2001 (from $1.6 billion to almost $2.7 billion). Leading the way were B.C. Lotteries and the Liquor Distribution Branch, where incomes grew by 82.5 per cent and 30.8 per cent respectively, while ICBC turned a $14 million loss six years ago into a $395 million profit in the most-recent period.

Thanks gamblers and drivers!

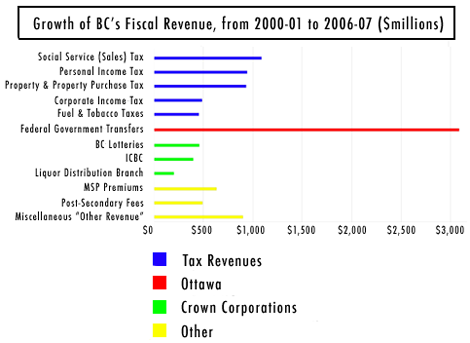

When the growth of B.C.'s revenues over the past six years is looked at in real terms, our increasing reliance on non-provincial taxation becomes even more clear. (See chart at the top of this column.)

As stated earlier, B.C.'s total GAAP revenues have climbed from $29.7 billion to $38.5 billion over the past six years -- an increase of $8.8 billion.

Incredibly, more than a third of that latter amount -- $3.1 billion -- has come from a single source: the federal government.

Next in size of growth was Victoria's sales tax revenues, which, since 2001, grew by $1.1 billion. (Taylor failed to mention that the B.C. Liberals had raised the social services tax to 7.5 per cent in 2002, before restoring it to seven per cent in late 2004.)

Other sizeable increases in tax receipts were recorded for personal income tax ($942 million); property and property purchase tax ($932 million); corporate income tax ($484 million); and fuel and tobacco taxes ($452 million).

The largest increases in non-tax revenues were MSP premiums ($630 million), post-secondary tuition ($488 million), B.C. Lotteries ($457 million), ICBC ($395 million), and the Liquor Distribution Branch ($198 million).

Day's work

I finished my analysis of the public accounts just before lunchtime and, clutching several pages of calculations, raced upstairs to The Tyee newsroom. To be honest, I wanted to catch Beers before he left, hoping that, impressed by my work, he might invite me to go with him to his club.

He was putting on his suit jacket as I got to his office. The Glock was neatly inconspicuous in its shoulder holster. Anxiously, I thrust the papers towards him, but he brushed past me and made for the exit.

"You're a moron," he said over his shoulder. "Give your scribblings to Vanessa, and she'll get an intern to shape them into a story our readers can comprehend." And off he went to have lunch, probably with a captain of industry, or a cabinet minister, or a Hollywood starlet.

I silently dropped my papers on Vanessa's desk and slowly walked downstairs to my office in the basement. Lunch with Beers would have to wait for another day.

I'm a pundit; it's what I do.

Related Tyee stories:

- Budget 2007: Cracked Foundation?

Critics take crowbars to 'Building a Housing Legacy' - BC Health Spending Exploding? Don't Believe It

The real story is a provincial budget skewed by deep cuts to welfare, local government and transportation. - Could You Be Finance Minister? Take Our Quiz!

And learn how Carole Taylor made $446 million seem like nearly $2 billion.

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: