Alberta's oil sands extractors' use of natural gas, already voracious and set to rise steeply, is more than half paid for by Canadian taxpayers -- a vast yet little-known subsidy that insiders say encourages profligate consumption of a finite energy source.

The numbers are huge. Oil sands operations currently consume about one billion cubic feet of gas per day, heating thick bitumen so it can be extracted from surrounding rock and gravel. This reverse-alchemy eats up about 20 per cent of Canada's natural gas demand and may balloon to 40 per cent by 2035.

The price is huge, too -- much of it written off against corporate taxes. Bitumen recovery and upgrading will eat up more than 15 billion cubic metres of natural gas this year according to data from the Alberta government. At current prices this will cost $3.4 billion, of which $1.7 billion will be paid for by the public.

Both gas consumption and prices are projected to balloon in coming years, which will vastly increase lost revenue to the taxpayer.

But even though Canadian citizens are on the hook, the Alberta extractors aren't required to share with the public the price they are assigning to the natural gas they are writing off.

Meanwhile, petro firms are pushing into methods of oil sands extraction that require ever increasing amounts of natural gas.

So why has it become so profitable to convert natural gas into tar? Perhaps the biggest piece of the puzzle is hidden in tax and royalty regulations.

Companies operating in Alberta's oil sands are allowed to deduct fuel costs from their provincial and federal taxes. They are also allowed to double dip and deduct these same fuel expenses from the royalties payable the Alberta taxpayer. This means that in the first eight months of 2010, taxpayers paid for more than half of natural gas used to extract bitumen from rock.

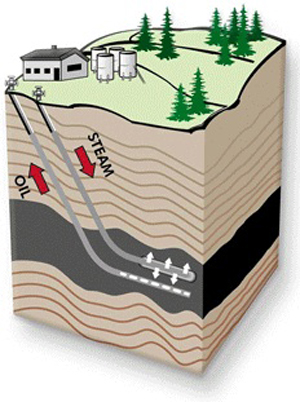

A real gas hog: Steam Assisted Gravity Drainage

Not only is this subsidy an enormous gift from the taxpayer to some of the world's most profitable companies, it also undermines economic incentives for industry to develop more efficient practices. A good example is seen in the history of a process called Steam Assisted Gravity Drainage (SAGD).

SAGD is one of several techniques used to extract tarry bitumen from the surrounding rock and currently accounts for about 40 per cent of non-surface mining production. Since bitumen will not flow unless heated, large volumes of steam are injected into horizontal pipes drilled into these formations to drain the tar to extraction wells.

An important yardstick of the efficiencies of such operations is called the Steam-Oil Ratio (SOR). Although SORs are now reported to the government, they remain a guarded industry secret for many individual companies -- apparently for good reason.

A case study for one of the original SAGD pilot projects from 1987 to 1989 reported a SOR value of 2.38. Another project from the early 1990s had an SOR of 2.5. One would expect that as time goes on and industry efficiencies improve that SOR values would come down.

Instead they have steeply increased. The most recent data provided by the Energy Resources Conservation Board (ERCB) to The Tyee shows a 2010 average for 14 commercial SAGD operations of 3.7. Even weighting the data based on bitumen production provides an average SOR of 3.0 -- about 50 per cent higher than industry best practice and double what SAGD was supposed to achieve in theory. Several individual operations have SORs over five.

Thanks in part to the taxpayer funded fuel subsidy, SAGD now requires about 50 per cent per cent more steam to produce a barrel of tar than it did 20 years ago.

The fine print about royalties

To understand how companies are able to offload so much of their fuel expenses to the taxpayer we have to peer deeper into the fine print of the Alberta royalty regime.

Bitumen producers pay the Alberta taxpayer based a variable royalty rate that fluctuates with the price of crude -- approximately $80 per barrel in 2010. Based on this price, companies pay a bitumen royalty of 30.77 percent. Since natural gas costs can be directly deducted from these royalties, companies can then recover 30.77 cents for every dollar spent on natural gas.

Companies can also deduct their remaining natural gas costs (69.23 cents) from their provincial and federal corporate taxes at 28 per cent, which works out to a further 19.38 cents on the dollar.

In other words, the taxpayer is currently paying for 50.15 per cent of the one billion cubic feet of natural gas consumed every day heating bitumen in northern Alberta.

As the price of oil rises, so too does the proportion of natural gas costs deductible from royalties. If crude prices rose to $120 per barrel, bitumen operators would be able to write off almost 57 per cent of their natural gas consumption.

It should also be noted that companies pay only a token royalty rate until they recover 100 per cent of their capital investments, interest charges and operating expenses -- what the Alberta government refers to as "payout". Prior to payout, royalties are less than one seventh as much, and companies are allowed to write off a much larger portion of their natural gas expenses. Many of the more generous aspects of this royalty program were introduced in 1997 when oil prices were less than a third of current prices.

Tax subsidies help make process profitable: expert

Dr. Adam Brandt of Stanford University expressed surprise when informed of natural gas write-offs available to Alberta oil sands operators. "I didn't realize that it was that large of an effective cost reduction."

Brandt is an expert on quantifying the environmental impacts of energy systems, particularly greenhouse gas emissions. During the conversation with The Tyee, he calculated the current cost to operators for natural gas was as little as $4.33 per barrel of bitumen produced -- prior to write offs. "I've never done these numbers before so I didn't know that the cost could be so low."

Some of the figures from the ERCB averaged over 2010 show steam oil ratios as high as 8.7 for Husky Oil's Tucker Lake project -- more than three times higher than the SAGD pilot projects from 20 years ago.

"I have a hard time believing that they are making money with [a SOR of] 8.7. Although if they were able to write off 50 per cent of the cost of the natural gas, maybe they are. It kind of looks that way."

Operations with steam oil ratios that are high have a correspondingly lower energy profit. "At the very high end maybe a third of the energy content of the bitumen is offset by the natural gas consumed in production," said Brandt

He cautions that steam oil ratios are highly dependent on local conditions of individual bitumen deposits as well as the stage of development. "A project will look worse as it is warming up." Natural gas prices are also lower now than in previous years, which would affect the heating cost per barrel of bitumen.

Taxpayer liability growing by $15 billion a year?

Declining reserves of global crude and ballooning supplies of shale gas from the advent of hydraulic fracking have also perversely improved the profitability of converting gas into bitumen. By 2007, energy from crude became twice as valuable as equivalent energy from much cleaner natural gas. The most recent prices indicate that a barrel of bitumen tar is currently worth three times more than the equivalent energy from natural gas.

But why shouldn't natural gas be treated like any other business expense? Unlike labour, steel or concrete, natural gas is a finite publicly owned resource. It also produces 30 per cent less carbon emissions per unit energy than crude and 45 per cent less than coal.

The Alberta royalty regime also sends the wrong market signals to those now investing billions in oil sands infrastructure, stifling innovation and favouring technologies that are needlessly wasteful, say industry insiders. They warn that if this infrastructure is built on the assumption that 50 per cent of gas costs will be covered by the taxpayer, it may lock in highly inefficient natural gas use for the lifetime of these operations -- up to 30 years or more.

A recent industry presentation shows the lifetime fuel costs of SAGD plants are two to three times larger than initial capital expenditures. Assuming a $10 billion annual investment in SAGD, the lifecycle fuel cost for new plants is increasing by $20 to 30 billion per year, and the taxpayer portion of this fuel cost liability is growing by a staggering $10-15 billion per year.

Write-offs just part of business: Alberta government

The province of Alberta dismisses charges that natural gas costs to bitumen producers are unfairly low. "While your point about natural gas costs being 'written off' against royalties is valid you could make that same argument for any allowed cost," said Alberta Energy spokesperson Tim Markle. "The fact remains that the costs are only partially offset by royalties, so there is still an incentive to reduce costs as much as possible, as it increases net revenue to the company."

But how much of an incentive? Calculations provided by Stanford University indicate that after write-offs, natural gas expenses from the most efficient SAGD operations represent as little as eight per cent of the value of a barrel of bitumen produced. At the other end of the spectrum, natural gas used at an operation with an SOR of 5 still represents only about 15 per cent of the value of bitumen produced.

This also assumes that those companies that supply their own natural gas are not selling to themselves at inflated prices. Such a scenario raises obvious issues around public oversight and transparency, particularly in light of the enormous volume of gas consumed.

"It is always a challenge to determine what would be the appropriate price in such situations involving internal transfers," said Dr. Kin Lo, professor of accounting at University of British Columbia.

"Not only is it necessary to obtain a comparable market price for the gas, but one should also factor in the fact that the company did not have to incur many of the other expenses associated with selling the gas, so the price should be adjusted downward relative to the market price. I don't know what prices the oil companies use for the gas consumed, so I can't speculate as to whether those prices are too high."

Natural gas values claimed by companies hidden from public

In fact no one outside the Alberta government or their industry partners knows what natural gas prices companies are reporting. "All the information contained within OSR Project approvals, as well as reporting information, is treated as confidential and cannot be reported publicly," confirmed Markle.

But taxpayers have good reason to demand more transparency. It is standard practice for oil sands producers to purchase gas on the commodities futures market. If a given company saddled themselves with an unfavourable supply contract, the taxpayer will foot the bill for half the difference without any right to look at the books.

When contacted for comment, the Canadian Association of Petroleum Producers (CAPP) rejected claims that the current royalty regime provides a perverse subsidy regarding gas consumption. "The royalty rate on the net profit increases with higher oil prices, so royalties actually go up. If the cost of natural gas is the same, then higher oil prices equals higher net profits and higher royalties and higher taxes," said Travis Davies, CAPP's manager of media and issues.

However this does not seem to take into account the lost opportunity cost of selling conserved natural gas as an alternative fuel to the more carbon intensive bitumen. Any gas diverted from bitumen production could be sold as a stand-alone energy source, providing the Alberta government with the same natural gas royalties whether it is used for either purpose. This scenario would also provide higher bitumen royalties since these expenses would no longer be deducted from payments to the taxpayer.

Alberta is blessed with vast reserves of publicly owned non-renewable energy resources. It remains a foible of global economics and weak government policy that it is currently so profitable for companies to convert relatively clean natural gas into carbon-intensive bitumen.

If oil sands operators had to cover the full cost of their natural gas expenses, is it possible that many of these billion dollar ventures might instead be revealed as boondoggles? Since the taxpayer is denied access to basic cost data even though they are paying half the bill, there is no way of knowing.

As they say in business, there's no such thing as a free lunch. That is, unless you can get the government to pick up the tab. ![]()

Read more: Energy, Environment

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: