How low can it go? That's the question I'm now asking about CanWest Global Communications.

If you've read my book, Asper Nation, which was published a year ago and was excerpted in these pages, you'll know that I ask a lot of questions about CanWest, especially about the political bias of its owning Asper family of Winnipeg and its control of much of Canada's -- and of most of Vancouver's -- news media.

But I never thought I'd end up owning the company.

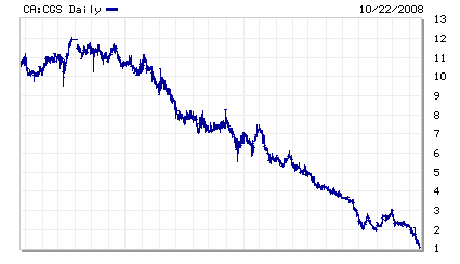

Unfortunately, that's exactly what happened recently when I bought 500 shares of CanWest stock. They were trading at about $1.40 in mid-October after the stock market meltdown, which was down from more than $10 just over a year ago and $15 in mid-2006. Only a month ago, the Globe and Mail -- hardly a friend to the Aspers -- enthused about the "pent-up value" that was just waiting to "burst out" of CanWest shares, which were then trading at around $3. Then came the big crash, and suddenly CanWest shares were half-priced again.

It was a perfect investment opportunity, or so I thought. How could I lose? After all, I literally wrote the book on the company, which not only owns a national television network, but also owns Canada's largest newspaper chain. As Lord Thomson of Fleet famously observed from experience, owning television was "just like having a licence to print your own money." And the Southam dailies CanWest bought in 2000 from Conrad Black as he fled the country (on his way to landing in a Florida prison) generated profits of 20 to 25 per cent, from what I could tell.

'We're not too worried': Leonard Asper

If anyone should have been a good judge of CanWest's viability, you'd think it would be me. But no. Since I shelled out my hard-earned $700, shares in CanWest have continued to slide.

What went wrong? Just a few things.

First, almost as soon as I bought into CanWest, its Australian operations reported fourth-quarter earnings down 79 per cent from a year ago. CanWest owns 57 per cent of Network TEN in Oz thanks to the ingenuity of late company founder Izzy Asper, a sharp tax lawyer who in 1992 found a loophole in that country's 15 per cent limit on foreign ownership of media. The Aussies soon closed the loophole, but ever since then Network TEN has looked a lot like our Global Television (affectionately known to some as the "Love Boat Network" for its reliance on re-run Hollywood fare) and until recently had been a bulwark of CanWest profitability.

Izzy's sons, Leonard and David, who have run CanWest since his death in 2003, decided not to sell the company's stake in Network TEN last year after Australia lifted its media ownership limits entirely, including a long-standing prohibition on cross-ownership of newspapers and television, thanks largely to Asper activism. Newspaper owners lined up to bid for CanWest's majority share of TEN, but the Aspers decided to hang onto it despite an earnings downgrade due to growing concern over the economy. "We're not too worried about cyclical downturns," explained Leonard on a recent visit to Sydney. "These things come and go."

Stock analysts were less than impressed, however, and began downgrading CanWest stock despite the CEO's insistence that Network TEN had "a lot of growth opportunities."

Enter Goldman Sachs

The other main reason for CanWest's slide has been growing concern among investors that the Aspers may have painted themselves into a corner with their acquisition last year of 13 cable channels formerly owned by Canadian media giant Alliance Atlantis. As CanWest's fortunes dim, it is becoming increasingly obvious to many that this ill-advised expansion could even contain the seeds of the company's demise. Unfortunately for Canadians, it could also result in the country's largest television company soon being mostly American-owned. The dominoes became aligned after the Aspers set their sights on the baker's dozen cable channels Alliance Atlantis put up for sale in late 2006, including HGTV, Showcase, and History Television. Broadcast TV has become increasingly subject to competition for ever-more fragmented audiences in the 500-channel universe, not to mention the interactive web 2.0 world. CanWest lacked outlets in the lucrative cable genre, and the Asper boys fairly lusted after some.

There was only one problem -- they couldn't afford to make an offer on their own for the Alliance Atlantis channels because CanWest was still heavily in debt after borrowing almost $4 billion in 2000 to buy Southam. No Canadian bank would lend them the money, so the Aspers went cap in hand to Wall Street and sold Goldman Sachs, a giant private equity firm, on a scheme to carve up Alliance Atlantis.

The Wall Street investment bankers bought Alliance Atlantis's movie division, theatre chain, and the lucrative CSI franchise, which was held jointly with CBS. Goldman Sachs and CanWest went in together on buying the cable channels, with the Americans putting up 64 per cent of the $2.3-billion purchase price.

Might CanWest cede control to Americans?

The deal was rife with peril for CanWest, as it gave Goldman Sachs a buyout option that could force the Aspers to buy its shares at a certain price. It also called for a merger in 2011 between their cable partnership and CanWest's broadcast operations, including Global Television and the E! network. The division of ownership between CanWest and Goldman Sachs will depend on the relative earnings of each part of the combined enterprise. If CanWest earnings continue to fall, Canadians will likely wind up as minority owners.

"We could see CanWest losing its shirt over this," warned media critic Ian Morrison of the lobby group Friends of Canadian Broadcasting. "It actually put us in a situation where in the worst case scenario here, we think the Aspers could lose CanWest."

Despite flouting Canada's foreign media ownership limits, which directly and indirectly (through a holding company) are supposed to add up to 46.7 per cent, the deal was quickly rubber-stamped by an Asper-friendly Conservative government. With the world economy slumping and advertising revenues already in the toilet, it now hangs like an anvil around CanWest's neck. The company's fourth-quarter earnings should be released next month.

String of controversies

Another reason for CanWest's fall from stock market grace might be a growing public -- and investor -- distaste for Asper antics. These have included the pro-Israel, anti-CBC, global-warming-dismissing news media manipulation that I chronicled in Asper Nation. CanWest media outlets have enthusiastically pushed a neo-liberal economic agenda of deregulation and a neo-conservative political agenda of American military intervention, albeit occasionally over the protests of their journalists.

Recent hard-line tactics may have also given the company a black eye. These have included lawsuits against not only this publication, which was recently settled, but also one against activists who printed a four-page parody of CanWest's Vancouver Sun. It mocked the Sun's news coverage of the Middle East conflict as blatantly pro-Israel government, which drew the ire of the ardently Zionist -- and litigious -- second-generation Aspers. While the case has scarcely been reported by large corporate media outlets, it has attracted much grassroots opposition from people and groups who consider it a groundless SLAPP suit (strategic lawsuit against public participation) and a serious infringement of free speech.

Along with the Aspers' controversial 2001order that their major dailies all carry "national" editorials written at company headquarters in Winnipeg and their 2002 firing of Ottawa Citizen publisher Russell Mills for defying their political agenda, these episodes might be seen to erode the company's credibility -- a valuable asset for any news media firm -- which could undermine investor confidence.

Share price drops below $1

Media economist Robert Picard has noted that communication empires, like other empires, don't last forever and often not even for as long as we expect. Conrad Black, who looked invincible as Canada's media potentate a decade ago with his launch of the National Post, actually only topped the heap for a little more than four years. The Asper ascendancy has already lasted twice as long.

"Media empires are not permanent and omnipotent but rather are subject to the internal needs of organizations and bureaucracies, as well as external economic, financial, and regulatory forces. Those who wish to control or reduce the harmful effect of empires must understand the capitalist environment, as well as the forces driving empires and their leaders."

Those factors must include psychological considerations, as Black's fall doubtless demonstrated that behind his business cunning lurked a self-destructive side that pushed him to go too far and get caught swindling shareholders. The Asper heirs are driven by a desire to not only promote their father's political agenda, but to expand his media empire even further. Those aims may not be shared by other CanWest stock holders, who might prefer a reasonable return on their investment instead. As a result, and with CanWest's share price briefly dropping below $1, some are clamoring for more professional leadership of the company.

So much for 'convergence'?

At least for the next handful of years, CanWest should "continue as a going concern," given that large amounts of its $3.7 billion in debt won't come due for payment until 2012, a TD Newcrest financial analyst said this week, even as he declared the company's shares are no longer worth the risk.

But the stock market soured long ago on media "convergence," the notion that bigger is always better. Any Asper insistence on hanging onto both newspaper and television assets in an economic downturn may further accelerate investor flight from CanWest.

Asset sales are probably the only thing that might keep the Aspers' heads above water in the maelstrom, most logically their newspaper holdings, which include both of Vancouver's biggest dailies. That would mean more diversity of Canadian media ownership.

Either way, I figure I can't lose. At least, not more than $700. C'mon boys, you can do it!

Related Tyee stories:

- 'Asper Nation' Excerpted (Series)

Marc Edge takes a hard look at media concentration in Canada. - How Big a Story Is CanWest's New Deal?

Big merger causes existential crisis for Canadian journalism. - Senators Let Big Media off Hook

Committee's long-awaited report shrugs at CanWest, targets CBC.

Read more: Labour + Industry

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: