The Alberta government has failed to collect nearly $2.5 billion per year in resource royalties since 2009 due to a major calculation blunder, according to Jim Roy, a private royalty expert who advises governments around the world.

As a consequence, the province has failed to collect $13 billion in the last five years, charges Roy, a former senior advisor on royalty policy for Alberta Energy.

That's not what Alberta's long-reigning government promised to voters in 2007.

After a controversial royalty review, the first one in a decade, premier Ed Stelmach told Albertans that the new formulas for calculating royalties would increase Alberta's ''fair share'' of hydrocarbon profits by $2 billion a year, beginning in 2009.

At the time Jim Prentice, then federal industry minister, supported the changes proposed by Stelmach.

But instead of increasing royalties by $2 billion a year, Alberta's ''fair share'' plummeted due to bad forecasting and major flaws in how the province collects natural gas and bitumen royalties, Roy said.

''Announcing a royalty increase and delivering a royalty decrease is difficult to explain to voters,'' Roy said. ''The Tories chose to pretend the big blunder did not happen. Nobody talks much about the government gifting the petroleum industry $13 billion.''

Rates more sensitive to price

The management of Alberta's hydrocarbon income has become a significant election issue as the Tory government has posted a $5-billion deficit and raised taxes and cut services for ordinary Albertans.

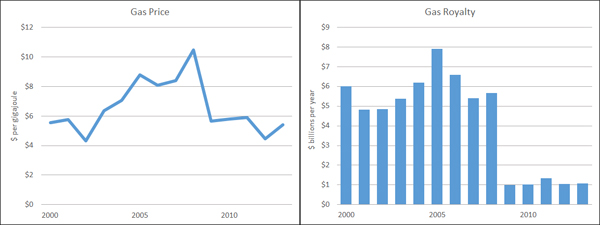

Since 2009, natural gas revenue for the government has experienced the greatest losses. The new formula implemented in 2009 made the royalty rate much more sensitive to price, and the new formula substantially dropped royalties for unconventional resources such as shale gas.

''The government expected natural gas prices to rise, but instead they collapsed,'' Roy said. ''As a result, government earnings from natural gas dropped by $5 billion after 2009.''

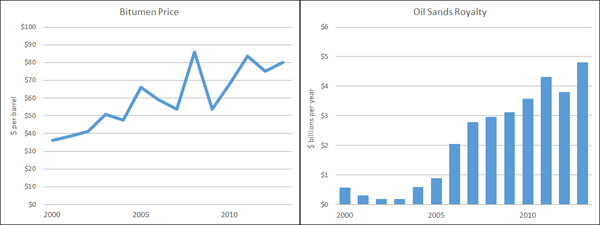

Despite a substantial increase in world oil prices between 2009 and 2014, bitumen earnings did not increase significantly. Any upward shift in earnings was largely due to added production in volume or project pay-outs. Bitumen developers don't pay royalties until they have written off their capital costs.

But therein lies another problem, Roy said. Alberta has a low royalty rate for bitumen compared to rates in countries that have similar heavy oil resources. Alberta, for example, takes from 25 to 40 per cent of profit, equivalent to 10 per cent of gross revenue. In contrast, Venezuela, which also extracts heavy oil, takes 40 per cent of gross revenue -- four times as much as Alberta.

Saudi Arabia captures 85 per cent of profits from its oil fields, while Norway takes 80 per cent of profit -- both three times as much as Alberta, Roy said. ''Newfoundland/Hibernia takes 30 to 50 per cent of profit, plus 7.5 per cent of gross revenue or twice as much as Alberta.''

The royalty expert also argues that the province has failed to control the pace of bitumen development. As a result, industry has put too much bitumen on the market and that glut, in turn, has played a role in driving down global prices.

''The oil sold at low price is gone. The money is lost. The world has given Alberta a clear price signal. Alberta would be foolish to continue increasing bitumen production for sale at low price,'' Roy said.

According to Roy's calculations, approximately 40 per cent of Alberta's projected deficit for fiscal year 2015/16 could be eliminated by returning to the royalty formulas in place prior to 2009.

NDP vows royalty review

Rachel Notley, the leader of Alberta's New Democrats, has already promised to hold a review of the province's royalty structure if her party wins next Tuesday's election.

Premier Prentice contends that a major review of Alberta's royalty formula would have negative consequences.

''I don't think you ever say categorically in the history of the province we should never review where we stand on royalties,'' the former corporate banker told the Calgary Herald on April 29.

But given low oil prices, ''it is the worst thing we could do right now where we are fighting to hang on to every job we can,'' he said.

The province's oil industry has already come out against adjusting Alberta's royalties, among the lowest in North America.

''I don't think there's any room for any increase in royalties,'' Cenovus president and CEO Brian Ferguson told Bloomberg News this week.

''If there are changes that make the structure uncompetitive, that will be negative for investment in Alberta.''

In 2006, Alberta's auditor general reported that the government planned to collect 66 per cent of the economic rent or profits available from petroleum extraction, but the government was not meeting its objective and was not clear about how it even measured economic rent.

The Tory government reached that target only once in 1998. Alberta's share dropped to 31 per cent in the years 2000-2008. Although the new royalty formulas were intended to increase the rent collected, the share collected by the owners of the resource dropped to 13 per cent. ![]()

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: