"Our government has always felt that the best thing we could do is leave more money in your pocket so you can make your own decision about what's best for you and for your family."

So said Gordon Campbell on Wednesday, Oct. 27, in a province-wide television address intended to resurrect the premier's plunging poll numbers and restore his government's sunken popularity.

Campbell used his televised speech to unveil an unexpected 15 per cent reduction in B.C. personal income tax rates, and recalled that when he had cut personal income taxes by 25 per cent back in 2001, "our economy took off" as a result.

A day later, on Thursday, Oct. 28, the Canadian Institute for Health Research (CIHI) released its annual study entitled "National Health Expenditure Trends."

The numbers reveal the impact on B.C. health spending of Gordon Campbell's incessant tax-cutting over the last decade. For the seventh consecutive year under Campbell's leadership, our province's total per capita health expenditures have fallen below the national average.

And all of that decline is due to reduced public-sector health expenditures. Indeed, while Campbell's government has slashed taxes and put the brakes on public-sector health spending, private-sector expenditure on health in B.C. -- compared to elsewhere in Canada -- is soaring.

So, while Campbell argues that it is better to "leave more money" in taxpayers' pockets, it seems that many individual British Columbians -- at least those who can afford to do so -- are using that extra money to purchase the health services either no longer provided or rationed by the public sector.

BC's slip behind Canada in public health spending

The CIHI's latest analysis covers the period from 1975 to 2010. The data shows that B.C.'s total per capita health spending -- public-sector and private-sector spending combined -- was higher than the national average in 21 of the 25 years before Gordon Campbell's BC Liberals won election to government in 2001.

That trend continued through to 2003. In that year, per capita health spending in British Columbia was $3,930; for Canada as a whole, $3,900.

A dramatic change took place in 2004, when health expenditure across Canada rose to $4,114 per capita, well ahead of the comparable figure in B.C., $4,060. (These are current dollars; that is, part of the annual increase in expenditure is due to inflation -- a decline in the purchasing power of the Canadian dollar.)

That trend has continued every year since then; and indeed, the gap is growing between our province and the rest of the country. In the current year, 2010, the CIHI estimates that per capita health spending across Canada will be $5,614, but in B.C., just $5,355.

When Campbell's Liberals took office in 2001, B.C.'s total per capita health expenditures were $137 higher than the national average. A decade later, in 2010, British Columbians' per capita health spending will be $258 lower than for Canadians as a whole.

Looked at another way, B.C.'s total per capita health spending in 2001 was four per cent above the national average. In 2010, we will spend 4.6 per cent less on health care compared to other Canadians on a per capita basis.

And one last comparison between B.C. and Canada as a whole. From 2001 to 2010, total per capita health spending across Canada grew by 62.7 per cent; in B.C., it rose by just 49.2 per cent.

The cost of tax cuts to BC health care

How to explain B.C. falling behind the rest of Canada in total per capita health expenditures? The answer is simple: Gordon Campbell and his BC Liberal government have opted to allocate fewer resources to public-sector health care than nearly every other province in the country.

In 2001, B.C.'s per capita public-sector spending on health care was third-highest amongst Canada's 10 provinces, behind only Manitoba and Newfoundland. By 2010, B.C. had dropped to ninth place, ahead of Quebec alone.

According to the CIHI data, per capita public-sector health expenditures in B.C. in 2001 were $235 higher than the national average. By the end of the decade, in 2010, Victoria's per capita health spending will be $164 lower than for the country as a whole.

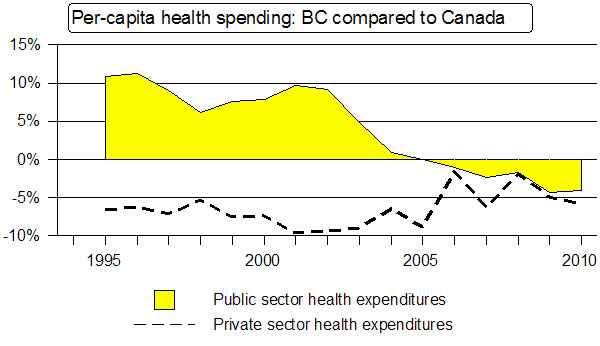

The chart above shows the dramatic decline in B.C.'s per capita public-sector health expenditures compared to the rest of Canada since Gordon Campbell became premier in 2001.

At the beginning of the decade, Victoria's health spending on a per capita basis was 9.7 per cent above the national average. By 2005 B.C. had slipped to slightly under the national average, and in 2010, we will be 4.1 per cent below the country as a whole.

Tax revenues then and now

None of this should be too surprising. As one would have expected, Victoria's taxation revenues under Gordon Campbell have fallen significantly as a proportion of the provincial economy. In fiscal 2001/02, the province’s tax revenues represented (see pp. 72-75 of this document) 10.6 per cent of B.C.'s gross domestic product (GDP), but by 2009/10 they had dropped to just 9.1 per cent.

Total government revenues -- from all sources, including taxation, natural resources, Crown corporations and federal transfers -- in 2001/02 represented 21.1 per cent of the provincial economy. After a decade of Campbell Liberal rule, the comparable figure in 2009/10 was an even 20 per cent.

(B.C.'s annual GDP is just under $200 billion, so each percentage point represents nearly $2 billion.)

With reduced revenues, Victoria has fewer funds to allocate to programs and services. In 2001/02, the province's GAAP (generally accepted accounting principles) expenditures were 22.7 per cent of GDP.

By 2006/07, that figure had plummeted to a bare 18.8 per cent, and in 2009/10 -- when our GDP reflected a weakened provincial economy in the global recession -- it was only 20.9 per cent.

(According to the government's 2010/11 budget, Victoria's post-recession expenditures will be about 19.7 per cent of GDP in 2012/13.)

British Columbians buying more private health care

In a nutshell, the tax cuts introduced by Gordon Campbell and his BC Liberals over the past decade have left Victoria with reduced financial resources. As a consequence, the province has fewer resources to allocate to public services, including health care.

So, as the latest CIHI report clearly shows, compared to other provinces across Canada, B.C.'s per capita health expenditures -- both public-sector and total -- are rapidly falling behind.

But that is not the case with private-sector health expenditures. While the B.C. government has been cutting taxes and restricting the growth of public-sector health care, individual British Columbians are allocating some of their tax savings to the purchase of privately-provided health care.

As stated earlier, total per capita health spending in B.C. rose between 2001 and 2010 by 49.2 per cent. The public-sector portion of those total expenditures grew by 43 per cent, but the private-sector component has soared by 77.4 per cent.

According to the CIHI, private-sector health expenditures represented 26.1 per cent of total health spending in B.C. when Gordon Campbell became premier in 2001. A decade later, the comparable figure is 29.2 per cent.

Returning to the chart higher on this page, it is evident that private health expenditures by British Columbians -- which historically have been well-below the Canadian average -- are approaching parity with the rest of the country.

In 2001, private-sector health spending in B.C. was 9.5 per cent below that of Canada as a whole. But over the last five years, from 2006 to 2010, the comparable average has been just 4.2 per cent.

And now, a further 15 per cent tax cut

Campbell's surprising announcement on Oct. 28 of a 15 per cent cut to personal income taxes means that the provincial government will have fewer financial resources in the future to spend on programs and services. And that means B.C. likely will fall further behind the rest of Canada in terms of per capita public-sector expenditures on health care.

It also means that we are likely to see a continuation of the growth in private-sector health spending.

"The best thing we could do is leave more money in your pocket," said Campbell in his Oct. 28 speech.

It sounds good, except that with the B.C. government providing relatively fewer health services in comparison to the rest of the country, many British Columbians will be using their tax-savings to privately purchase the health care once offered by Victoria.

As for those lower-income British Columbians who have obtained little or no benefit from Campbell's tax cuts, and cannot afford private health care?

The premier didn't say. ![]()

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: