[Editor's note: If ever there was a Tyee story to print out it's this one, complete with a chart and three tables allowing you to follow Will McMartin's math as he demonstrates that B.C. health spending is neither out of control nor headed for crisis. To print Tyee articles, click on the printer icon just above this note, or the one at the end of the article, before the comments section begins.]

It's not easy to imagine Carole Taylor wearing a stovepipe hat, but there's no doubt that B.C.'s finance minister has taken to heart Abraham Lincoln's famous observation that "you can fool some of the people all of the time..."

Appointed to the finance portfolio a bare 15 months ago, Taylor has proved that she can fool many British Columbians, and especially members of B.C.'s pliant, credulous news media, whenever she puts her mind to it.

Last winter, Taylor bluffed the news media and public-sector unions into believing that surplus monies in the provincial treasury would automatically disappear -- gone to debt repayment, poof! -- at the end of the fiscal year because the province had adopted generally accepted accounting principles (GAAP).

It wasn't true, as I explained here. Still, the fib was believed by journalists who reported it as fact, and by union leaders who feared the loss of up to $1 billion in bonuses dangled by Taylor as an inducement to the signing of new collective agreements. The unions quickly capitulated before the finance minister's make-believe deadline.

A few months later, with the release of the 2005-06 public accounts, Taylor's legerdemain was revealed as B.C. ended the fiscal year (and began the current period) with a whopping $3.9 billion in cash and short-term investments. Her assertion that GAAP required surplus cash would vanish -- going to debt-holders -- proved to be just so much hot air.

Teflon Taylor

She was at it again last week, at a news conference to release the government's first quarterly report for the current fiscal period. With a straight face, Taylor warned that exploding health expenditures will soon threaten the viability of other government outlays.

In a decade, she claimed, health spending could consume nearly three-quarters of Victoria's annual budget. With education taking up the remaining quarter, nothing would be left to fund children's services, welfare, transportation, the police, the courts, environmental protection, debt servicing or other valued programs.

"You can see what I'm trying to impress upon everyone," Taylor told the assembled scribes, referring to a chart that showed health costs rising from 41.6 per cent of last year's budget, to 71.3 percent in 2017-18. "This is an issue that we all have to get our heads around."

On top of that, so as to bring a sense of urgency to the looming catastrophe, B.C.'s finance minister also disclosed that the province's six health authorities recently requested an additional $1 billion-plus over the next three years to deal with unidentified cost "pressures."

Why, money is just flying out of the provincial treasury to pay for out-of-control health care. Action is needed, now!

Knock 'em dead

In show-business parlance, it was a boffo performance. Predictably, B.C.'s goggle-eyed news media quickly succumbed to the charms of our Gucci-favouring finance minister.

Not atypical was Gary Mason, a Vancouver columnist with The Globe and Mail, who used such terms as "ever-gathering storm," "seemingly out of control," and "shocking" to describe Taylor's dire forecast. "[T]he growing health-care crisis is real," Mason insisted breathlessly, "and people need to wake up to it in a hurry."

Golly. It's a good thing that premier Gordon Campbell, who last spring fled the legislative assembly to tour European health facilities with his brother-in-law, has decided to cancel the legislature's scheduled fall sitting to travel around B.C. and have a "conversation" about health care with British Columbians.

But there is just one, tiny problem with Taylor's bleak forecast, and the underlying premise of Campbell's desire to introduce dramatic reforms to B.C.'s public health system.

There is no fiscal crisis.

Reports published by the finance ministry -- readily available to the public, and the news media, too -- show that provincial expenditures on health have not exploded, nor are they expected to do so in the foreseeable future. Taylor's warning of a looming fiscal crisis caused by skyrocketing health spending is contradicted and refuted by her own department.

Real numbers

The Financial and Economic Review is produced annually by the finance ministry, and each edition provides a wealth of information on provincial government programs, Crown corporations, fiscal and economic topics, demographic trends, and much, much more. First published in 1940, the Review has been available online since 2002, and the latest volume (the 66th) was released last month. It can be accessed here.

The best way to verify Taylor's assertions is to examine Victoria's health expenditures as a proportion of the B.C. economy. This year's Review has a table that shows British Columbia's annual gross domestic product (GDP) at market prices over the past quarter-century (on page 27), and another entitled "Historical Expense by Function: Consolidated Revenue Fund," with the province's outlays by main categories of expenditure over the past two decades (on page 91).

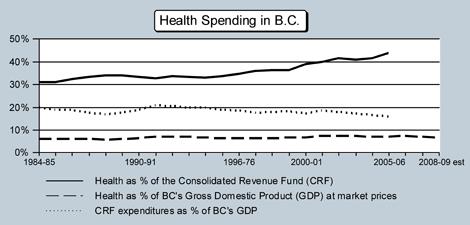

It is easy to compare data from the two tables, which has been transposed to Table 1, presented at the bottom of this article, and can be seen graphically as the broken line at the bottom of the chart at the top of this column.

Two decades ago, in 1984, B.C.'s GDP stood at $49.8 billion. In the comparable fiscal period (from April 1984 to March 1985), CRF outlays on health totalled just over $3.0 billion, or 6.1 per cent of GDP.

Last year, in 2005, provincial GDP surpassed $168.0 billion, while health expenditures for the 2005-06 fiscal year hit $11.7 billion. That was slightly under 7.0 per cent of GDP.

As a proportion of B.C.'s economy over the past two decades-plus, health expenditures have ranged from a low of 5.8 per cent (in 1988-89) to a high of 7.5 per cent (in 2002-03). The annual average was 6.6 per cent.

It is obvious that the growth of health spending as a share of the provincial economy since the early 1980s has been very modest. (Most, if not all, of the increase can be attributed to our ageing population, as seniors were 10.7 per cent of the total in 1981, and is estimated by Stats BC at 14.1 per cent this year.)

No explosion

Now, consider data from Taylor's first quarterly report. On page 46 is a table that shows the finance department's projections for B.C.'s GDP at market prices until 2010. And on page 62 is another table entitled "Expenses by Function: 2006-07 - 2008-09," which provides an update on planned government expenditures. (It is important to note that the latter table is not for the CRF alone, but is a GAAP presentation, which slightly boosts health outlays.)

By comparing planned health spending with forecasted GDP we can see that the government's health expenditures are expected to represent 7.3 per cent of the provincial economy in the current fiscal year, and 7.1 per cent and 6.9 per cent in the two subsequent years. That is, while B.C.'s health spending has averaged 6.6 per cent of GDP per year since the early 1980s, the finance department estimates it will be 6.9 per cent in the fiscal year 2008-09.

So much for Taylor's assertions that health expenditures are out of control.

As the chart accompanying this column clearly shows, B.C.'s annual health expenditures as a proportion of the provincial economy have been remarkably consistent for the past quarter-century. There is no evidence of an explosion. Nor does the latest finance department forecast suggest that one is expected in the near future.

The fine print

Taylor's claim that health consumes a rising proportion of Victoria's annual budget, however, is more accurate. Looking again at page 91 of the most-recent Review, we can compare health expenditures as a proportion of annual CRF spending over the past two decades-plus. (See Table 2 below.) In 1984-85, health outlays represented 31.0 per cent of the CRF; by 2005-06, that figure had climbed to 41.6 per cent.

Again looking at the accompanying chart, the solid line at the top shows that health spending has consumed a steadily increasing portion of the provincial budget in recent years.

This presents a conundrum of sorts. How is it that health spending as a proportion of total government expenditures is rising, while at the same time it remains relatively constant as a share of the B.C. economy?

The surprising answer is revealed by the dotted line in the middle of the chart atop this column: Victoria's budgeted expenditures, as a proportion of provincial GDP, have been slowly shrinking. In 1984, for example, CRF spending was 19.7 per cent of GDP; but in the current fiscal year, the comparable figure is just 15.9 cent. (You can find all the supporting numbers in Table 3, below.)

Health spending, then, is increasing as a proportion of the government's annual budget, only because the budget itself is growing smaller in relation to the B.C. economy!

Accounting is what changed

This raises a final question: how or why have B.C.'s budgets declined in relation to the provincial economy? There are several answers.

One is that government expenditures on welfare and other social services grew significantly during the severe economic recession of the early 1980s, and remained at unusually high levels for a decade thereafter. As a result, the fiscal budget grew in comparison to the economy, but in recent years has declined as welfare rolls have shrunk.

But perhaps the most interesting reason is that more than a few of the province's finance ministers in recent decades -- we've had 12 since 1980, all of whom were bedevilled by a seemingly never-ending string of budgetary deficits -- resorted to fiscal legerdemain, chicanery and deceit in trying to "balance the books."

There were all kinds of attempts made to eradicate the deficit: raising taxes and cutting spending being just two of the most obvious. But one of the most-favoured means was the removal of spending items from the annual budget. Put another way, instead of slashing expenditures, some finance ministers simply stopped counting them.

During the 1990s, for example, the New Democratic Party government shifted highway construction costs to the B.C. Transportation Financing Authority, and transferred B.C. Transit's Lower Mainland operations to a regional authority. The Campbell Liberals continued the practice, notably by transforming the B.C. Ferry Corporation from a Crown corporation into an "off-the-books" entity.

Best of all, the Campbell Liberals adopted GAAP, which excludes nearly all capital expenditures from the fiscal budget, because construction or purchase costs are now spread over the useful life of the assets acquired. To wit: Victoria will spend nearly $5 billion for new capital assets this year, but a mere fraction of that amount will be counted as a budgetary expense in the current fiscal period.

Consider that transportation spending, which between the Second World War and the early 1980s was 10-25 per cent of B.C.'s annual budgets, now represents a mere 3 per cent of budgeted expenditures.

Not surprisingly, as certain of spending items -- welfare, capital projects, transportation -- declined or were removed from the budget, the remaining expenditures grew as a proportion of the total budget. Foremost among these, of course, was health.

No crisis

It's painfully clear. Health spending has not exploded, nor is it threatening to do so. There is no looming fiscal crisis.

Expenditures for health have grown as a proportion of Victoria's outlays simply because the fiscal budget has been slimmed down through accounting changes, the off-loading of certain items of expenditure, and a reduction in welfare caseloads.

Any one with a calculator -- even a member of the news media -- could figure it out by thumbing through readily-available finance ministry documents. Few if any have done so, or may be expected to make the attempt.

Soon, Gordon Campbell will begin a "conversation" on health care with British Columbians, and Carole Taylor will buttress the premier's call for dramatic reforms by claiming that runaway health costs have created a looming fiscal crisis.

Some people -- and many reporters -- will be fooled.

The rest of us can amuse ourselves by picturing her in a stovepipe hat.

Table 1:

Health expenditures in the Consolidated Revenue Fund as % of B.C. Gross Domestic Product (at market prices)

| Fiscal Year | Gross Domestic Product ($000,000) | CRF Health Expenditures ($000,000) | CRF Health Expenditures as % of GDP |

|---|---|---|---|

| 1984-85 | 49,840 | 3,042 | 6.1 |

| 1985-86 | 53,540 | 3,161 | 5.9 |

| 1986-87 | 56,547 | 3,446 | 6.1 |

| 1987-88 | 62,515 | 3,684 | 5.9 |

| 1988-89 | 69,408 | 4,012 | 5.8 |

| 1989-90 | 75,582 | 4,502 | 6.0 |

| 1990-91 | 79,350 | 5,028 | 6.3 |

| 1991-92 | 81,849 | 5,617 | 6.9 |

| 1992-93 | 87,242 | 6,003 | 6.9 |

| 1993-94 | 94,077 | 6,287 | 6.9 |

| 1994-95 | 100,512 | 6,584 | 6.6 |

| 1995-96 | 105,670 | 6,778 | 6.4 |

| 1996-97 | 108,865 | 7,038 | 6.5 |

| 1997-98 | 114,383 | 7,224 | 6.3 |

| 1998-99 | 115,641 | 7,478 | 6.5 |

| 1999-00 | 120,921 | 8,019 | 6.6 |

| 2000-01 | 131,333 | 8,754 | 6.7 |

| 2001-02 | 133,514 | 9,888 | 7.4 |

| 2002-03 | 138,252 | 10,410 | 7.5 |

| 2003-04 | 145,948 | 10,686 | 7.3 |

| 2004-05 | 157,241 | 10,833 | 6.9 |

| 2005-06 | 168,011 | 11,717 | 7.0 |

(SOURCE: 2006 British Columbia Financial and Economic Review, pp. 27 and 91.)

Table 2:

Health expenditures as % of the Consolidated Revenue Fund

| Fiscal Year | Total CRF Expenditures ($000,000) | CRF Health Expenditures ($000,000) | CRF Health Expenditures as % of CRF |

|---|---|---|---|

| 1984-85 | 9,801 | 3,042 | 31.0 |

| 1985-86 | 10,127 | 3,161 | 31.2 |

| 1986-87 | 10,624 | 3,446 | 32.4 |

| 1987-88 | 11,055 | 3,684 | 33.3 |

| 1988-89 | 11,834 | 4,012 | 33.9 |

| 1989-90 | 13,200 | 4,502 | 34.1 |

| 1990-91 | 15,010 | 5,028 | 33.5 |

| 1991-92 | 17,101 | 5,617 | 32.8 |

| 1992-93 | 17,858 | 6,003 | 33.6 |

| 1993-94 | 18,833 | 6,287 | 33.4 |

| 1994-95 | 19,953 | 6,584 | 33.0 |

| 1995-96 | 20,054 | 6,778 | 33.8 |

| 1996-97 | 20,241 | 7,038 | 34.8 |

| 1997-98 | 20,135 | 7,224 | 35.9 |

| 1998-99 | 20,528 | 7,478 | 36.4 |

| 1999-00 | 22,161 | 8,019 | 36.2 |

| 2000-01 | 22,444 | 8,754 | 39.0 |

| 2001-02 | 24,669 | 9,888 | 40.1 |

| 2002-03 | 24,941 | 10,410 | 41.7 |

| 2003-04 | 25,122 | 10,686 | 41.0 |

| 2004-05 | 26,061 | 10,833 | 41.6 |

| 2005-06 | 26,690* | 11,717 | 43.9 |

* does not include $710 million in wage settlement incentive payments.

(SOURCE: 2006 British Columbia Financial and Economic Review, p. 91.)

Table 3:

Consolidated Revenue Fund expenditures as % of B.C. Gross Domestic Product (at market prices)

| Fiscal Year | B.C.'s Gross Domestic Product ($000,000) | CRF Expenditures ($000,000) | CRF Expenditures as % of GDP |

|---|---|---|---|

| 1984-85 | 49,840 | 9,801 | 19.7 |

| 1985-86 | 53,540 | 10,127 | 18.9 |

| 1986-87 | 56,547 | 10,624 | 18.8 |

| 1987-88 | 62,515 | 11,055 | 17.7 |

| 1988-89 | 69,408 | 11,834 | 17.0 |

| 1989-90 | 75,582 | 13,200 | 17.5 |

| 1990-91 | 79,350 | 15,010 | 18.9 |

| 1991-92 | 81,849 | 17,101 | 20.9 |

| 1992-93 | 87,242 | 17,858 | 20.5 |

| 1993-94 | 94,077 | 18,833 | 20.0 |

| 1994-95 | 100,512 | 19,953 | 19.9 |

| 1995-96 | 105,670 | 20,054 | 19.0 |

| 1996-97 | 108,865 | 20,241 | 18.6 |

| 1997-98 | 114,383 | 20,135 | 17.6 |

| 1998-99 | 115,641 | 20,528 | 17.8 |

| 1999-00 | 120,921 | 22,161 | 18.3 |

| 2000-01 | 131,333 | 22,444 | 17.1 |

| 2001-02 | 133,514 | 24,669 | 18.5 |

| 2002-03 | 138,252 | 24,941 | 18.0 |

| 2003-04 | 145,948 | 25,122 | 17.2 |

| 2004-05 | 157,241 | 26,061 | 16.6 |

| 2005-06 | 168,011 | 26,690* | 15.9 |

* does not include $710 million in wage settlement incentive payments.

(SOURCE: 2006 British Columbia Financial and Economic Review, pp. 27 and 91.)

Veteran political consultant and analyst Will McMartin is a regular columnist for The Tyee. ![]()

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: