Last fall, in anticipation of the budget she will deliver to the legislative assembly on Tuesday, Feb. 20, Finance Minister Carole Taylor had her department prepare a four-page flyer entitled "What Choices Would You Make?"

Mailed to households across the province, the flyer asked British Columbians to answer four budgetary questions, the first of which was as follows (emphasis added):

"There are always more demands placed on the public purse than we can meet. That means if we want to spend more in one area, we must find ways to spend less somewhere else. Where do you think the budget should spend more? And to pay for it, where do you think the budget should spend less?"

Around the same time, on Sept. 15, Taylor appeared before the Select Standing Committee on Finance and Government Services -- which then was preparing for a provincial tour of pre-budget consultations with the public -- to explain why she posed this question.

"The real thinking -- approach -- behind this paper is just to say that balancing a budget requires give and take, and there are choices," Taylor told the committee. "There are places you would put more money; there are places you would pay less money."

The finance minister did not identify those areas of government expenditure that needed "more money." She didn't have to, because earlier that morning during a news conference to release the province's first quarterly report for fiscal 2006-07, she had displayed to the assembled scribes a chart showing health expenditures skyrocketing ever higher, and eventually consuming nearly three-quarters of the government's budgeted spending.

Then, two weeks later, on Sept. 28 -- as the Select Standing Committee was in the midst of its public consultations -- Premier Gordon Campbell launched his "Conversation on Health Care" with the claim that runaway health spending was a looming fiscal "tsunami" about to devastate British Columbia.

The government also printed and distributed yet another four-page flyer ("Join the Conversation on Health"), which, under a banner headline stating that "The facts are clear," claimed "Growing health costs are unsustainable."

The inference was clear. With Victoria's health expenditures soaring out of control, not only was a "conversation" with British Columbians necessary to find ways to limit that growth, but provincial residents also had to help Taylor identify government programs and services that could be cut so as to free funds to cover exploding health costs.

Spending proportions: the basic math

It was a sham, of course, but in more ways than one. While health spending is growing modestly as a proportion of Victoria's total annual expenditures, it is hardly out of control, and light-years away (if ever) from consuming three-quarters of the provincial budget.

More importantly, not only was the exercise of asking British Columbians to identify programs and services for the chopping-block doomed to fail (and it did), but Taylor's "choices" flyer failed to acknowledge a basic fiscal fact: the provincial government has been quietly slashing selected expenditures for the past couple of decades.

Indeed, dramatic spending cuts in recent years to three areas of expenditure -- local government, transportation and social assistance -- actually has brought about an increase in the proportion of the provincial budget allocated to health.

That's because there is a "zero-sum" relationship between individual items or categories of expenditure in the B.C. budget, since the aggregate of all of those items is 100 per cent of the total.

When one or more areas of government spending decline as a proportion of the total, other expenditure items necessarily increase as a share of the total; and vice-versa.

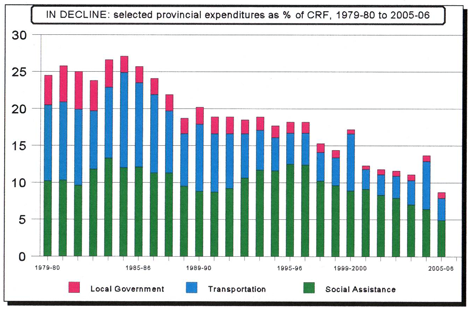

As the chart at the top of this page illustrates, in the early 1980s Victoria's annual allocations to local government, transportation and social assistance represented about one-quarter of the Consolidated Revenue Fund (CRF) expenditures. In recent years, however, the combined total of those same categories of spending has dropped to approximately 10 per cent of the CRF.

Not surprisingly -- although Campbell and Taylor feign alarm at this development -- health spending over the same period grew as a proportion of the budget while the above three items declined. Over a two-decade-long period, health went from less than one-third of the CRF (31 per cent in 1984-85) to more than two-fifths (41.6 per cent in 2005-06).

Obviously, Taylor did not have to ask British Columbians last fall to identify areas of government expenditure to be cut so as to pay for health care. That's because, as the chart reveals, she and other finance ministers have been quietly making those cuts for more than two decades.

Let's look at those three declining areas of provincial expenditure.

Far less to municipalities

The news media in recent weeks have featured numerous stories and columns railing against the onerous burden of municipal taxes on B.C. businesses. Several of these reports have focused on an analysis by the Canadian Federation of Independent Business (entitled "Uneconomic Development: The Growing Property Tax Gap in British Columbia"), which found that the business taxes are nearly three-times those levied on comparable residential properties.

The many media reports fail to acknowledge, however, that the key reason municipalities have increased tax rates on businesses is because provincial transfers to local governments have plummeted since the 1980s.

Over the five-year period preceding the devastating economic recession of the early 1980s, Victoria's transfers to local government averaged nearly $300 million annually, or just over four per cent of the CRF.

During the remainder of the decade, local government transfers dropped to slightly more than two per cent of the CRF, and then in the 1990s went into a long, slow decline to less than one per cent, where they remain today.

(Consider that in 1979-80, local governments got $207 million from Victoria; and in 2004-05, that figure was a near-identical $210 million. Over the same period, however, CRF expenditures grew from more than $5 billion, to over $26 billion.)

Local government transfers today, if they were the same proportion of the CRF as they were more than two decades ago, would be about $1.2 billion, rather than $200 million.

Smaller share for transportation

Victoria's transportation expenditures from 1979-80 to 1986-87 annually averaged about 10 per cent of the CRF.

In the early 1990s, however, the New Democratic Party government established the B.C. Transportation Financing Authority to finance provincial road construction. And in recent years the B.C. Liberal government instituted generally accepted accounting principles (GAAP), whereby capital assets are amortized and depreciated over their useful life.

Both measures had the effect of reducing CRF transportation expenditures. From 1994-95 to 1998-99, transportation spending was about four per cent of the CRF, and from 2000-01 to the present, approximately three per cent.

Actual annual transportation expenditures in recent years have been comparable to those from the early 1980s, even though, as mentioned earlier, Victoria's total CRF spending over the same period has more than quintupled, from $5 billion to $26 billion.

Big decline in social assistance

Spending on social assistance over the 1980s and 1990s annually averaged about 10 per cent of the CRF.

In 1983-84, when Bill Bennett's Social Credit party was in government, social assistance for the first time surpassed $1 billion annually, consuming 13.3 per cent of total CRF expenditures.

A decade later, in 1995-96, when Mike Harcourt's New Democrats were in power, social assistance spending surpassed $2.5 billion, or 12.5 per cent of the CRF.

Shortly thereafter, the NDP introduced the B.C. Benefits program so as to reduce social assistance caseloads and expenditures. When the New Democrats were defeated in 2001, social assistance had dropped to 9.1 per cent of the CRF.

Gordon Campbell's B.C. Liberals made further changes to social assistance policies, with the intent of continuing the reduction of caseloads and spending.

In 2002-03, social assistance was just 7.9 per cent of the CRF, and over the next three years fell to 7.0 per cent, 6.4 per cent and 4.9 per cent.

Actual social assistance expenditures were just $1.3 billion in 2005-06.

Honesty, please

The Select Standing Committee on Finance and Government Services issued its pre-budget report on Nov. 15, and to Taylor's chagrin, committee members failed to comply with her request for a list of specific programs and services that could be cut.

It was the public's fault, apparently. According to the committee's report, the MLAs "did not receive a sufficient level of responses to this question to adequately assess where the public believes budget reductions could be made."

In fact, "the Committee encountered few witnesses who were willing to express specific opinions on where the government could spend less." British Columbians, apparently, are just too busy with their daily activities to scrutinize provincial fiscal documents.

Yet, the committee did suggest that future consultation exercises offer the public additional details regarding Victoria's expenditures. Specifically, they recommend "that framing the debate around specific ministries -- rather than broad categories -- would result in more responses to this type of question."

Perhaps. But what if the government simply were to pledge that future public discussions concerning the expenditure of public monies avoid such alarmist terms as "tsunami" and "scary"? And what if finance ministers, instead of constantly fudging the province's finances, were to be straightforward and honest?

Carole Taylor could make a first step in this direction with her budget on Tuesday. Let's keep our fingers crossed.

Related Tyee stories:

- Carole Taylor's False Alarm

- Could You Be Finance Minister? Take Our Quiz!

- Canada's Health Care 'Crisis'

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: