While many environmentalists and some prominent scientists are trying to limit the ultimate climate damage of the Alberta oil sands by opposing pipeline approvals, there may be a more direct way to moderate the reckless pace of extraction of this massive carbon deposit: taxation.

Higher taxes on bitumen would not only shrink the climate footprint of the oil sands, but increase revenue to provincial coffers and improve the lives of Albertans.

The oil sands are such a low-grade resource they remained unexploited for almost 100 years after they were first documented in 1875. Even today only 10 per cent of the known resource is considered commercially viable at current technology and oil prices.

Almost 80 per cent of these identified bitumen reserves are accessible only through underground steam injection methods or "in-situ recovery." The Alberta government considers deposits with as little as three per cent bitumen to be economic, and recovery rates using in-situ methods average less than 10 per cent. At the end of the age of oil, the oil sands are truly the bottom of the barrel.

With such a high-cost low-value product, companies investing billions in the oil sands have correctly flagged the sensitive connection between rising levels of taxation and the declining economics of bitumen production. Oil sands operators know that every incremental cost -- including taxation -- will have a direct and significant impact on how much of this enormous storehouse of carbon is profitable to pull out of the ground.

A study by MIT in 2012 showed that worldwide carbon pricing equivalent to a $15 per barrel decline in the price of oil would decrease oil sands production by up to 75 per cent this decade. Projections by researchers showed that under a Kyoto-like global policy, oil sands production "essentially disappears" by 2050. This might explain why the Canadian government has been so obstructionist in international climate negotiations.

Reversing race to the taxation bottom

Given the billions of dollars of investments at stake, it is not surprising that the global oil lobby has been so successful at keeping Alberta taxation rates rock bottom.

Government documents recently released by the Alberta Federation of Labour show that Canada's three western provinces have some of the lowest taxes on natural gas and conventional oil in North America -- about 25 per cent less than in Louisiana.

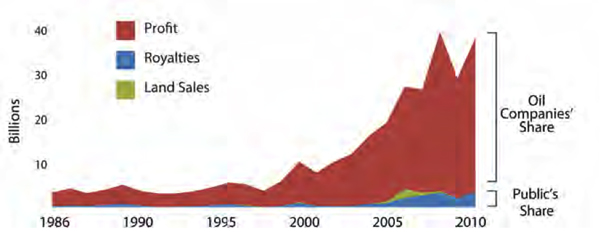

Oil sands royalties are similarly skewed towards industry. A recent report by the Parkland Institute estimates that since 1986, oil sands operators have realized pre-tax profits of $260 billion while the public owners of the resource recouped revenues less than 10 per cent of that.

According to the authors:

"Rent is the value of the resources sold remaining after accounting for costs and a reasonable profit, and it is either collected by the resource owners or the corporations in a type of zero-sum situation... Owners are entitled to 100 per cent of the rent and collecting anything less is equivalent to providing the industry with a subsidy. The provincial government's low royalties in the tar sands meant that in 2010, 89 per cent of the rent, worth approximately $30 billion, went to the oil corporations through what is referred to as 'excess profit'... Since 1997, the public's share of rent in the tar sands has consistently been dwarfed by that of oil companies, regularly by a factor of 10 or more."

Put another way, former premier Peter Lougheed pledged to capture 35 per cent of the wealth on oil, natural gas and bitumen, but consistent shortfalls of this target meant Alberta has forfeited approximately $195 billion in public revenues between 1971 and 2010. This not only sends the wrong signal to oil sands companies driving pell-mell expansion and ballooning labour costs; future generations might well consider Alberta's taxation regime a global climate crime.

Cowed in Alberta

To understand how cowed Albertans have become to petroleum taxation, consider that the Fort McMurray School Board voted on a proposal this year to cut the school week down to four days. Why? Because the communities that include some of the largest petroleum reserves on the planet couldn't afford school bus drivers five days a week. The motion was voted down -- not because this situation is so absurd -- but because trustees worried that oil sands workers couldn't access daycare during a shortened school week.

In 2010, Mary-Ellen Proctor, the executive director of the Fort McMurray women's shelter, went on a 21-day hunger strike to raise awareness and desperately needed funding to replace their overcrowded facility. "At one time we took any women in crisis. Now we are down to just high risk women who might get killed. We just don't have the capacity to look after the others."

The facility turns away over 100 women and children each year due to lack of beds, often forced to return to their abusers. Due to distortions in the local construction economy from the oil sands expansion, a replacement facility will cost $50 million. Companies extracting billions in profits seem unwilling to pony up this comparatively puny amount and a grassroots fundraising campaign continues. Another example of stark wealth disparity in the boomtown of the oil patch is the fact that more than 1,400 children per year were reliant on the Fort McMurray food bank last year.

Alberta collects resource rents on 70 per cent of Canada's oil production -- the sixth largest in the world. Given that it is home to less than four million people it should be one of the wealthiest places on Earth. Norway, with comparable oil production and population, has so far salted away over $700 billion and counting. The Alberta government just ran a $3-billion budget deficit and has burned through $20 billion of past oil wealth since 2008.

Not only is this a travesty of fiscal management, it is directly contributing to far more low-grade tar being dug out of the ground and burned than would otherwise be the case. It is not just the citizens of Alberta that should be outraged by this resource giveaway. Every person on the planet that cares about our looming climate crisis should be demanding that the Alberta government begin charging more reasonable resource rents.

A more balanced approach

The International Monetary Fund recently released a report on global energy subsidies -- now topping $1.9 trillion -- estimating global carbon emissions could be reduced by 13 per cent by eliminating inadequate taxation. Canada ranked in the top 15 per cent of developed nations for public giveaways to the energy sector.

Obviously the world still needs oil. A more balanced taxation regime in Alberta would go a long way to cooling local inflated labour costs and balancing the government books. Refining bitumen locally rather than expanding pipelines of dangerous dilbit would help end the $35-billion subsidy Canada is effectively providing to U.S. refineries, while creating more local long-term jobs.

Raising taxes -- perhaps more than anything -- would help reduce the looming threat to the global climate from the massive deposit of bitumen slumbering under Alberta's boreal forest. ![]()

Read more: Energy, Environment

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: