A pair of New Democrat MPs from British Columbia are pressing the Trudeau minority government to save small businesses slammed by rent costs during the COVID-19 crisis, urging the adoption of a grassroots proposal gathering thousands of signatures.

MPs Gord Johns and Peter Julian say if such assistance isn’t provided soon, many small businesses ordered closed as a public health measure risk never reopening.

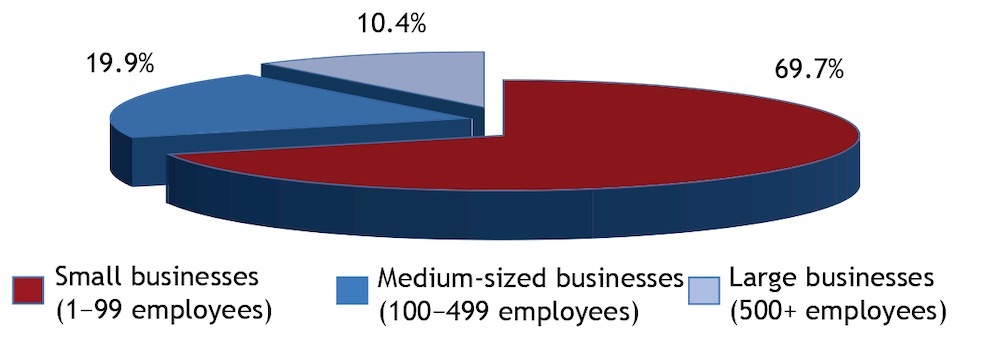

The federal government estimates small business employ seven out of ten members of Canada’s private labour force, based on 2017 numbers.

On Thursday, Johns and Julian sent federal Finance Minister Bill Morneau a letter — copied to his colleague, Small Business Minister Mary Ng — calling on the government to establish a commercial rent abatement program that would reimburse 66 per cent — or two-thirds — of a small business’s monthly lease payment up to a maximum of $6,600 from April to June. Landlords would pick up the remaining one-third.

Rent-relief eligibility would be limited to businesses and non-profits with gross annual revenue of less than $5 million in 2019, with a focus on businesses operating in the retail, dining, tourism and leisure, and hospitality sectors.

“If the federal governments wants to, it can approach the provinces to see who wants to eat the property taxes,” Johns, the NDP critic for small business and tourism, told The Tyee.

On that front, the Canadian Federation of Independent Business has called on provincial governments to reduce annual commercial property taxes by at least 25 per cent during the crisis.

Last week, Ontario NDP Leader Andrea Horwath also proposed a rent-relief package, calling on Premier Doug Ford’s Progressive Conservative government to provide small and medium-sized enterprises, charities and community-based non-profits with a 75-per-cent subsidy up to $10,000 a month for three months.

The federal NDP’s rent-relief request is based on the same proposal from Save Small Business, which has gained the support of more than 26,000 small businesses across Canada and who signed an online petition calling for rent abatement.

“We’ve paused our businesses to save lives. The government must act now to pause our expenses to save the Canadian economy,” states the Save Small Business website.

Late last month, the grassroots coalition — which only formed on March 22 — sent a survey to about 20,000 signatories, 76 per cent of whom reported between an 80 and 100-per-cent drop in revenue since the economic shutdown.

When asked whether they would default on their commercial rent “without further support,” 38 per cent responded that they would be unable to pay their April rent, and a further 32 per cent said they could not meet their May rent — bringing the total of small-business rent defaulters to a staggering 70 per cent by May 1.

Small businesses that missed their April 1 rent means that on April 15, they will be in violation of their commercial lease and could be locked out by their landlords — “so this needs to be done urgently,” said Johns, a former small business owner.

Parliament was reconvened on Saturday for a rare sitting to allow Members of Parliament and senators to debate and pass the federal government’s wage-subsidy relief for businesses (Bill C-14) initially mentioned in the COVID-19 Emergency Response Act (Bill C-13) that received royal assent last month. The provision will cover 75 per cent of wages over three months for employees who might have already been laid off.

Small business will also get some relief from the Canada Emergency Business Account’s interest-free loans of up to $40,000 to small businesses and not-for-profits with 2019 payrolls starting at $50,000. But Johns says that won’t be enough to cover the “leases and losses,” as well as operational expenses, such as utilities and security systems, of small businesses.

“Plus, I don’t know a lot of small businesses that can carry a debt of $30,000 over the next couple of years in a depressed economy,” said Johns, referring to the $10,000 portion that would be eligible for forgiveness if the $30,000 portion of the loan is fully repaid on or before Dec. 31, 2022.

But half of 1,974 small businesses recently surveyed by Save Small Business indicated they won’t apply for the loan, and only 41 per cent said their payroll was within the $50,000-$1 million threshold to qualify.

Some would apply if they could, such as Yung Li, who runs Laser Environment Inc. in Mississauga, Ont. and who told The Tyee that his computer-hardware store’s 2019 payroll fell just under — at $46,500 — the minimum requirement for the loan.

Constituents in Johns’ central Vancouver Island riding of Courtenay-Alberni, are in the same boat. Jiggers Fish & Chips, a food-truck run by couple Shelly Lee Fader and Shane Robert Greer who are entering their 19th year of operation in their hometown of Ucluelet, is $483 short of reaching the $50,000 mark based on their last year’s payroll. “That loan could have really helped us out right now,” Fader said in an email to Johns, which he had permission to share with The Tyee.

Save Small Business co-founder Jon Shell said that Morneau’s office told his group that the emergency loan program is intended to address the concern over covering fixed costs.

“There is an unfairness of requiring retail businesses to take out a loan when they’re shut for a public health emergency in order to make sure that the landlords get every penny of what they’re owed so the banks get every penny they’re owed,” said Shell, a former small-business owner who now manages Toronto-based Social Capital Partners, a non-profit currently working on an employee-ownership capital initiative. “What we’re looking for is a fair deal for everyone.”

He explained that the Australian government has helped both tenants and landlords during the COVID crisis: small businesses receive rent reductions equal to reductions in their revenues, while support, through banks, is provided to landlords to defer their mortgages.

Save Small Business has compiled a chart comparing the response from Canada, not only with Australia, but also with the United Kingdom, France, Denmark and the U.S.

Save Small Business’s rent-abatement strategy was formulated in partnership with the Toronto Association of Business Improvement Areas, whose membership includes commercial landlords. While that group would be on the hook for one out of three months’ worth of rent, their tenants “get to survive,” said Shell, who estimates the federal-landlord bailout of small-business tenants would cost between $1 billion and $1.5 billion, based on Statistics Canada data for average commercial rents across the country.

“The equivalent of saying the landlords should get every penny of the rent they’re owed is saying we need to give business tenants all the revenue they would have earned,” he said.

Australia and the U.K., along with some U.S. states including New York, have also placed a moratorium on evictions, and Save Small Business would like that to happen in Canada by the provinces, which have jurisdiction over commercial leases.

The Tyee reached out to Morneau’s and Ng’s offices for comment on the rent-relief idea for small businesses, and was directed to a joint statement both ministers released last week on the launch of the emergency-loan program that does address leases.

When asked about rent abatement during the C-14 debate on Saturday, Ng only referenced the tax deferrals and wage subsidy for small businesses, but acknowledged that the government would “continue to listen to businesses so they are supported during this very difficult period.”

And it’s only going to get worse, Shell predicts.

“If we get to May with no more help, and 70 per cent of local businesses can’t pay the rent, we’re going to see mass closures across the country,” he warned.

“Everyone’s just talking about rent right now in the small business community. If you could solve that problem, we would buy a lot of time.”

But there isn’t a lot of time.

“My phone is ringing off the hook — people are in tears, they’re feeling hopeless,” said Johns, who is receiving “dozens” of calls a day from small business owners in his tourism-friendly riding worried that they will default on their rent payments during the COVID-19 economic shutdown.

“Even if they have a landlord willing to defer leases, how are these entrepreneurs going to pay it in the long run? And, are they even willing to take on that debt? Well, most aren’t; they’re saying, this is too much and insolvency looks more appealing,” he said. “They’re seeing their life’s work vanish before their eyes.”

“We’re losing businesses by the day — already, people are walking away. Within a month, we’re going to see many empty storefronts. There’s a real urgency here. The government needs to step up and take some action to save Main Street and demonstrate that they’re going to work with commercial landlords to cover some of this through rent relief.” ![]()

Read more: Local Economy, Coronavirus

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: