Are the B.C. premier and her minister of finance on the same page with respect to negotiations on the tax framework for liquefied natural gas, or LNG? Will anything be left on the table so B.C. can benefit from LNG when the Liberal government is done cutting taxes to make B.C. competitive worldwide?

The government could be giving tens of billions of dollars away in order to secure construction of one or more liquefied natural gas plants. On June 14, the Wall Street Journal reported: "In an interview with the Wall Street Journal, British Columbia Premier Christy Clark said her government was in tax negotiations with one project and said that would serve as a model for others. She declined to name the project."

It went on to quote the premier, saying: "We're getting toward the end of our negotiating with one of the big companies that's in play and setting out the business case that all of the companies will play by. I do hope we'll get it nailed down in the next couple of months." In the B.C. Legislature on July 10, NDP finance critic Mike Farnworth questioned Finance Minister Mike de Jong about the Wall Street Journal story. When asked about the tax negotiations, de Jong said: "The companies that are involved in the consortia at the leading edge and closest to investment decisions... Shell and British Gas are two that come to mind."

He went on to say: "The Crown guards its jurisdiction to make taxation decisions zealously. It is not a negotiation, per se. We are clearly interested in what these agencies have to say and what information they can bring to bear. But at the end of the day, decisions around the taxation regime that will be in place in British Columbia will be made by the executive council and by the Ministry of Finance."

Whether the government is in negotiations or consultations, it is clear that no company would commit to investing billions until it had some certainty with respect to the tax framework. It is also clear that the revenue expectations for government are inversely proportional to the attractiveness of the tax regime from the perspective of the investors.

Let's see the numbers

Rich Coleman, minister of natural gas development, appeared on Voice of BC with Vaughn Palmer on July 4, where he discussed LNG possibilities and the desire of his government to attract their investment. He talked about being competitive worldwide. He also said B.C.'s revenue framework would not be like Australia's, and he said: "I think people will be very surprised to find out just how smart we've been on this and how competitive we will be."

That is why British Columbians deserve to know how much government expects to gain from LNG revenues after the negotiations compared to the estimate provided to the public before the negotiations -- and before the election.

The Liberals went into the election quoting from reports prepared for government by consultancies Ernst & Young and Grant Thornton on LNG opportunities for B.C. The consultants were given a revenue framework and assumptions which they used to crunch their numbers. I submitted a Freedom of Information Request for the documents government gave to those firms. On July 10, I was told I would have to pay $540 to receive them.

There are several problems with that, including that 48 hours after any documents are released to me, they are provided on a government website for free to the rest of the world. The lucky person who first asks for the information bears the cost. More importantly, experience shows that regardless of any fee, what is usually produced is a mass of blank paper stamped with the section number of the legislation used to refuse access to information. I appealed the fee assessment, arguing that the assumptions used to support the government's claim that it can pay off all provincial debt in 15 years should be shared with the public.

A brewing federal feud?

In response to Farnworth, de Jong referenced some of the complex issues hinted at by Coleman. Australia's super-profits tax on LNG (Petroleum Resource Revenue Tax) is a federal tax, while royalties are collected by Australian states. Some suggest that royalties were increased in Australia at the expense of federal revenue, but the data are not yet available.

In Canada, a tax dispute could break out if the province encroached on taxing authority that is not unique to it, but if it bases its new LNG tax solely on royalties it can finesse the federal government.

Those matters were addressed by de Jong when he replied to Farnworth, saying: "There has been contact between the province and the federal government. I'm hesitant to try to draw parallels between Canada, British Columbia and Australia and whatever state might have been involved there. I don't know who owns the resource in Australia. I don't know if the federal Crown owns the resource there, or if it's owned by the state. I just don't know. The measure of interaction or the degree of interaction may be different."

The finance minister must have been briefed on the complexities of federal-provincial LNG tax issues in order to give such a confusing answer.

Billions at stake

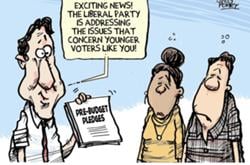

Despite claims about making B.C. "debt free," the reality hinges on LNG development. The government refuses to be open, asking for $540 for the documents it gave its consultants. The government appears to be inconsistent, with the premier saying it's in tax negotiations and the finance minister standing in the Legislature saying it's only "consultations."

One way or the other, more money is at stake than B.C. dreamt of when W.A.C. Bennett announced his two rivers strategy -- relevant today, because that's what Premier Clark uses as a reference. British Columbians deserve to know how many billions are disappearing as government negotiators whittle away the assumptions made in documents given to Ernst & Young and Grant Thornton. Our "open government" won't reveal the difference and won't even reveal its pre-election assumptions for its LNG revenue framework.

In order for LNG consortiums to commit billions in investment in 2014, B.C. must put its revenue framework in law in the spring 2014 legislative session. At that time, the Clark government should update British Columbians and say how much was lost relative to the claims it paid Ernst & Young and Grant Thornton to confirm before the election. ![]()

Read more: Energy, BC Politics

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: