Leaders in the British Columbia government have been giving mixed signals this week on the possibility of raising taxes. A new survey suggests that depending how they present a tax hike, they might find more public support for it than they expect.

On Tuesday, Premier Christy Clark spoke to a luncheon the Tri-Cities Chamber of Commerce hosted. "I will not reach into your pocket for more money, because that just makes it harder for families in British Columbia," she said in her speech. "Higher taxes and higher deficits chase jobs away."

But when an audience member asked directly during a brief question and answer period whether the Liberal government would raise taxes, Clark waffled. "Would we raise taxes in some areas but not others, it's a difficult question to give answers directly to just because what I'm interested in is the overall tax burden for the province," she said.

She reminded the audience that the Liberals since 2001 have been focused on reducing taxes. "We are not planning a budget that's going to be a big tax and spend budget. It's going to be a balanced budget. It's going to involve a lot of tough decisions."

And she offered reassurance that her government wouldn't be seeking a bigger slice of people's paycheques. "We are going to make sure that we keep taxes down for individuals," she said. "We are going to maintain the lowest taxes in Canada in this province. I just don't think we can continue to add to the burden for the people of British Columbia. We need to leave more money in your pocket."

Won't rule anything out: de Jong

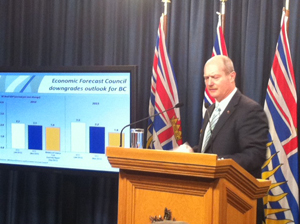

A day after Clark's speech, her Finance Minister Mike de Jong presented the second quarterly budget update. Halfway through the 2012-2013 fiscal year the projected deficit has grown by half a billion dollars and is now pegged at $1.469 billion even as the public service looks for cuts to meet that target.

Despite the deepening hole, he said he is confident he'll be able to present a surplus pre-election budget in Feb. 2013. He declined, however, to commit to keeping taxes at current levels.

"At this stage of the game you're not in a position to rule anything out," he said. "People understand governments make decisions and they also understand in this case they also live in a jurisdiction with the lowest marginal rates in the country."

There is an assumption among politicians that people are always opposed to raising taxes, but support depends very much on how the question is raised, said Seth Klein, the director of the B.C. office for the Canadian Centre for Policy Alternatives.

In survey results released Nov. 29, the CCPA found that some 71 per cent of British Columbians said they feel they already pay too much tax. Another 27 per cent said they pay about the right amount and just three percent said they pay too little.

However, when asked if they would pay between 0.5 and three per cent more of their income to support specific measures, many said they would.

Will pay more, for right reasons

They include 53 per cent who would pay more to raise welfare rates, 58 per cent who would pay to protect forests and endangered species, 61 per cent who would pay to eliminate Medical Service Plan premiums and 69 per cent who agreed with paying more to provide more access to home and community based health care services for seniors.

The CCPA's communications director Shannon Daub and public engagement specialist Randy Galawan developed the survey. The online survey was given to a random sample of 1,023 British Columbians.

"The point of the exercise was to show when you make it more concrete... the answer changes," said Klein. While a majority of people automatically reject paying more tax, he said, "Under the right circumstances, where people understand what they're paying for, you get a different kind of answer."

There is already evidence of this in our tax system, said Klein. Compared to the outrage over the introduction of the HST, there is muted opposition to the steady increase in Medical Service Plan premiums, a regressive tax, he said. Similarly, people seem to have accepted the carbon tax, even though two thirds of the money it raises goes to cutting corporate taxes.

The explanation may be that people don't mind paying taxes when they are tied in their minds to things they support, such as paying for healthcare and fighting climate change, he said.

Respondents' voting intention seemed to make little difference to the responses, with supporters of the Green Party and NDP only slightly more supportive than Liberal or Conservative voters of raising taxes to pay for particular services. However, younger people were significantly more likely to approve of such a raise than older people were.

BC ready for tax discussion: Klein

At the very least, people in the province are ready to have the discussion, said Klein. "British Columbians are saying they'd appreciate a more thoughtful debate about taxes."

While the Liberals have been sending mixed messages about taxes, the NDP's leader, Adrian Dix, has said the party is considering increasing taxes on high-income earners, a threshold he told CKNW's Bill Good would be $150,000 at a minimum. But even there, he's said, there's little room to increase taxes.

In the United States, where a similar discussion is taking place, President Barack Obama is pushing to raise taxes on people who earn more than $250,000 a year.

Most people think it would be fair for higher rates to kick in sooner, said the CCPA's Klein. "In this poll you've got a clear majority that are at least saying 'make the threshold a hundred thousand.'"

The CCPA report says 57 per cent supported raising taxes to "reduce income inequality, protect the environment and improve access to public services" on people making over $100,000. And 90 per cent agreed with raising taxes for people who make over $250,000. ![]()

Read more: Politics

Tyee Commenting Guidelines

Comments that violate guidelines risk being deleted, and violations may result in a temporary or permanent user ban. Maintain the spirit of good conversation to stay in the discussion.

*Please note The Tyee is not a forum for spreading misinformation about COVID-19, denying its existence or minimizing its risk to public health.

Do:

Do not: