After studying production data from 65,000 wells from 31 different unconventional shale rock formations in 2012, David Hughes predicted big trouble ahead for North America's unconventional hydrocarbon revolution.

The prominent geologist, who has studied Canada's energy resources for four decades, warned that shale gas and tight oil operations shared four big challenges: escalating capital costs, uneven performance and a growing environmental footprint, all followed by rapid depletion.

"Shale gas can continue to grow, but only at higher prices and that growth will require an ever escalating drilling treadmill with associated collateral financial and environmental costs -- and its long term sustainability is highly questionable," predicted Hughes just two years ago.

Recent economic data on the industry from Bloomberg, Energy Analyst and even the International Energy Agency shows that Hughes was bang on.

The tough economic news on shale, a dense rock that lies two to three kilometres underground, comes from a variety of key sources.

Constant borrowing

The first reality check appeared in a 2013 report by Virendra Chauhan, an analyst at London-based Energy Aspects last year.

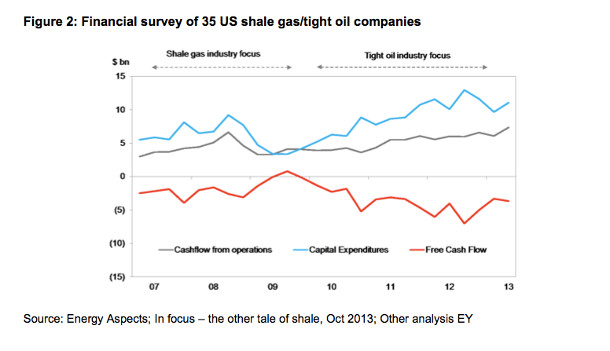

"The Other Tale of Shale" reported that depletion rates for shale wells, whether producing oil or gas, were so great that companies constantly borrowed more money to drill more wells.

Chauhan found that interest payments on debt for 35 shale firms accounting for 40 per cent of unconventional production increasingly consumed a growing share of their revenue.

"The very nature of shale wells, which exhibit high decline rates, results in the need to constantly allocate capital towards exploration drilling in order to maintain and grow production volumes," explained Chauhan.

"As a result, the average Capex (capital expenditure) spending of the 35 companies analyzed to serve as a guide to the industry has amounted to a staggering $50 per barrel of oil equivalent (BOE) over the last five years, at a time when their revenue per BOE has averaged $51.5."

Cash flow registered a solid negative for the firms Chauhan has looked at since 2007.

"The shale revolution is not a panacea that offers endless extension of the growth paradigm, and it is important to appreciate this to prevent the potential for a sharp disappointment in future global supplies," concluded Chauhan.

Peak production

Next came comments from Arthur Berman, a Houston-based geologist in an interview for OilPrice.com.

The respected analyst noted that shale production had peaked in most fields (the formations were supposed to gush for decades), and that companies were spending more money than they were earning because overproduction had killed gas prices.

Without higher prices for natural gas, he warned that "the shale gas boom is not sustainable."

He said companies and governments had overhyped the potential of shales because "that is all that is left in the world. Let's face it: these are truly awful reservoir rocks and that is why we waited until all the more attractive opportunities were exhausted before developing them."

He also thought the liquefied natural gas craze was not founded on real reserve estimates or real dollars. "It amazes me that the geniuses behind gas export assume that the business conditions that resulted in a price benefit overseas will remain static until they finish building export facilities," he said.

Lagging returns

Berman's comments were followed by a pointed analysis by Ruud Weijermars, a Dutch energy consultant, in the Oil and Gas Journal. Weijermars offered a sobering and critical look at the financial fate of shale gas projects at U.S. airports.

At the beginning of the shale boom in 2006, Chesapeake Energy approached the Dallas Fort Worth Airport (DFWA). It wanted to drill 330 wells and frack the Barnett shales underneath.

The DFWA negotiated a signing bonus for 18,543 acres and a 25 per cent royalty on gross revenues from sales.

But Chesapeake overestimated the amount of gas in the ground and underestimated the cost of extracting it. The company reportedly not only set off earthquakes with its injection wells, but had to retrofit its equipment with electric engines so as not to cause any safety hazards at the airport.

In the end, Chesapeake drilled only half its projected wells at a cost of $7.21 per thousand cubic feet (Mcf) in a market that offered a price of $4.23 Mcf. The airport made money, but Chesapeake lost $316 million.

"The project performance of the DFWA shale gas development project is exemplary for the lagging returns on investment from U.S. shale gas fields," concluded the Dutch analyst.

"All in all, the permissive attitude of regulators and financiers and their neglect of the flagging signs of weak fundamentals are all typical for investment bubble hypes, as seen recently in the dot-com bubble and housing scandal. The shale gas bubble is likely the next one to burst."

Drilling treadmill

The Oxford Institute for Energy Studies followed with another sobering assessment.

Analyst Ivan Sandrea noted that capital expenditures in unconventional shale and tight oil plays had increased from $5 billion in 2005 to $80 billion by 2013, along with $200 billion in mergers.

But the prosperity did not flow as predicted: "Related write-downs by several of the largest shale players are now approaching $35 [billion], suggesting that some of these plays will not meet original technical and business expectations."

Sandrea added that industry had found few sweet spots. "Overall, the cumulative drilling experience shows that these plays may be large in extent, but are not necessarily continuous or homogenous in scale; there are patches of strong well performance and repeatability within each play, some of which are better than others, but break evens still remain high and unpredictable for many companies."

One of the key problems was rapid depletion forcing a drilling treadmill: "But who can, or will want to, fund the drilling of millions of acres and hundreds of thousands of wells at an ongoing loss?"

Last month Bloomberg, the financial paper, reported that the debt carried by 61 shale gas drillers doubled to $163.6 billion over four years while revenue stagnated at 5.6 per cent.

"Drillers are caught in a bind. They must keep borrowing to pay for exploration needed to offset the steep production declines typical of shale wells," reported Bloomberg.

"At the same time, investors have been pushing companies to cut back. Spending tumbled at 26 of the 61 firms examined. For companies that can't afford to keep drilling, less oil coming out means less money coming in, accelerating the financial tailspin."

One of the companies studied included Quicksilver, which owns a potential LNG plant site in Campbell River, British Columbia. The company's interest expenses gobbled up almost 45 per cent its revenue.

Encana, a major investor in shale gas plays in B.C., has sold off many shale assets and recently cut staff by 20 per cent due to financial difficulties including an unhealthy debt to equity ratio of 58 per cent. Other major corporations such as Shell have downgraded shale assets.

The Bloomberg article warned that "the U.S. shale patch is facing a shakeout as drillers struggle to keep pace with the relentless spending needed to get oil and gas out of the ground."

Shale gas production in B.C. reflects these worrisome economics. While production in recent years has increased, income in the form of royalties has dramatically declined from $1 billion a year to less than $200 million a year for the resource owner, British Columbians. Meanwhile, industry subsidies in the form of royalty credits, infrastructure incentives, free science and free water have increased.

Brace for bust

Lastly comes the International Energy Agency. Its latest report documented a world of diminishing returns for energy investments. Big Oil is spending more but getting less in return.

It did not suggest that oil or gas production from fracked shale formations would save the day, guarantee independence or even deliver profitable returns.

It predicted, as energy and financial analyst Gail Tverberg highlighted in a recent blog post, an unlikely outcome: "Meeting long-term oil demand growth depends increasingly on the Middle East, once the current rise in non-OPEC supply starts to run out of steam in the 2020s." When contacted by The Tyee, David Hughes, a fellow of the Post Carbon Institute, offered this comment on recent economic developments for the debt-ridden industry.

"Although the shale revolution has temporarily increased North American oil and gas production, its longer term sustainability is highly questionable."

The hype about "Saudi America" and U.S. "energy independence" is unlikely to be realized and North Americans would be well-advised to plan their energy future in the absence of a fossil fuel bonanza from shale, he said. ![]()

Read more: Energy, Environment

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: