Every week Canada's least favorite Emir, Alberta Premier Ed Stelmach, earnestly lectures Canadians that the mighty tar sands are a boon to the national economy because "Alberta's engine drives Canada."

Just a week ago the eloquent Stelmach told the folks at the annual Canadian premiers conference that the project has the grandest of national visions: "It's all about jobs and it's all about the tax revenue that will flow to the federal government and the provinces." In other words dirty oil now cements prosperity and serves up stacks of cash for fat and lazy governments.

But simple-minded statements from members of Alberta's Wahabi-like sect, the province's well-tarred Tory party, are now a dime a dozen. They all read like incredulous Saudi Arabian press releases. For the real economic impacts of the tar sands, an almost untold business story, are really about a monetary hurricane and massive structural change. In fact the economic fallout from rising oil exports, in the absence of sensible national policy, totally dwarf the project's significant environmental messes.

Dollar dangerously pegged to oil prices

To date the $200-billion energy mega-project has not only changed Canada's economic life but also diminished the nation's economic diversity and resilience. Although the Emir pretends the tar sands is an economic "win-win," the project's chaotic development has planted several improvised explosive devices in the economy that should give any small-c conservative pause for thought.

In particular the oily behemoth has transformed the loonie into a volatile petro dollar, destabilized the country's manufacturing base with a bad case of the Dutch Disease, provided governments with access to easy revenue (always a problem), exported thousands of added value jobs to U.S. refineries and perilously yoked the nation's future to the yoyo world of global oil demand.

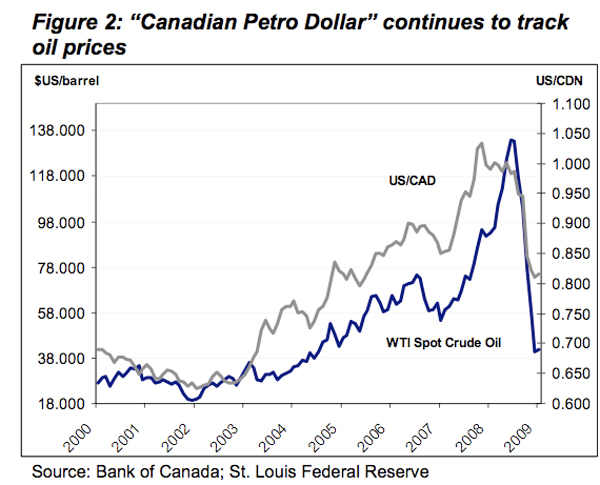

Now just about every economist and every Canadian who has traveled abroad recently knows that our dollar is now pegged to the price of oil. It started to appreciate in value against the U.S. greenback in 2002. That's the same year Canada outstripped Saudi Arabia as America's number one oil dealer. When the price of crude dropped from a high of $150 barrel in 2008 to $40, the Canada dollar sunk faster than oil-soaked duck in a Syncrude tailings pond. In other words the Canada's petro dollar tracks oil prices with the energy of a celebrity stalker.

For better or worse Canada's economic fate is now chained to oil exports and oil price shocks. That's what happens when a nation supplies the United States with 20 per cent of its oil and refuses to have a national conversation about the consequences.

Dutch Disease: the resource curse

But the steady appreciation of the Canadian dollar driven by rising bitumen production (from 600,000 barrels a day in 2000 to 1.3 million barrels today) has also created other dramatic risks. First and foremost is what economists call the resource curse or the Dutch Disease.

In the 1970s the Netherlands hurriedly exploited its rich offshore natural gas deposits. While gas exports drove up the value of the Dutch guilder, the nation's manufacturing sector found it hard to sell its goods. So while the gas sector expanded and the government overspent the revenue, the rest of the economy shrank and de-industrialized.

The ever-observant business magazine The Economist dubbed the economic malaise "the Dutch Disease," from which the astute Dutch eventually recovered. But just about every major oil exporter from Venezuela to Louisiana has suffered some form of the ailment. The political scientist Terry Karl notes in The Paradox of Plenty that if one conclusion can be drawn about the Dutch Disease it's simply this: "a country's economic performance following a resource boom depends to a considerable extent on the policies followed by its government."

Phillippe Bergevin first diagnosed Canada's growing infection in an excellent 2006 paper for the Library of Parliament entitled "Energy Resources: Boon or Curse for the Canadian Economy?" Bergevin detected a number of critical and telltale symptoms including "a rising resource-led export sector coupled with a struggling manufacturing sector and a rising currency."

Norway showed the way

Bergevin suggested that Canada could avoid a really nasty bout of deindustrialization by adopting Norway's fiscal discipline as well as saving hydrocarbon wealth in dedicated funds such as Norway's 20-year-old $400-billion pension fund. Such a fund, which invests in international capital markets, serves several purposes. By taking the money out of general revenue it curtails excessive government spending (another characteristic of petro states).

A sovereign wealth fund also restores balance and class to the currency. Unlike the loonie, Norway's krone does not bounce up and down like a basketball. Nor is Norway's exporting sector languishing. (Alberta's nearly 34-year old Heritage Trust Fund, which the Alberta government systematically loots whenever it feels like it, holds but a paltry $14-billion and couldn't balance the currency of Lagos.)

Bergevin pointedly recommended that both Alberta and Ottawa save its oil wealth for future generations. If the federal government had prudently separated tar sands taxes from its general revenue over the last two decades, Canada could boast a significant $100-billion rainy day fund by 2020.

"Norway's experience demonstrates that policies such as establishment of a petroleum fund can help alleviate the effects of the Dutch Disease," added Bergevin. But no one in Ottawa listened and the media yawned.

How the petro-dollar kills manufacturing

One of Quebec's largest and most important financial institutions, Desjardins also sounded the alarm about the Dutch Disease in 2006. Although oil exports had contributed to national revenue and created jobs, "there is reason to wonder about the benefits of exploiting the tar sands." While profit margins jumped for energy companies, the trade balance of the manufacturing sector tanked.

Given the new lustre of "the petrocurrency" and the potential for tar sands exploitation, the analysts at Desjardin predicted that "manufacturing industries will still be facing very tough times." They weren't kidding.

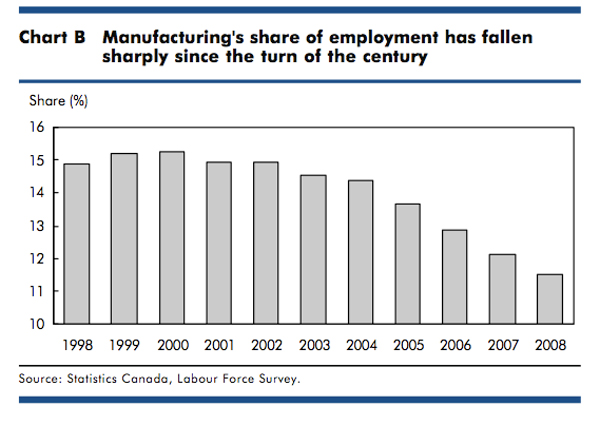

A year later a parliamentary committee looking at the manufacturing sector noted that a rising dollar combined with volatile energy prices and cheap Chinese imports had decimated the sector. It cited the Dutch Disease and concluded that Canada was witnessing "a long-term structural change favoring both the resources and the services sectors at the expense of the manufacturing sector."

In other words the bitumen curse will make Canada look more and more like Saudi Arabia, where petro dollars buy imported luxuries and temporary foreign workers. (Ironically the report's authors recommended the development of clean and renewable energy sources for Canadian industry.)

The Bitumen elephant stomps BC and Alberta

Alberta, of course, has a classic case of the Dutch Disease. Bitumen is the elephant that has stomped the rest of the province. A 2009 PriceWaterhouse Coopers study noted that the project had surely enriched the oil cartels as well as the construction and the transportation sector. However it had weakened or impoverished the rest of the economy. Agriculture has recorded negative growth since 2000 while "petroleum refineries, chemical manufacturers and the pipeline industry" have "not fared well" and "grown at a rate much slower than the provincial average."

British Columbia has been affected, too. In a 2008 presentation to the Canada West Foundation, Jock Finlayson of the Business Council of British Columbia noted that every one cent rise in the Canada's petro dollar subtracted $150-$160-million from the forestry sector; and another $50-million from the mining sector. Since 2007 alone B.C.'s forestry sector has lost $2.5 billion due to Canada's wonky petro dollar.

Last year Statistics Canada documented just how thoroughly the Dutch Disease can hollow out an economy. Between 2004 and 2008, years of frenzied tar sands activity, Canada lost 322,000 manufacturing jobs. That means that one in every seven manufacturing jobs vanished. The majority of the losses occurred in Central Canada. Textiles, clothing, wood products, motor vehicles, machinery, chemicals and electrical equipment all suffered extreme losses.

Hollowing out an economy

Daniel Drache, a political economist at York University, also doesn't think Canada's rapid deindustrialization is smart or sustainable. "Hollowing out of the manufacturing in Ontario and Quebec is a massive price to pay even if the resource Canada is booming... Canada's share of technology intensive industries -- auto production, aerospace, advanced economic software and other high value-added industries -- is much smaller than a decade ago, and this has left its factory economy structurally and competitively weakened. Most of all, the transfer of power to the resource giants and the financial sector is troubling and problematic."

Serge Coulombe, an economy professor at the University of Ottawa, and two European colleagues recently asked just how much of the manufacturing losses could be attributed to the petro dollar and rapid tar sands development. In the end Coulombe calculated that 53 per cent of the manufacturing employment loss (a total of 322,000 jobs) was directly related to a petro dollar and "Dutch disease phenomenon." That means for every job created in the tar sands (approximately 100,000) another job has died in the country's manufacturing sector due to bad public policy.

In an interview Coulombe noted that when a country becomes richer because of oil revenue, it's not a disease if the money is invested wisely. But that hasn't happened in Canada or Alberta. Coulombe says he has repeatedly advised both Tory and Liberal governments to save oil revenue in stabilization funds. "It is well-known in Ottawa they should do it but they don't want to do it. They simply spent the money by bringing down the GST by two per cent... Neither the Tories nor the Liberals are willing to talk about it."

Tar sands send Canadian jobs to US

In addition to subtracting jobs from the manufacturing and forestry sector, the tar sands is also exporting jobs to the United States. Every pipeline that ferries 400,000 barrels of raw bitumen a day to the United States transports approximately 18,000 refinery jobs out of Canada. In this respect the tar sands confirms another disastrous Canadian tradition: that of high grading resources and letting other economies do the profitable value-added work.

Last but not least, the tar sands has become a shiny and ungainly Titanic en route to what the philosopher Nassim Nicholas Taleb would call "the impact of the highly improbable." The financial collapse of 2008 illustrated the fragility of systems with large concentrations of capital and complex support systems. (In fact nearly $100-billion in investments disappeared from the tar sands casino.) As Taleb astutely noted in his furiously important book The Black Swan, "unforeseen errors and random shocks hurts large organisms vastly more than smaller ones." After all the hubris the tar sands looks like an Enron or an AIG heading for economic humiliation.

Several random icebergs now patiently await Alberta's bitumen supertanker. They include dramatic oil price shocks, disruptive technologies such as the electric car, a U.S. military that has identified fossil fuels as a national security risk, low carbon fuel standards and growing public sentiment that the oil industry behaves like another morally challenged energy industry: 19th century slave traders A reasonable carbon tax could also limit the size of the bitumen express. Alberta's Emir and the merry crowd in Ottawa never talk about these national economic risks.

Canada's useless Energy Board

So the project has now rearranged the Canadian economy as thoroughly as the federal government's National Energy Program beat up Alberta's economy in the 1980s. Public policy that favours further expansion courts more fragility and vulnerability. By exporting vast volumes of oil without demanding that governments save the money in pension funds (and thereby stabilize the Canadian dollar), Alberta now has given the rest of the country a formidable case of the Dutch Disease. By approving one pipeline after another, Canada's dysfunctional National Energy Board has actively chosen to export thousands of high value jobs to U.S. refineries. And on it goes.

Perhaps Alberta's Emir was right when he said the tar sands is all about jobs and revenue. He just forgot to add two important qualifiers: lost jobs and squandered revenue.

Monday: Tyee reporter Geoff Dembicki on remote tar sands workers cracking under the isolated stress. ![]()

Read more: Energy, Environment

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: