As the HST referendum counts down to its final hours, there are at least four good reasons why you should vote Yes to kill the tax:

1. Clearly not revenue neutral. Sold as revenue neutral, the 2010-11 Public Accounts released last Monday show this is clearly untrue. The HST was in place for eight of the 12 months covered. During that time, the HST raised $392 million more than projected. Under the HST's input tax credit system, business pays no tax. So where did this tax increase come from? British Columbian consumers, of course.

2. Too blunt an instrument. An "across the board" tax is unresponsive on a policy level. A flexible tax policy is an important tool of economic policy. Our provincial government needs to play all the keys of the policy piano if we are to have healthy and vibrant communities. A flat sales tax on all products and services does not allow government to pick and choose what products will be tax exempt, removing an important instrument from the economic and social policy stimulation toolbox.

3. Gets in the way of cutting other taxes. But it gets worse. In trying to sell the HST to a skeptical public, Victoria has promised a two per cent reduction by 2014. How will the provincial government make up this shortfall? Ironically, by eliminating a proposed reduction in small business tax rates. And by increasing corporate taxes from 10 per cent to 12 per cent. Knee-jerk defense of one tax policy (HST) winds up dismantling another (income tax). Bear in mind that HST is a spigot that turns most easily in only one direction. In Europe, HST rates now average 19.6 per cent and have risen to 25 per cent in many countries.

4. More open to cheaters. As noted last week, Ottawa's HST collection system is a leaky bucket. For the first decade of the tax, then revenue minister Elinor Kaplan pegged GST fraud losses at $154 million. In 2010, 199 new cases of GST/HST fraud totaling $73.6 million went before the courts. Judgments amounted to $7.3 million, of which $1.7 million was recovered, $4.2 million is expected to be recovered in future, and $1.7 million is deemed unrecoverable. And of course what gets before the courts only tells part of the story.

Not surprisingly, as the HST referendum campaign draws to a close, we all know more than we did at the beginning.

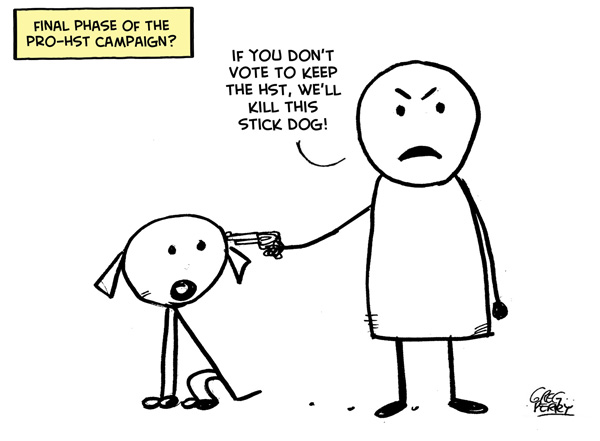

Consider this: Consumers are paying more tax under HST. We've traded a flexible PST policy instrument in the hands of the province for a blunt, across the board, tax-on-everything (HST) in the hands of Ottawa. To sell this puppy to the people of B.C., small business will lose the stimulus of a proposed tax reduction, and corporate taxes will go up... And under the HST, all our provincial tax money is being dumped into Ottawa's leaky input-tax-credit-bucket, creating new opportunities for the unscrupulous.

Just exactly why would anyone vote No? ![]()

Read more: Politics

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: