[Editor’s note: This is adapted for The Tyee from an article published by the Washington state based Sightline Daily.]

When British Columbia enacted a carbon tax shift in 2008, many thought other jurisdictions would follow with their own ways of cashing in their carbon. Seven states and four provinces were working out the details of a huge carbon cap-and-trade market called the Western Climate Initiative. Stéphane Dion was about to start promoting his Green Shift. U.S. presidential candidates Barack Obama and John McCain were campaigning with promises of clean energy on the double quick; Obama even pitched carbon pricing in his stump speech. Ottawa was murmuring about following the lead of Washington, D.C. with a carbon cap of its own.

Then history took a turn: financial collapse, Harper, Harper, Harper, Tea Party, climate science denial, the fiasco at Copenhagen. The front in the war on climate disruption shifted from grand policy goals to fighting tar sands, Enbridge, and other dirty-fuel infrastructure. Momentum abated for comprehensive laws at the provincial and federal level that would gradually but persistently wean companies and households from fossil fuels by charging a small but rising fee for carbon pollution.

British Columbia then found itself alone: the only jurisdiction in North America with an appreciable economy-wide price on global warming emissions. Six years in, how goes the revolution?

What's B.C.'s carbon tax shift done to carbon pollution, the provincial economy, and public revenue?

1. Pricing carbon has reduced carbon pollution.

B.C.'s carbon tax shift launched on July 1, 2008, with a rate of $10-per-metric-ton of carbon dioxide. It increased by $5-per-ton each year through July 2012, when it reached $30. Since then, the province has left the tax rate alone. The tax applies to almost all fossil fuels burned inside the province. Certain agricultural sectors are exempt (see page 23) and by definition the tax does not apply to carbon emitted at non-B.C. power plants that zap power into the province, "process emissions" from industries such as aluminum and cement manufacturing, or fuel for planes and boats that cross provincial borders.

When you tax something, you get less of it. That's the point of taxing carbon pollution. What's happened to emissions in the province?

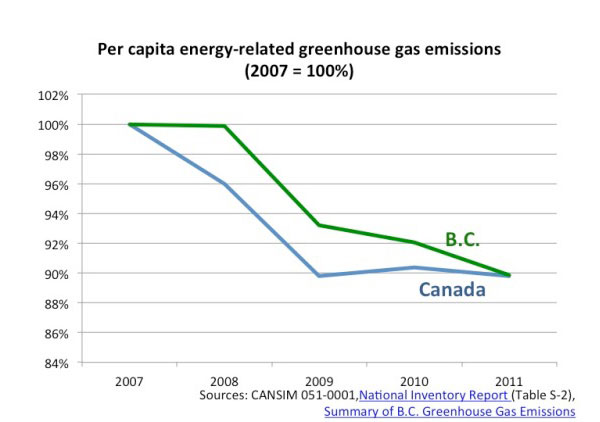

Energy-related greenhouse gas emissions in B.C. dropped by six per cent overall (and 10 per cent per capita) between 2007 and 2011 (the last year for which data are available).

Carbon pricing skeptics might note that emissions have also fallen elsewhere in Canada. Between 2007 and 2011, Canada's energy-related emissions fell by an equal amount.

But the carbon tax shift was not the only thing happening -- far from it. Other forces also trimmed emissions, such as fuel-switching from coal to gas. These electricity-related changes have little effect in B.C. which gets almost all of its electricity from hydropower.

Meanwhile, some trends, such as the Great Recession, have suppressed emissions, while others, such as the natural gas boom in northern British Columbia, have boosted emissions. B.C.'s tax shift is one influence among many.

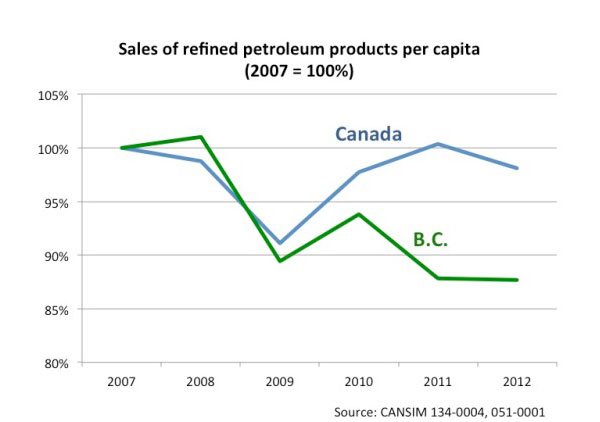

Petroleum-product consumption -- a trend less complicated by other factors than electricity or industrial emissions -- may be the best indicator of the influence of the tax shift on carbon pollution. The province's per-capita combustion of motor fuels and other petroleum diminished by 15 per cent in the first four years of the tax shift -- 10 per cent more than in Canada overall.

2. The carbon tax shift has not hurt the economy.

Economies are whipsawed by massive forces all the time. The carbon tax shift has raised the price of petroleum products and natural gas by around 10 per cent -- less than their prices normally vary in a year.

Meanwhile, it's reduced corporate and personal income taxes. Economic theory suggests this swap of taxes will not hurt the economy and may even help. Some studies suggest that B.C.'s carbon tax shift in particular will eventually give British Columbia an economic boost.

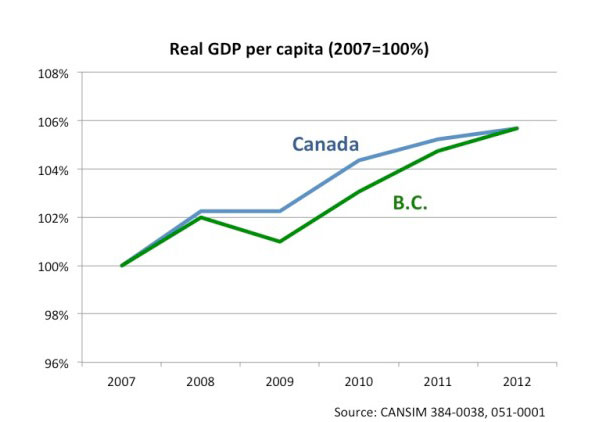

Still, you wouldn't expect to be able to discern much of an economic impact in aggregate statistics. After all, since the carbon tax started, the province has been affected by a global financial meltdown, the bursting of a gigantic housing bubble in the United States (the principal market for B.C. commodities), a boom and then a slowdown in China (another principal market for B.C. goods), and cascading economic debacles in Greece and other parts of the Euro zone (a third major market for B.C. exports). The effects of a gradual, modest increase in fuel prices, offset by reductions in income taxes, are almost guaranteed to be lost in the noise of these other trends.

What is detectable is that B.C.'s economy has roughly matched the Canadian economy overall in GDP growth; the economy has done just fine.

3. Pricing carbon has not caused inflation.

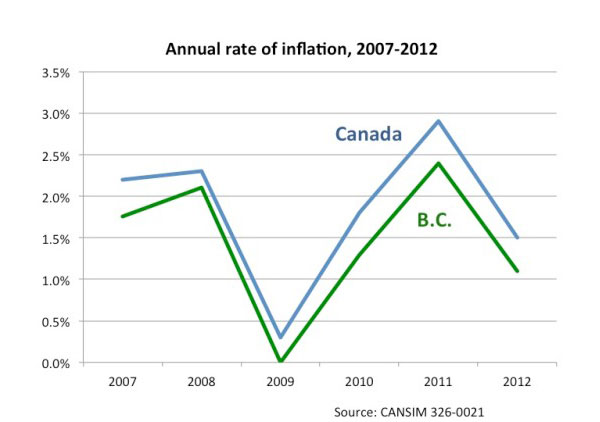

Will raising fossil-fuel prices drive up the price of everything else, triggering inflation the way that the oil-price spikes of the 1970s did? No. On inflation, B.C. has done no worse than Canada overall. As the chart shows, inflation was lower in British Columbia than in Canada as a whole in 2007, before the tax s hift started, and it has stayed lower ever since, neatly paralleling the national average.

4. The carbon tax shift has been revenue neutral.

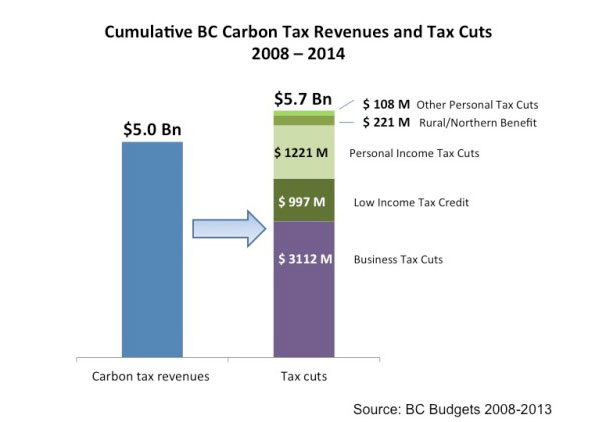

By law, carbon tax revenue must go back to citizens and companies as tax cuts (see page 64): "tax reductions must be provided that fully return the estimated revenue from the carbon tax to taxpayers in each fiscal year." In practice, the tax shift has actually reduced tax revenue slightly overall: the carbon tax raised $1.1 billion in the fiscal year ending in 2013, for example, but offsetting tax cuts lowered other treasury receipts by $1.4 billion.

This chart shows expected revenues for the first six years of the program, during which net revenue declined by $700 million. The goal of the policy was not to reduce revenue, but the province overestimated carbon tax revenue and therefore reduced other taxes by more than necessary to maintain revenue-neutrality.

5. BC's carbon tax shift is not perfect.

B.C.'s carbon pricing system is flawed.

First, although B.C.'s carbon tax shift helped low-income families in its early years, it has since become mildly regressive. An expansion of tax credits for working families would balance the disproportionate cost paid by low-income families.

Second, the carbon tax shift is not likely to get the province all the way to its ambitious emissions reductions goals for the later years of this decade. In fact, carbon tax revenues (and the associated carbon emissions) are expected to begin rising now that the carbon price has stopped stepping upward each year.

Third, the value of offsetting tax reductions is expected to grow faster than carbon tax revenue. In other words, the shift is yielding a revenue gap that's gradually growing.

All three of these issues could be addressed by returning to annual $5-per-ton increases in the tax rate. This would help keep carbon pollution on a downward trajectory and at the same time would generate additional revenues that could be split between closing the revenue gap and providing additional tax reductions for low-income households.

B.C.'s carbon pricing system is not perfect, but it remains the best in North America and probably the world. To the south, in California, a limited one-year-old carbon pricing system -- a cap -- is taking shape and expanding it coverage of the economy. In Oregon and Washington, political momentum is building to emulate California and their northern neighbour in Canada. If all goes well, before too much longer the province will no longer be a lonely beacon of carbon pricing. It'll be the northern anchor of a West Coast bloc that is leading the world to a prosperous, low-carbon future. ![]()

Read more: Energy, BC Politics, Environment

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: